Bitcoin (BTC) continues its recovery journey following a sharp decline that saw the flagship cryptocurrency plummet to as low as $56,000.

Currently, Bitcoin is encountering resistance at the $65,000 mark, with market participants suggesting that breaching this level could propel the digital asset to above $70,000.

In this context, crypto analyst RLinda shared insights in a TradingView post on May 4, emphasizing the significance of monitoring a price target of $64,500.

Picks for you

According to the analysis, should Bitcoin break through and consolidate its price above this threshold, it could pave the way for further upward momentum, potentially pushing the price towards $73,000.

She highlighted that a breakout and consolidation above the $64,500 mark could signal a shift in market sentiment, transitioning from a neutral or bearish stance to a bullish one. This change in market dynamics could attract more investors, further fueling Bitcoin’s ascent.

“All eyes on 64500. Breakthrough and consolidation of the price above this level will be the reason for further growth to $73,000. A breakout and consolidation of the price above this zone ($64,500) may cause further growth,” the expert said.

The expert also observed a local consolidation phase on the shorter timeframes, indicating that Bitcoin appears to be strengthening by 14% and testing a crucial area. This suggests a level of confidence in Bitcoin’s current trajectory.

Bitcoin’s risk areas to watch

However, it’s important to note that the market expert pointed out that Bitcoin is not totally out of the woods yet, identifying a potential risk zone of around $58,900.

Amidst the swirling projections surrounding Bitcoin’s price trajectory, the cryptocurrency faced a sluggish start to May, with bears seemingly gaining the upper hand over bulls. This resulted in Bitcoin’s price dipping to $56,000, marking its lowest point in approximately two months.

The heightened volatility emerged following the Federal Reserve’s decision to maintain interest rates.

Bitcoin found some resilience in the wake of lower-than-expected United States employment data. This development will likely pressure the Fed to consider initiating an interest rate cut.

Furthermore, activity within the exchange-traded fund (ETF) sphere appears to influence Bitcoin. Particularly noteworthy were the first inflows for the Grayscale Bitcoin Trust (GBTC) in nearly three months, signaling renewed investor confidence.

Bitcoin price analysis

By press time, Bitcoin was trading at $63,779, boasting one-day gains of nearly 1%. On the weekly timeframe, BTC has seen an increase of about 0.26%.

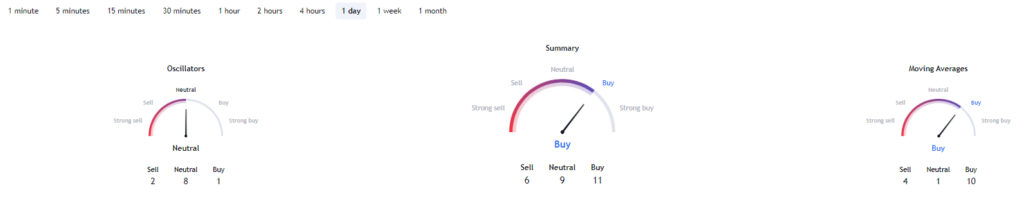

Additionally, Bitcoin’s technical indicators, which are predominantly bullish, mirror the current market momentum. A summary of the one-day metrics retrieved from TradingView suggests a ‘buy’ rating at 11 while moving averages also indicate a ‘buy’ sentiment at 10. Oscillators are currently at a ‘neutral’ stance, tallying at 8.

In summary, all eyes are on Bitcoin bulls to sustain the cryptocurrency above the $63,000 mark and propel it towards the $65,000 threshold. Achieving this milestone would position the asset favorably for a potential resurgence towards the $70,000 mark.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.