Summary

⚈ Baidu is expanding aggressively into artificial intelligence and cloud computing, recently unveiling its new AI models, Ernie 4.5 Turbo and Ernie X1 Turbo.

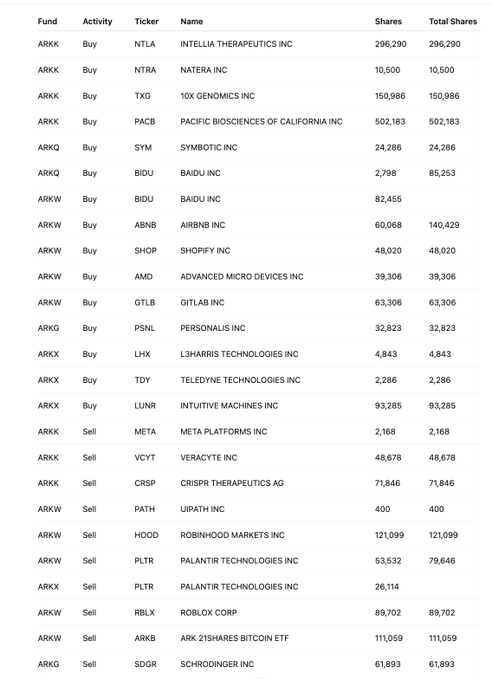

⚈ ARK Invest made significant biotech buys, including Intellia and 10X Genomics, while reducing its positions in companies like Palantir, Robinhood, and CRISPR.

Cathie Wood’s ARK Invest has increased its stake in Chinese technology giant Baidu (NASDAQ: BIDU), an equity favored by the famed ‘Big Short’ investor Michael Burry of Scion Asset Management.

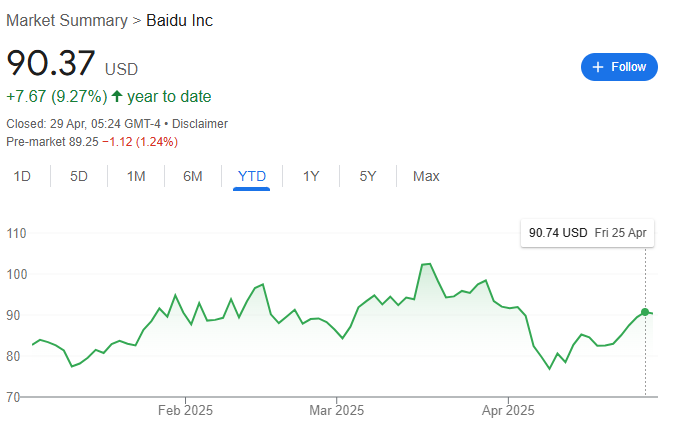

Wood’s ARK Innovation ETF (ARKK) purchased 2,798 shares of Baidu, while the ARK Next Generation Internet ETF (ARKW) added 82,455 shares, bringing ARK’s total holdings in the company to 85,253 shares.

The acquisition of Baidu shares comes as the “Google of China” aggressively expands into artificial intelligence (AI) and cloud computing.

Amid rising AI competition in China, on April 25, the firm unveiled its latest artificial intelligence model, Ernie 4.5 Turbo, alongside its new reasoning model, Ernie X1 Turbo.

Notably, Baidu remains a key entry point for investors seeking exposure to the highly competitive Chinese tech market despite ongoing geopolitical tensions and regulatory challenges.

Wood’s investment strategy

Wood’s increased investment aligns with her strategy of betting on disruptive technologies and overlaps with Burry, who has also been vocal about Baidu’s potential.

For Burry, Baidu is his second-largest equity position, accounting for 13.61% of his portfolio, behind e-commerce giant Alibaba (NYSE: BABA), which holds a 16.43% share as of the last quarter of 2024.

At the end of the last session, BIDU was trading at $90.37, down a modest 0.4%. Year-to-date, the equity is up nearly 10%.

Cathie Wood’s key sales

Beyond Baidu, Wood’s ARK funds made several other notable trades. On the buy side, the firm added 296,290 shares of Intellia Therapeutics (NASDAQ: NTLA), 150,986 shares of 10X Genomics (NASDAQ: TXG), and 502,183 shares of Pacific Biosciences of California (NASDAQ: PACB).

On the sell side, the investor trimmed positions in several high-profile names, including 48,678 shares of Veracyte (NASDAQ: VCYT) and 71,846 shares of CRISPR Therapeutics (NASDAQ: CRSP), while ARKW offloaded 121,999 shares of Robinhood (NASDAQ: HOOD).

A significant reduction was seen in Palantir (NASDAQ: PLTR), with ARKW selling 79,646 shares, bringing its total holdings down to 26,114.

Notably, this offloading by the software giant comes as the equity reclaimed the $100 level, although uncertainty lingers regarding its valuation due to its high P/E ratio of 781.50.

Featured image from Shutterstock