Tellor (TRB) has made impressive gains in a week, up 200% month-to-date and trending in social platforms. Finbold turned to cryptocurrency indicators, looking for insights on whether this could be a buy or sell signal for TRB.

Tellor is a $355 million Oracle network and a direct competitor to Chainlink (LINK) in relaying off-chain data to cryptocurrencies. Notably, LINK has a $8.5 billion market cap – which is 24 times higher than this trending cryptocurrency.

Tellor (TRB) price analysis

TRB trades at $141.72, with 198.6% gains from a local bottom of $42.73 reached on May 1. Following this surge, technical indicators show bullish momentum, which investors could see as both a buy and sell signal.

In particular, the daily relative strength index (RSI) shows a staggering 81.78 overbought status, which often signals trend reversals. Moreover, the token trades nearly two times above the 30-day exponential moving average (30-EMA), currently making support at $76.48 after a breakout on May 2.

Tellor is trending on social indicators

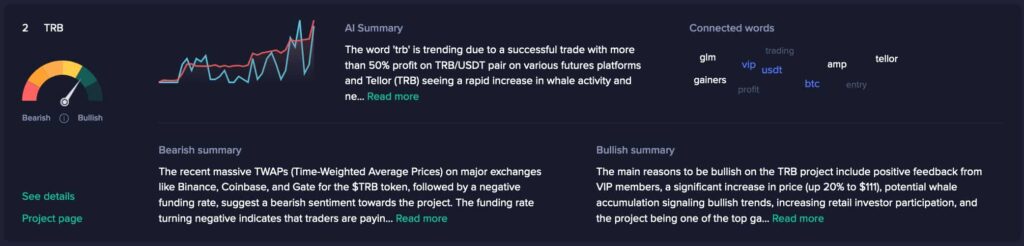

Similar to the technical analysis, social indicators suggest a bullish momentum for Tellor, which could soon cause a trend reversal. On that note, Finbold gathered data from Santiment, showing TRB as the second-most trending cryptocurrency dominating the market’s social metrics.

The platform’s AI summary highlights price action, increased whale activity, and “VIP interest” as the reasons why Tellor is trending.

Interestingly, as the price surged, social volume and social dominance reached monthly highs of 15 and 0.1%. This evidences the cryptocurrency trending momentum, but peaking social metrics for low-cap cryptocurrencies often signal local tops and reversals.

However, if the momentum continues, Tellor could see further growth, seeking higher capitalization as the protocol competes for demand and market share in a multi-billionaire market of Oracle solutions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.