Bitcoin (BTC) average transaction fees crossed the $100 mark for the first time on April 20, following the halving event. As transaction costs rise, the majority of investors are either holding dust or unable to withdraw from exchanges.

Notably, Finbold retrieved data from mempool.space showing average Bitcoin fees of $105.69 paid in the last 24 hours. In BTC measures, users paid 166,150 sats or 0.00166150 BTC per transaction, on average, during this period.

Furthermore, Bitcoin miners mined the last four blocks with a fee rate above 1,072 sat/vB, translating to $100 for small Segwitt transactions. Sat (or satoshis) is Bitcoin’s smallest unit, named after its creator, Satoshi Nakamoto, while vB stands for virtual bytes—the measure used by the cryptocurrency‘s protocol.

Previously, the Bitcoin fee all-time high in USD was $62.78, reached exactly three years ago on April 21, 2021.

Sell-off? Consequences of Bitcoin fees in USD above $100

Bitcoin miners usually see the fee increase as positive, considering these entities collect those fees. This dynamic gains more relevancy after the halving as a way to balance the reduction of the block subsidy

However, users, investors, and traders are mostly negatively affected, now paying above $100 for each activity. The negative consequences include holding dust balances, being unable to withdraw from exchanges, and diminishing the profit of Bitcoin’s DeFi ecosystem.

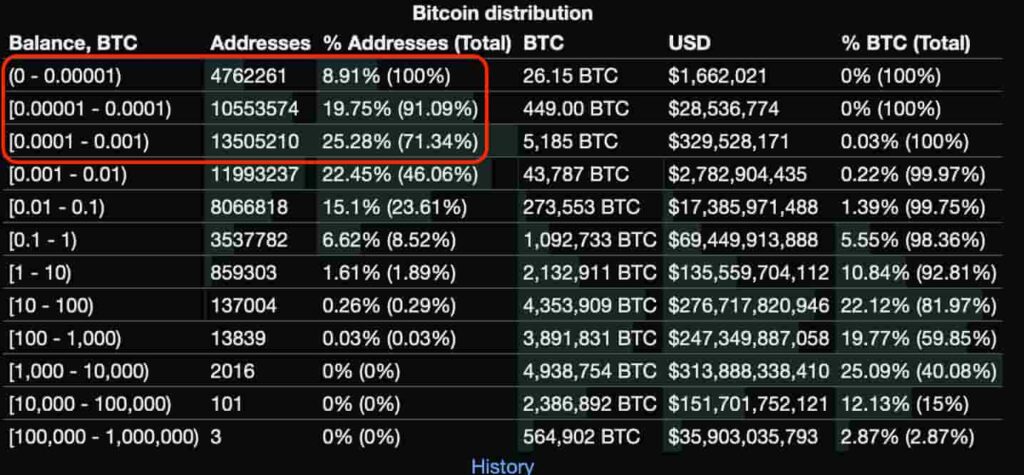

First, dust refers to account balances and UTXOs below the fee threshold, which effectively makes them unspendable. According to BitInfoCharts‘ rich list, 53.94% of all Bitcoin addresses hold something below 0.001 BTC.

At current prices, most balances are below $64, which is, effectively, dust with Bitcoin fees above $100.

On the other hand, many cryptocurrency traders and investors keep their personal stash on centralized exchanges, occasionally withdrawing for long-term holding. Yet, Bitcoin fees make withdrawal costlier, which could incentivize a sell-off for fiat or other cryptocurrencies.

A cryptocurrency enthusiast who goes by the alias Untraceable on X believes high Bitcoin fees could ignite an altseason.

Why do Bitcoin fees increase?

Experts blame the current surge on the Bitcoin halving and the launch of the Runes Protocol, which increased transaction demand.

Technically, Bitcoin fees increase when there is more demand for a limited space on its blockchain. Thus, users compete and outbid each other to convince miners to increase their transactions in the next block. The more congested and demanded the Bitcoin network is, the higher the fees can go.

The BTC protocol is currently intentionally designed to have a small block size and a 10-minute time interval between each block. Other cryptocurrencies solve the fee issues in different ways. For example, Bitcoin Cash (BCH) increased the block size, Litecoin (LTC) diminished the block interval, Monero (XMR) mixed both, and Nano (XNO) securely removed fees from the equation.

As Bitcoin fees now reach an unprecedented value in dollars and the risks of a sell-off become imminent, the market awaits to see if the demand for block space will drop and the average cost will drop to lower levels. Meanwhile, users must pay four times the world’s average daily income of $26 per BTC transaction.