After the price of Bitcoin (BTC) dropped below the critical $26,000 mark, pulling the majority of the cryptocurrency market down with it, some crypto analysts see this dip as preceding an even deeper one before the late summer, when a bullish pump is possible.

Specifically, pseudonymous cryptocurrency expert Crypto Tony said he was “looking for a relief wave” for the flagship decentralized finance (DeFi) asset before its “final leg down towards $24,500,” as he explained in a tweet shared on June 6.

However, the analyst is not all bearish on Bitcoin, as he also argued that “this is the final leg down before we accumulate for a pump to come July / August,” as demonstrated by his analysis of the digital asset’s chart patterns.

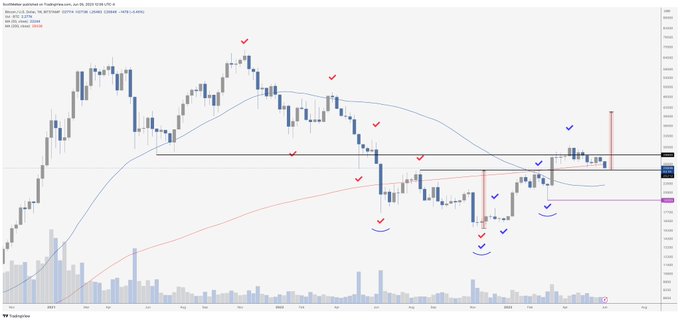

At the same time, Scott Melker, a.k.a. The Wolf Of All Streets, noted that Bitcoin was “dumping on the [Securities and Exchange Commission (SEC)] action against Binance,” which the agency earlier announced, adding that he has “been watching $25,212 for months, approaching quickly,” in his June 6 tweet.

Bitcoin price analysis

As things stand, Bitcoin was at press time changing hands at the price of $25,756, recording a decline of 3.81% in the last 24 hours and dropping 7.32% across the previous seven days, adding up to the losses of 10.88% on its monthly chart, as per data retrieved on June 6.

Meanwhile, crypto analyst CryptoJelleNL has observed that Bitcoin had again closed the previous week above the 200-week moving average (MA), taking it as a bullish sign despite the current setback, suggesting it was “a matter of time until Bitcoin finally breaks that $30k level once and for all.”

That said, Altcoin Sherpa had earlier noted that the maiden crypto could drop to as low as $23,000, referring to technical analysis (TA) indicators like the 200-week exponential moving average (EMA), 200-day EMA, support and resistance levels, as well as the 0.382 ratio Fibonacci level.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.