The cryptocurrency market experienced volatile trading last week, starting on a high note only to reverse course by week’s end. Initially, optimism surged as several analysts predicted Bitcoin (BTC) would reach new highs.

However, the release of robust U.S. job data on Friday altered the sentiment, hinting at a hawkish stance by the Federal Reserve.

This downturn has led to many cryptocurrencies becoming oversold, potentially signaling a “buy the dip” opportunity.

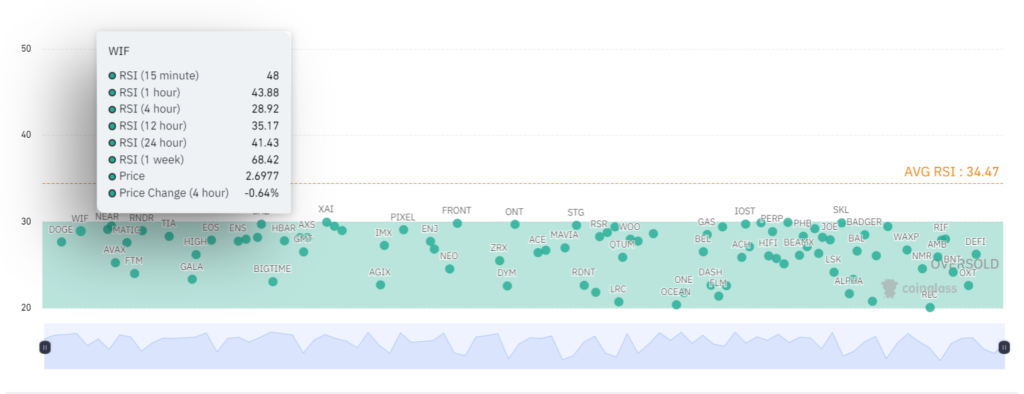

In this dramatic shift, the crypto landscape turned from bullish to bearish within days. The overall Relative Strength Index (RSI) supports this transition, with an average 4-hour RSI of 34.47, according to CoinGlass.

Against this backdrop, Finbold has identified two short-term oversold cryptocurrencies worth considering during this market crash.

Dogwifhat (WIF)

Dogwifhat (WIF) shows strong potential as a buy opportunity. The 4-hour RSI is 28.92, while the 24-hour RSI is 41.43. These indicators suggest that WIF is oversold in the short term but shows signs of stability over the daily timeframe.

This RSI pattern indicates a potential rebound as the immediate selling pressure eases, and the asset could correct upwards.

Additionally, the 1-week RSI of 50 suggests a neutral long-term trend, indicating that the recent downturn may be a short-term correction rather than a prolonged bearish trend.

At the current price of $2.60, WIF has seen a 0.64% decrease in the last 24 hours, reinforcing its status as an oversold asset with potential for recovery.

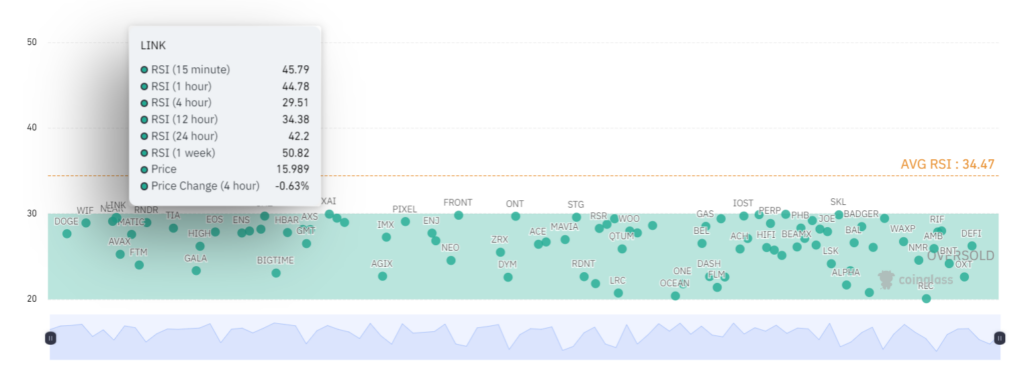

Chainlink (LINK)

Chainlink (LINK) also presents a compelling case as an oversold cryptocurrency ready for a potential rebound.

The 4-hour RSI of 29.51 indicates an immediate oversold condition, suggesting that the recent selling pressure has been excessive.

With a 12-hour RSI of 34.38 and a 24-hour RSI of 42.20, LINK shows signs of stabilization over the daily timeframe, reinforcing the potential for short-term recovery.

The 1-week RSI of 50.00 suggests a neutral long-term trend, similar to WIF, indicating that the recent downturn is likely a short-term correction.

Currently trading at $15.5, LINK’s RSI indicators collectively point towards a potential rebound opportunity.

For a week-long investment perspective, WIF and LINK show promising buy signals based on their RSI indicators. Nevertheless, having an oversold RSI status does not guarantee price recovery and could also indicate a bearish trend

Cryptocurrencies are highly volatile assets, and everything can change in the blink of an eye.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.