Amid Bitcoin’s (BTC) ongoing struggle to convincingly sustain levels above $60,000, technical analysis, combined with historical price patterns, suggests a potential path towards a new all-time high (ATH) of around $250,000 by late 2025.

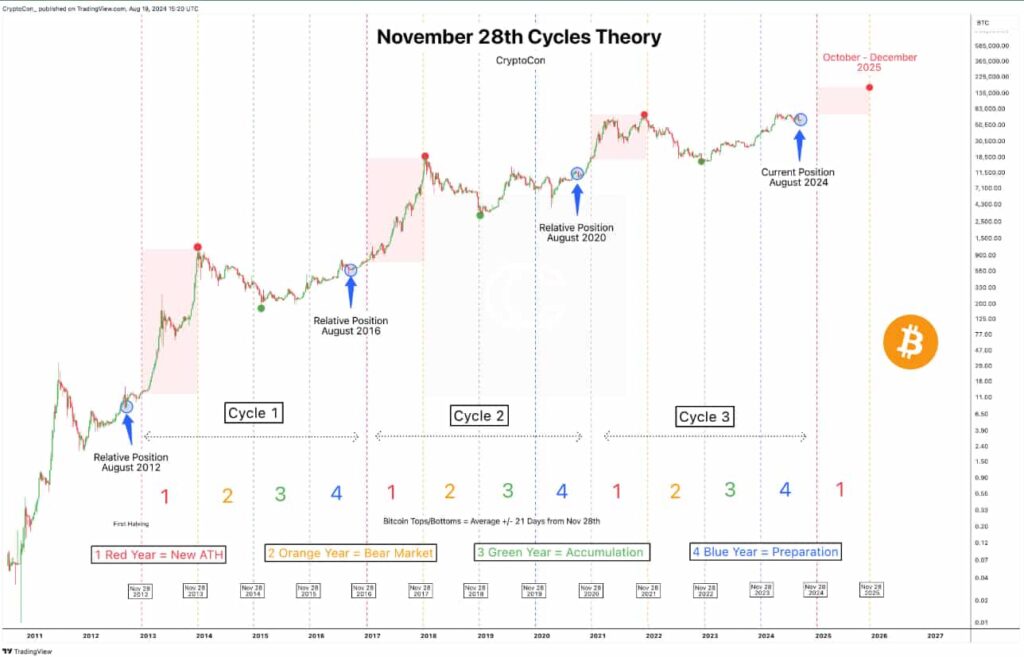

In a recent analysis shared by crypto analyst CryptoCon on August 19, Bitcoin’s price movements were evaluated using the November 28th Cycles Theory.

This theory divides Bitcoin’s price history into four distinct phases. Notably, ‘New All-Time High (Red Year)’, ‘Bear Market (Orange Year)’, Accumulation (Green Year)’, and ‘Preparation (Blue Year)’.

As of August 2024, Bitcoin is in the ‘Preparation Phase’, which typically precedes significant upward price movements during the subsequent ‘Red Year’. Finbold reported about Bitcoin’s blue year, with an analysis on August 16.

Why a new all-time high is plausible

The November 28th Cycles Theory has historically pinpointed major turning points in Bitcoin’s price, often aligning with Bitcoin’s halving events.

These halving events, which occur approximately every four years, reduce the reward for mining new blocks by half, thereby decreasing the supply of new Bitcoin entering the market.

Historically, this supply reduction has served as a catalyst for significant price increases in the year or two following each halving.

In the current cycle of 2024, CryptoCon observed that Bitcoin has followed a similar path to previous cycles, albeit with some notable differences.

The early part of the year witnessed a robust rally from January to March, with Bitcoin surging by over 60%, from approximately $34,000 to just above $73,000. This rally was more powerful and quicker than initially anticipated, fueled by heightened investor optimism, macroeconomic factors like a weakening U.S. dollar, and increased institutional adoption.

However, following this surge, Bitcoin entered a prolonged correction phase. By early May, Bitcoin had retraced, pulling back to around $58,000 and experiencing choppy trading conditions throughout the summer.

This extended correction phase contrasts with previous cycles, where recoveries following a rally of this magnitude tended to be more rapid, typically within weeks rather than months.

The slower recovery has been attributed to mixed economic signals, regulatory uncertainties, and cautious investor sentiment, particularly amid broader financial market volatility.

Despite these deviations from historical patterns, the underlying cycle dynamics remain consistent with the November 28th Cycles Theory.

The Preparation phase appears to be setting the stage for a significant price surge as Bitcoin transitions into the Red Year of 2025, where past cycles suggest the potential for new all-time highs.

Analyst observations and key levels to watch

CryptoCon’s analysis highlights that, despite some predictions of a market top or even a recession, the current ‘Preparation Phase’ is laying the groundwork for a potential price surge in 2025.

The theory’s core principles remain intact, with March 2024’s stronger-than-expected rally followed by an extended correction, adding complexity but not derailing the overall cycle projection.

The key levels to watch include the $60,000 resistance, which Bitcoin has struggled to maintain. A decisive break above this level could pave the way for testing the $100,000 mark, which is a significant psychological barrier.

Beyond $100,000, the $200,000 mark represents another critical threshold based on historical cycle multiples. These levels will be crucial for assessing the strength of Bitcoin’s upward momentum as it progresses toward the projected $250,000 target.

Bitcoin price analysis

At the time of reporting, Bitcoin was trading at $60,705, with a gain of over 3% on the daily timeframe. On the weekly chart, BTC is also up by 3.4%.

While the projection of a $250,000 ATH by 2025 remains speculative, it is grounded in a historical analysis of Bitcoin’s price cycles and halving events.

The current cycle, while showing some unique characteristics, continues to align with the broader patterns identified in previous cycles. Investors should approach this target with cautious optimism, recognizing the influence of broader market conditions and the inherent volatility of Bitcoin.

By closely monitoring key resistance levels and market trends, investors can better position themselves to capitalize on potential price movements as Bitcoin advances through its current cycle.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.