Although Jim Cramer, a prominent investor and host of CNBC’s ‘Mad Money’ last year recommended to his readers and listeners to invest in Boeing (NYSE: BA) stock, opining that 2024 would be its year, the aeronautics behemoth continues to face troubles with its products.

As it happens, Boeing paused the launch of its already delayed 777x fleet after a routine post-flight inspection uncovered the failure of a crucial piece of equipment that ties the engine to the aircraft and found similar problems on two other active test airplanes in another blow to Boeing’s reputation.

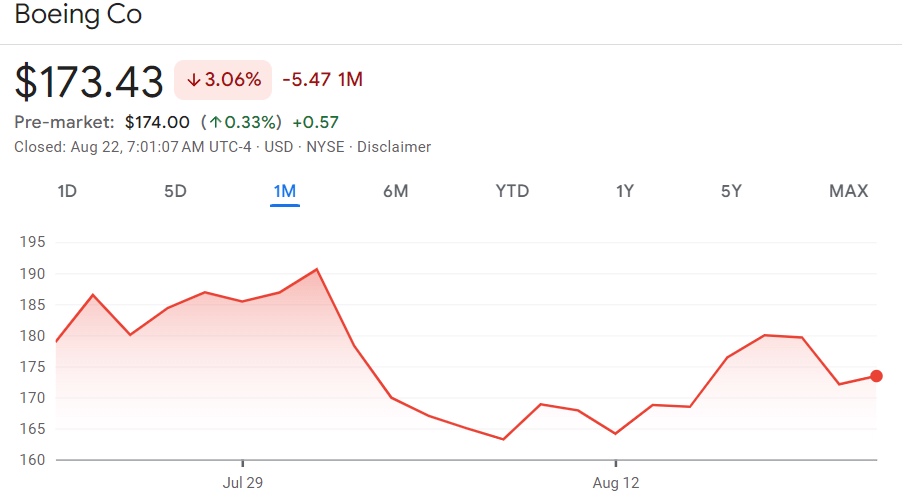

Boeing stock price history

Following the recent developments, which came to light on August 19, the price of Boeing stock dipped from $179.64 to $170.44, suffering a loss of 5.12% in a matter of hours but marking a slow recovery since. Specifically, it now stands at $173.43, up 0.77% on the day and 2.02% across the week.

At the same time, Boeing stocks are recording a decline of 3.06% on their monthly chart, adding up to the 31.11% decrease since the year’s turn and losing 24.62% in the previous 12 months, according to the most recent price information retrieved by Finbold on August 22.

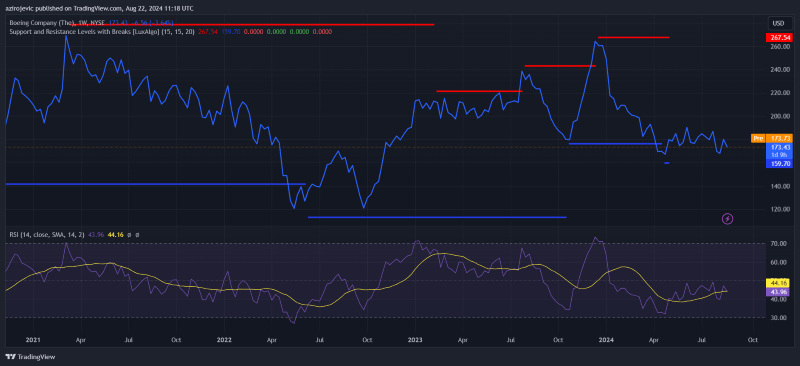

Boeing stock price technical indicators

Meanwhile, the technical performance of Boeing stock is exceptionally poor, displaying a negative trend in both the long-term and short-term timelines and trading on the lower end of its 52-week range, as well as near the low of its last month’s range between $162.50 and $196.95.

It is also worth noting that its strongest support zone currently lies between $163.23 and $164.33, with the most important resistance standing in the area between $174.87 and $178.85, with its 20, 50, 100, and 200 simple moving averages (SMAs) trending in the red.

What’s next for Boeing stock?

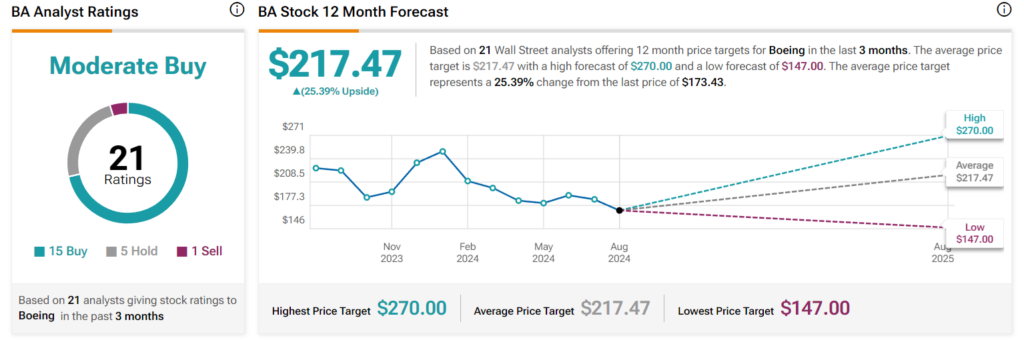

Elsewhere, Wall Street analysts are relatively optimistic in terms of the Boeing stock forecast, setting the average target at $217.47, which indicates a 25.39% increase from its current price, with the lowest target standing at $147 (-15.24%), and the highest at $270 (+55.68%), and a general score of ‘moderate buy.’

That said, among the more bearish experts is Zacks Research analyst A. Dutta, who has reduced his company’s estimates regarding Boeing’s Q3 2024 earnings per share (EPS) to $0.54. On top of that, Bank of America (NYSE: BAC) has earlier referred to Boeing taking three 737 MAX jets out of service after another problem with the model:

“Boeing confirmed that non-conforming components were found on three already delivered airplanes, resulting in their grounding. This could further impact the timing of deliveries, despite the uncertainty surrounding the number of aircraft affected by this issue.”

Ultimately, considering the most recent quality failures for Boeing, which has seen similar problems pile up with some of its jets, affecting its standing among customers, the future of BA stock price is questionable, so abstaining from trading it for the time being could be a good idea.

On the other hand, if the company managed to get out of its troubles and clean up its image, the lower BA stock price could be the perfect opportunity to ‘buy the dip’ before the price increase. However, assets in the stock market can sometimes act unpredictably, so doing one’s own research is critical.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.