Ethereum’s native token, Ether (ETH), has seen a notable increase in value, reaching $3,550 on June 19. This surge follows the U.S. Securities and Exchange Commission’s (SEC) decision to end its investigation into whether Ether is an unregistered security.

This development, combined with the initial approval of Ethereum spot exchange-traded funds (ETFs), has significantly boosted market confidence.

The SEC’s decision to close its investigation into Ethereum 2.0, announced by Ethereum developer ConsenSys, is a major victory for the cryptocurrency industry.

This announcement follows the SEC’s approval of 19 b-4 filings from firms like VanEck, BlackRock (NYSE: BLK), and Fidelity, allowing them to list and trade spot Ether ETFs as reported by The Block.

Analysts predict these ETFs will attract $4 billion worth of inflows within five months, reflecting strong demand for ETH tokens.

Additionally, the amount of Ether held on crypto exchanges has dropped to an eight-year low, suggesting reduced selling pressure and a growing preference for holding ETH in private wallets or decentralized protocols.

Despite the Ethereum Shanghai upgrade in March 2023, which allowed stakers to withdraw their tokens, most users have continued staking, highlighting a preference for stability and rewards over selling.

ChatGPT-4o Ethereum price prediction

In this context, Finbold provided technical analysis and market projections to ChatGPT-4o for a one-month ETH price prediction.

This one-month time frame is selected to capture the immediate and medium-term impacts of recent significant developments, including the SEC’s decision to end its investigation into Ethereum 2.0 and the launch of spot Ether ETFs by major financial institutions.

This period allows for the assessment of market reactions, the inflow of investments from the new ETFs, and the technical trends that may influence Ether’s price.

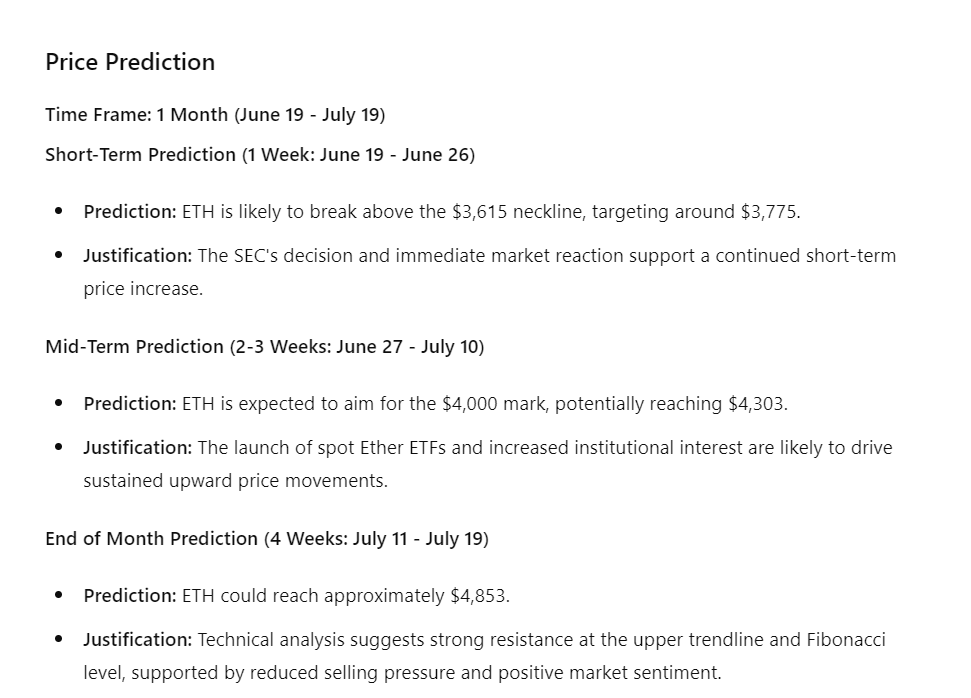

According to ChatGPT-4o, in the short term, from June 19 to June 26, Ethereum is likely to break above the $3,615 neckline, targeting around $3,775. This is justified by the SEC’s decision and the immediate positive market reaction, which support a continued short-term price increase.

In the mid-term, from June 27 to July 10, Ethereum is expected to aim for the $4,000 mark, potentially reaching $4,303. The launch of spot Ether ETFs and increased institutional interest are likely to drive sustained upward price movements during this period.

By the end of the month, from July 11 to July 19, Ethereum could reach approximately $4,853. Technical analysis suggests strong resistance at the upper trendline and Fibonacci level, supported by reduced selling pressure and positive market sentiment.

Ethereum price analysis

At the press time, Ethereum is trading at $3,550 with a strong support level of $3,500 and a one-day increase of nearly 5%.

The immediate resistance level is the $3,615 neckline. Technical indicators show that the 50-day exponential moving average (EMA) acts as a support level of around $3,500, while the 0.5 Fibonacci retracement level coincides with recent support.

The newfound regulatory clarity and institutional interest have bolstered market confidence, leading to reduced selling pressure and strong technical indicators for further price increases.

As market reactions and investment inflows continue to shape Ethereum’s trajectory, all eyes will be on how these developments influence its price in the coming weeks.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.