Bitcoin (BTC) continues to extend its gains in the short term, recently clearing the $42,000 resistance. This comes as Bitcoin attempts to put behind recent sell-offs that emerged following the spot exchange-traded fund (ETF) approval.

It’s worth noting that despite the ongoing bullish sentiments surrounding Bitcoin, a section of the market continues to anticipate that the ETF will positively impact the asset in the long term.

In particular, crypto trading expert Michaël Poppe, in a post on X (formerly Twitter) on January 27, focused on the longer-term impact of Bitcoin ETFs, anticipating a significant influence in the next few years. According to Poppe, widespread adoption could propel Bitcoin to reach a high of $500,000.

“The real impact on the ETF is going to come in the next few years, resulting into a price of Bitcoin going to $300,000-500,000,” he said.

Bitcoin short-term outlook

At the same time, after Bitcoin surged past the $42,000 mark, Poppe projected that the market should not expect further moves in the coming months, suggesting that the cryptocurrency is poised to consolidate in the range of $37,000 to $48,000 in the next months.

In contrast to Poppe’s long-term outlook, crypto analyst Fiery Trading, in a TradingView post on January 27, offered an immediate perspective for BTC following the short-term gains.

The expert remained cautious about the short-term bullish trend, emphasizing the importance of the $42,200 resistance level. In his opinion, a clear rejection at this point could signal continued bearish dominance in the short term.

On the flip side, a successful breakthrough could pave the way for further gains, potentially reaching levels around $43,500 or higher. Additionally, he suggested that the ETF will likely have a longer-term impact on Bitcoin’s valuation.

Bitcoin gains as ETF outflow slows

It’s worth noting that Bitcoin experienced a sell-off after the ETF approval, attributed to outflows from the Grayscale Bitcoin Trust (GBTC). Recent Bitcoin gains have coincided with a period where the profit-taking from GBTC has slowed.

Overall, other funds experiencing increased inflows have withdrawn Bitcoin from the market, potentially contributing to upward price movements. While most ETFs are observing positive inflows, it is noteworthy that BlackRock’s (NYSE: BLK) iShares Bitcoin Trust (IBIT) surpassed the milestone of $2 billion in total inflows as of January 26.

Bitcoin price analysis

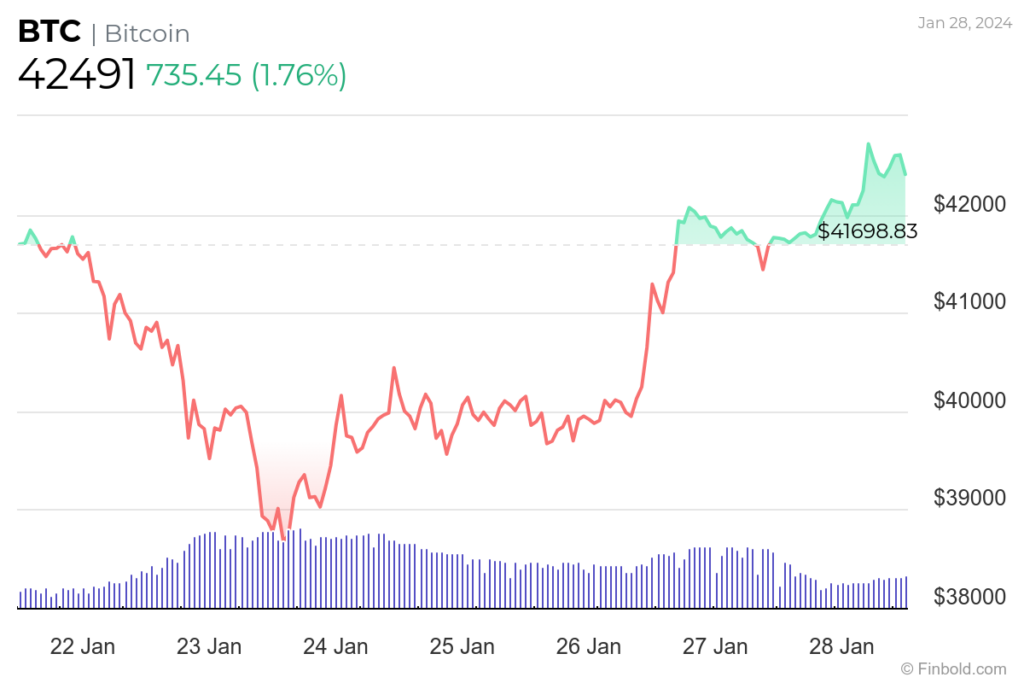

By press time, Bitcoin was trading at $42,491, recording gains of almost 2% on the daily chart. On the weekly chart, BTC is up 1.8%. The current price level represents a five-day high after plunging to as low as $38,600 on January 23.

Amid the current bullish sentiments, Bitcoin technical analysis is dominated by positive indicators. The summary of the one-day gauges retrieved from TradingView recommends a ‘buy’ at 13. The same sentiment is replicated for oscillators at 2, while moving averages suggest a ‘strong buy’ at 11.

In conclusion, although Bitcoin has recorded short-term gains, most analysts remain cautious, with some noting that the price could move either way as long as the asset is below $48,000.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.