Although the cryptocurrency industry is growing exponentially, digital assets are increasingly popular as an alternative to traditional money, and governments and financial institutions around the world are seeking ways to introduce them into their operations, it has no lack of critics.

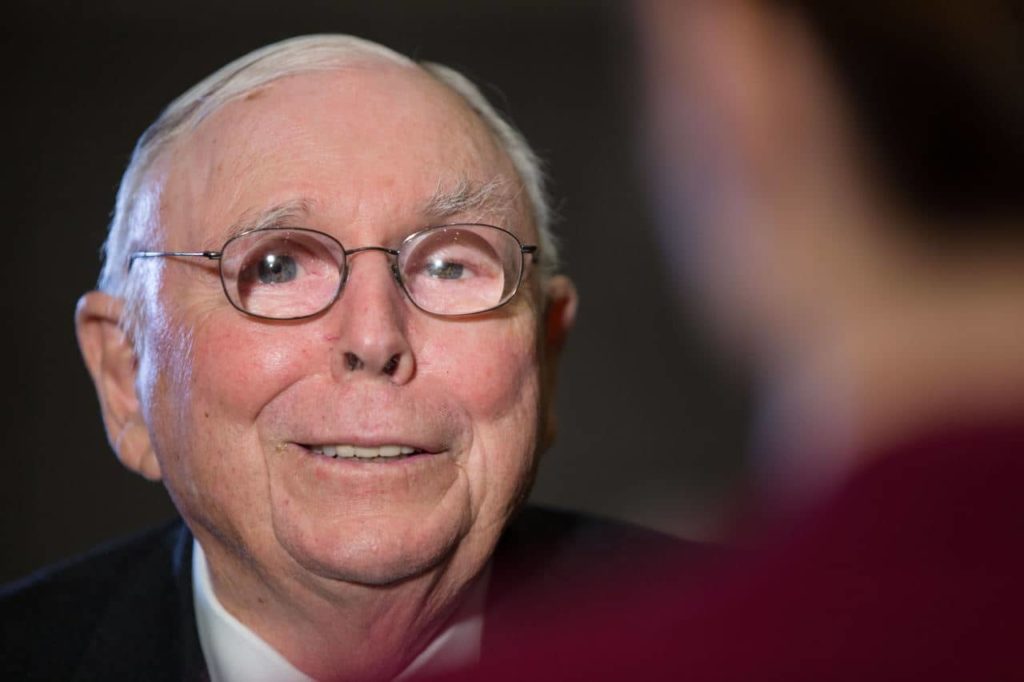

One of them is the Berkshire Hathaway (NYSE: BRK.A) vice chairman and long-time Warren Buffett collaborator Charlie Munger, who reiterated his aversion toward cryptocurrencies in an interview with the Australian Financial Review published on July 12.

Discussing his investment tips in the interview, Munger said that investors should “never touch” crypto, but instead look beyond the inflation spike, as well as support both fossil fuels and renewable energy.

Explaining his reasoning, he said that:

“Crypto is an investment in nothing. (…) I regard it as almost insane to buy this stuff or to trade in it.”

‘Buying crypto is crazy, selling crypto is evil’

According to the 98-year-old billionaire, the industry was full of bad actors selling worthless digital coins, adding that anyone who buys or sells crypto was undermining the existing monetary system.

“I think anybody that sells this stuff is either delusional or evil. (…) I’m not interested in undermining the national currencies of the world,” Munger said.

Instead of focusing on crypto, he suggested investing in stocks, which he considered a superior investment because they are pieces of real businesses.

Long-time critic of cryptocurrencies

A known crypto critic, Munger has previously heavily criticized the industry, even likening it to venereal disease. At the Berkshire Hathaway Annual Shareholder Meeting back in 2018, he expressed the view that trading in crypto was “just dementia.”

Munger reiterated his position at the shareholder meeting in April 2022, emphasizing that he avoided “things that are stupid and evil and make me look bad in comparison to somebody else – and Bitcoin does all three.”

Meanwhile, Berkshire Hathaway CEO Warren Buffet is not far from his vice chairman’s criticism of crypto, repeatedly expressing his scathing views on the industry which he referred to as “rat poison” in May 2018.

Due to their views, both Munger and Buffett were criticized by Anthony Scaramucci, the founder and managing partner at investment firm SkyBridge Capital, an outspoken crypto supporter, and a former advisor to Donald Trump.

In April 2022, Scaramucci slammed the veteran investors, in addition to other crypto critics like JPMorgan’s (NYSE: JPM) Jamie Dimon and Blackrock’s Larry Fink, for not doing their homework on assets like Bitcoin (BTC) and Ethereum (ETH).