Bitcoin (BTC) and NVIDIA Corp (NASDAQ: NVDA) have led the cryptocurrency and stock markets in 2024 with astonishing performances. However, investors may wonder which has made the better investment year-to-date (YTD).

Interestingly, these two assets’ remarkable performances are not isolated. Cryptocurrencies, commodities, and stocks reached new highs in 2024, pointing toward a more optimistic economy.

On that note, Finbold previously reported what Gold, BTC, and the S&P 500 price action have in common.

Picks for you

In particular, most risk assets benefited from a more optimistic forecast of interest rate reduction this year – even when the most recent data raises questions about whether the Federal Reserve’s “anti-inflation” policies are working, with a CPI worse than expected in February’s year-over-year (YoY).

Bitcoin’s YTD performance as an investment in 2024

First, Bitcoin has had a very special year so far, reaching new all-time highs (ATH) yet in the first quarter. Unprecedently, BTC broke the previous ATH before the mining block subsidy halved, which should occur by April 21.

Looking at the chart, Bitcoin started 2024 trading at $42,180 on January 1 and is currently priced at $71,450. This reflects a year-to-date surge of 69.60% for a 71-day period. Notably, the Bitcoin daily Relative Strength Index (RSI) is overbought at 76.82.

Meanwhile, BTC saw lows of $38,514 and highs of $72,967— a nearly 90% variation from minimum to maximum.

NVIDIA stocks’ YTD performance as an investment in 2024

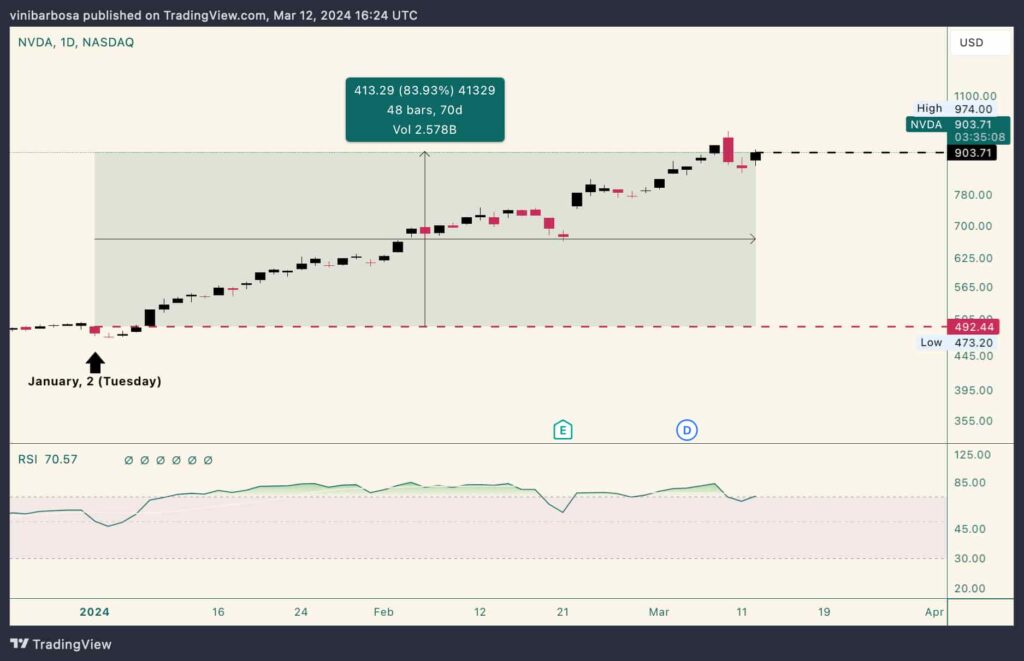

On the other hand, NVDA benefited from the growing demand for GPUs amid an artificial intelligence (AI) narrative surge. This industrial movement fueled Nvidia’s performance by an impressive 83.93% YTD increase in price.

The technology company’s stock price went from $492.44 per share on January 2 to $903.71 at publication. In this context, the stock changed hands for as low as $473.20 and as high as $974 during the year.

Yet, it is worth noting that the strength technical indicator, at 70.57 RSI, suggests a strong, healthy momentum.

Conclusion on the, so far, better investment in 2024

In conclusion, Nvidia has, so far, proved itself a better investment than Bitcoin in 2024. Investors who purchased NVDA experienced less volatility between the highs and lows while seeing more gains year-to-date.

Moreover, the RSI suggests that Nvidia currently has a healthier status than Bitcoin for further continuation.

All things considered, investing in either NVDA or BTC carries risks, and both markets are unpredictable. Past performance does not guarantee future outcomes, and investors must understand the fundamentals of the assets before deploying meaningful capital.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.