Bitcoin (BTC) registered its highest jump in the past two weeks at $71,000, falling just short of its all-time high.

Analysts predict that reaching the critical $72,000 mark could act as a fuse, igniting mass liquidations and setting new records.

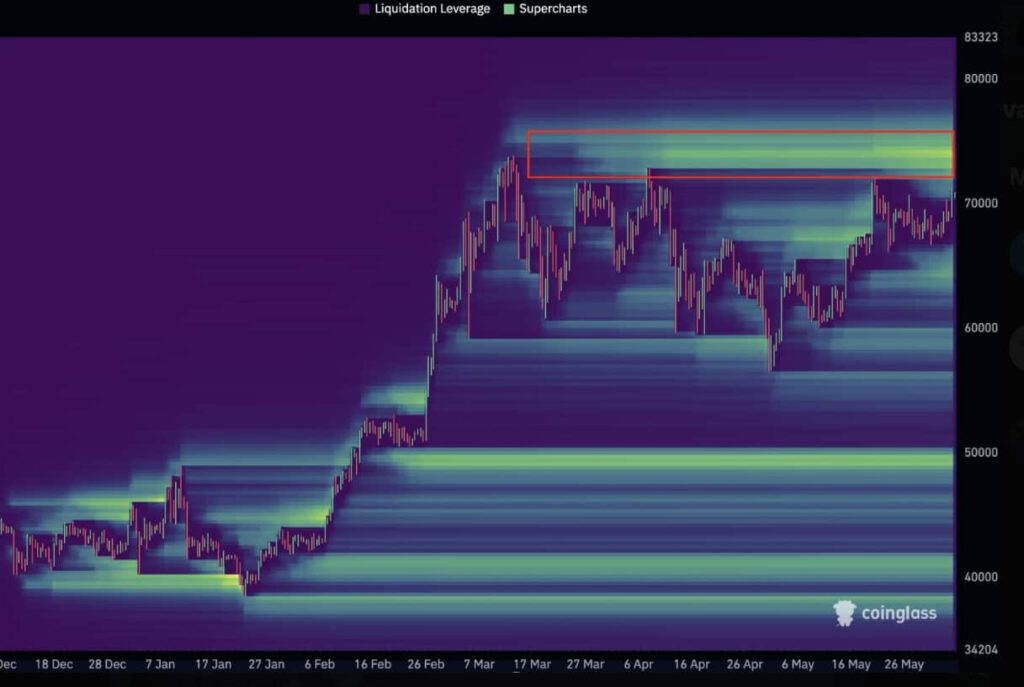

Crypto analyst Willy Woo highlighted insights from the Bitcoin Liquidation Heatmap in a recent post on X (formerly Twitter). He noted a potential $1.5 billion Bitcoin short liquidation if BTC hits the crucial $72,000 mark.

“Tapping $72k is the fuse set to start a liquidation cascade. $1.5b of short positions ready to be liquidated all the way up to $75k and a new all-time high,” Woo stated.

According to CoinGlass, a potential move above $72,500 would trigger the liquidation of over $1.2 billion worth of leveraged short positions.

Supporting analysis from Rekt Capital

Trader Rekt Capital’s analysis further supports Willy Woo’s insights. In a recent post, Rekt Capital noted that Bitcoin broke out of a significant two-week downtrend. He pointed out that while Bitcoin spiked past $70,000, it needs to close above resistance to confirm the breakout.

He also suggested that, based on historical patterns, Bitcoin might consolidate between $68,000 and $71,500 before entering an upward parabolic movement phase.

This anticipated consolidation phase aligns with Woo’s prediction that hitting the $72,000 level would trigger substantial liquidations, paving the way for new all-time highs.

Current Bitcoin price and market trends

Currently, Bitcoin is priced at $70,765, with a 24-hour trading volume of $37.6 billion. Despite recent volatility, Bitcoin has surged by 2.85% in the past 24 hours, indicating a significant recovery.

Technical indicators paint a bullish picture for Bitcoin. The Relative Strength Index (RSI) sits at 62, indicating strong buying pressure, and the positive MACD level at 1182 suggests upward momentum.

Meanwhile, open interest in Bitcoin has surged by 5%, reaching a valuation of $37.5 billion.

However, a contrasting signal emerges from the TD Sequential, which has flashed a sell signal on the hourly chart, hinting at a potential short-term price correction.

While the overall sentiment leans bullish, this highlights the importance of exercising caution and considering other factors before making investment decisions in Bitcoin’s volatile market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.