The cryptocurrency market has seen a significant downturn, with the total market capitalization dropping from $2.49 trillion to $2.21 trillion over the past month. Over the week, Bitcoin (BTC) fell 4.6% to $60,844.77, while Ethereum (ETH) dropped by 7.19% to $2,903.84.

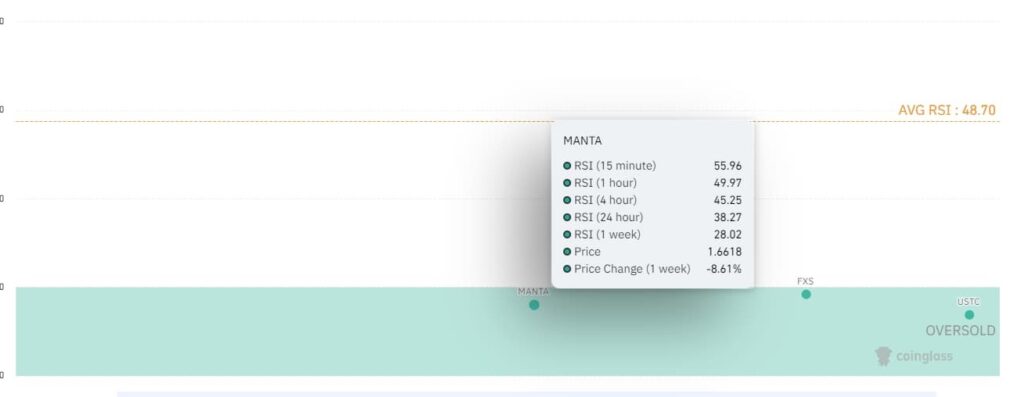

However, the overall 1-week relative strength index (RSI) standing at 48.70 indicates that not all assets are equally impacted. Moreover, some may be approaching oversold territories, hinting at potential buying opportunities according to data from CoinGlass.

From an optimistic perspective, Finbold identified two cryptocurrencies that are notably oversold on a short-term basis, as evidenced by their 1-week RSI readings, and may offer good buying opportunities amidst the market crash.

MANTA (MANTA)

MANTA emerges as a standout among oversold assets. Currently priced at $1.66, MANTA has experienced a significant decrease of 38.10% over the past month.

This is coupled with an RSI of 28.02 over the week and 38.27 over the past 24 hours, suggesting that MANTA is deeply oversold. These technical indicators, combined with MANTA’s strong fundamentals, suggest a potentially undervalued asset that may be poised for a rebound.

Frax Share (FXS)

Another cryptocurrency showing similar patterns is Frax Share (FXS), currently priced at $4.26, down by 35.39% over the same period. RSI levels of 29.21 weekly and 38.06 over the past 24 hours indicate that FXS is approaching oversold territory.

This technical assessment points towards a possible price recovery, making FXS an attractive investment option for those considering entering the market during this downturn.

The current market landscape presents a challenging yet opportunistic scenario. Both MANTA and FXS show significant price reductions accompanied by low RSI values, classifying them as potentially oversold.

For technically inclined investors, these cryptocurrencies provide notable buy signals based on their current market valuations and technical indicators. However, it’s crucial to remember the high volatility of cryptocurrencies, where market conditions can rapidly change

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.