In recent years, the Magnificent Seven stocks have continued influencing the overall equities market, driven by significant growth and strong financials.

The current ‘Magnificent Seven’— Meta Platforms (NASDAQ: META), Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), Netflix (NASDAQ: NFLX), Alphabet Inc (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), and Nvidia (NASDAQ: NVDA)—are hailed for their unparalleled contributions to technology, innovation, and market dominance.

Indeed, other stocks show the potential of emulating this exclusive club of seven companies. In this line, Finbold queried OpenAI’s latest and most advanced artificial intelligence (AI) platform, ChatGPT-4o, to predict which stocks are likely to emulate the ‘Magnificent Seven’ in 2025 amid the current market rally.

Picks for you

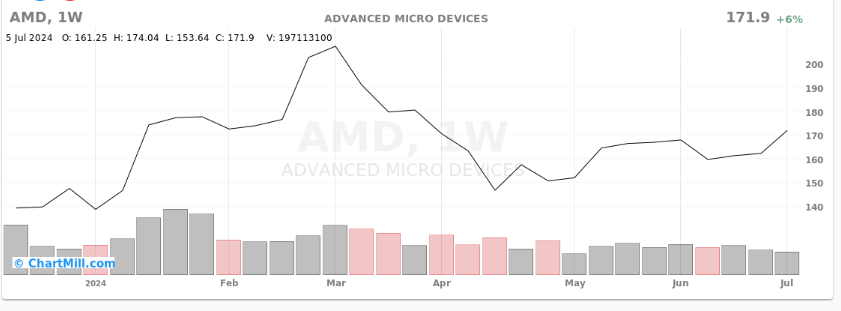

Advanced Micro Devices stock

According to ChatGPT-4o, one of the prominent candidates is Advanced Micro Devices (NASDAQ: AMD). The company is known for making significant strides in the semiconductor space and competes directly with industry leader Nvidia. The tool noted that the company’s processing power and energy efficiency innovations suggest it is poised to capture a larger market share. In 2024, the stock has significantly benefited from the AI wave, with the equity mainly trading in the green zone.

By the close of markets on July 5, AMD was trading at $171.90, with year-to-date gains of 24%.

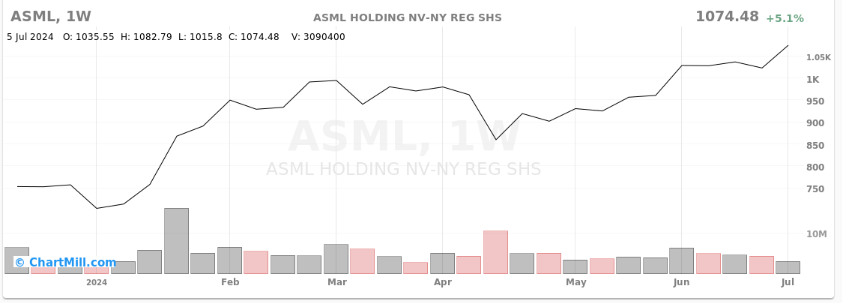

ASML Holding stock

ASML Holding (NASDAQ: ASML) is another strong contender. As a leader in photolithography systems essential for semiconductor manufacturing, ASML’s cutting-edge technology is critical for producing the next generation of chips. The AI tool pointed out that the company’s dominance in extreme ultraviolet (EUV) lithography places it at the forefront of technological advancement.

In 2024, the stock has rallied by almost 50%, trading at $1,074 by press time.

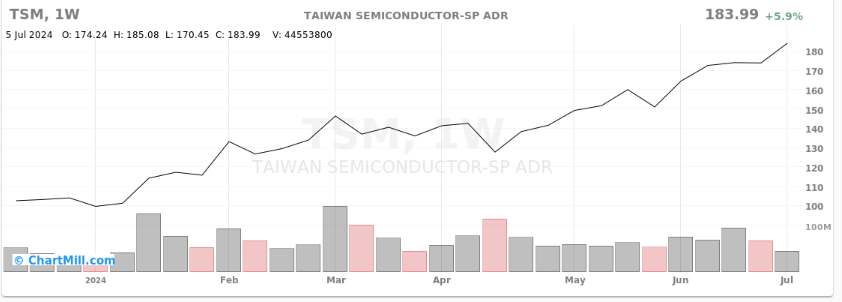

Taiwan Semiconductor Manufacturing Company stock

Taiwan Semiconductor Manufacturing Company (NYSE: TSMC) also made the list. ChatGPT-4o stated that TSMC is a cornerstone of the global tech industry, providing advanced semiconductor manufacturing services to tech giants worldwide. Its leading-edge chip production capabilities and partnerships with top tech companies underscore its indispensability in the supply chain.

Indeed, the stock has also benefited from the AI wave, having gained over 80% year-to-date (YTD), trading at $183 as of press time.

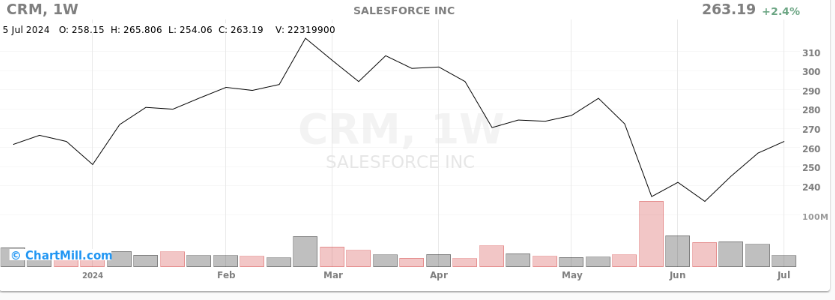

Salesforce stock

Salesforce (NYSE: CRM), a pioneer in customer relationship management (CRM) software and cloud services, continues to expand its product offerings and market reach. With comprehensive CRM solutions and a robust cloud platform, Salesforce supports diverse business needs and demonstrates significant growth potential, as per ChatGPT-4o.

At the close of markets on July 5, CRM was valued at $263, with YTD gains of almost 3%.

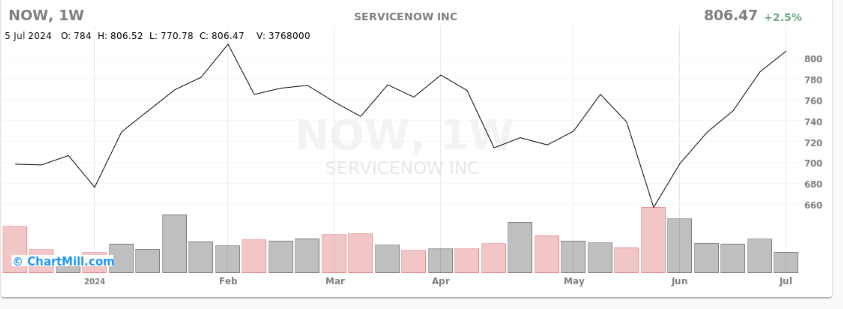

ServiceNow stock

ServiceNow (NYSE: NOW) specializes in digital workflows and enterprise cloud solutions. The company’s innovative enterprise solutions streamline and automate business processes, making it well-positioned to capitalize on the increasing demand for digital transformation, according to ChatGPT-4.

In 2024, NOW has gained over 17%, trading at $806 at the time of publishing.

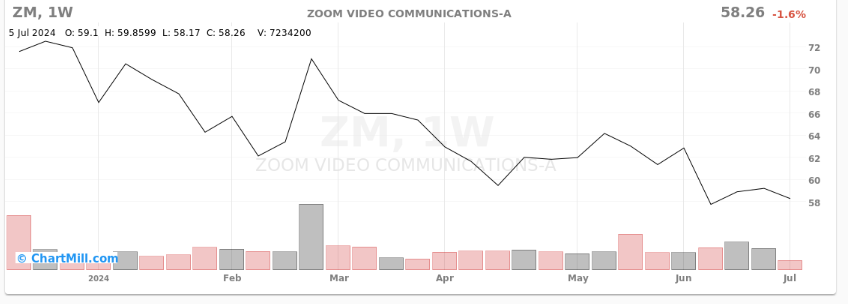

Zoom Video Communications stock

Zoom Video Communications (NASDAQ: ZM) remains a strong player despite the return to some in-person activities. The company gained prominence during the pandemic by facilitating meetings for people working from home.

The shift towards remote work and virtual communication persists, and Zoom’s continuous innovations keep it at the forefront of this sector. Its dominance in video conferencing and user-friendly platform support ongoing remote work trends.

As of press time, ZM was trading at $58 with YTD losses of over 15%.

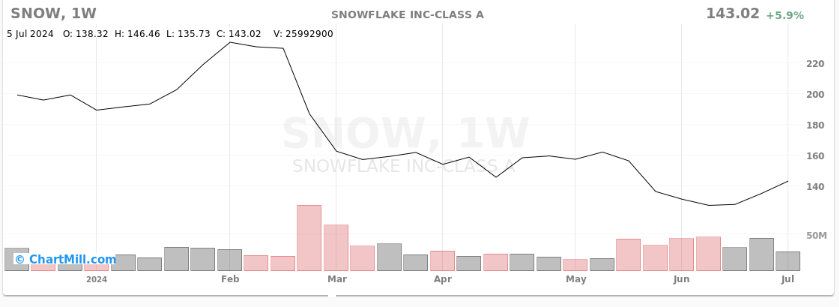

Snowflake stock

The last and seventh company on the list is Snowflake (NYSE: SNOW), with the AI platform noting that it rounds out the list as a leader in data warehousing and analytics. The company’s robust data storage and processing capabilities are crucial for businesses leveraging big data to drive decisions and strategies. Snowflake’s solutions play a vital role in business intelligence and analytics.

Although the AI tool identified SNOW as a potential magnificent seven, the equity has largely traded in the red zone across 2024. By press time, SNOW was valued at $143 with YTD losses of 24%.

In conclusion, while the ‘Magnificent Seven’ continues to dominate the market, other companies are showing significant promise. As these companies continue to innovate and grow, they could emulate the success of the current market leaders, further shaping the future of the equities market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.