Earnings season is heating up, with electric vehicle (EV) manufacturer Tesla (NASDAQ: TSLA) among those set to announce its performance for the second quarter.

Notably, results scheduled for June 23 will provide updates on electric vehicle demand and offer insights into the sector’s recovery after an early-year slowdown.

In anticipation, Tesla’s stock has been one of the top performers recently, with monthly gains exceeding 30%. TSLA shares have successfully breached the $200 resistance zone and are targeting $250. At the last market close, TSLA stock price was valued at $239.

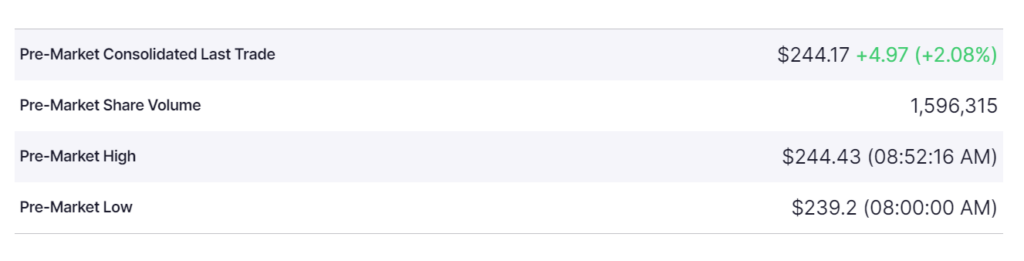

In the meantime, Tesla is showing bullish signals in the pre-market. The stock is up 2% ahead of the market opening, trading at $244.

Analysts project Tesla will report earnings per share (EPS) of $0.61, down from $0.91 in the same quarter last year, with revenue expected to reach $24.3 billion. This suggests a tempered performance compared to previous quarters, but the recent 31% rally in Tesla’s stock over the past month indicates some optimism is already priced in.

Tesla’s Q2 2024 production and delivery numbers showed strong performance, with 443,956 vehicles delivered and 410,831 units produced, marking a significant increase from Q1 2024. These figures underscore Tesla’s solid growth and bolster confidence in meeting its annual goal of 2 million EV deliveries.

ChatGPT-4o predicts TSLA stock

To gauge how the stock might perform post-July 23, Finbold consulted OpenAI’s advanced artificial intelligence (AI) tool, ChatGPT-4o.

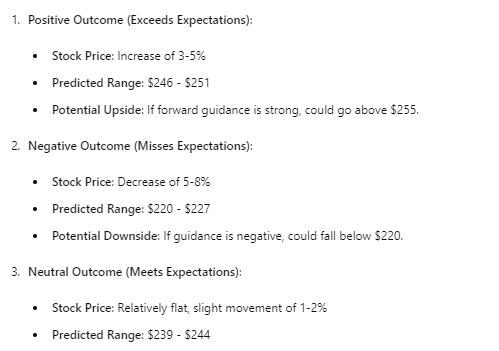

According to the AI platform, if Tesla surpasses the EPS and revenue estimates, a positive reaction could drive the stock up by 3-5%, potentially reaching $246-$251. Favorable forward guidance, especially on the 2 million delivery target for 2024, could push the stock even higher, possibly hitting $255 or more.

Conversely, missing EPS or revenue forecasts could lead to a 5-8% drop, bringing the stock down to around $220-$227. Any downward revisions to annual delivery goals or financial targets could exacerbate this decline, pushing the stock below $220. If results meet expectations without surprises, the stock might see minimal movement, within 1-2%, staying in the $239-$244 range.

Additionally, ChatGPT-4o noted that broader economic trends, such as interest rate changes or economic data releases, could impact Tesla’s stock independently of its earnings performance. Announcements about Tesla’s technological advancements, new products, or competitive dynamics might also sway investor sentiment.

Analysts take on TSLA stock

Elsewhere, analysts at TrendSpider noted in an X post on July 22 that Tesla has experienced a significant technical breakout, with its stock price surpassing a crucial resistance trendline, suggesting potential bullish momentum.

The weekly candlestick chart indicates Tesla has broken through a long-standing descending resistance trendline from late 2021, and the ascending triangle pattern reinforces this positive outlook.

However, with the Relative Strength Index (RSI) at 98.8, caution is advised. This high RSI signals overbought conditions and suggests a possible short-term pullback or consolidation. Historically, such high RSI levels are unsustainable and can lead to price corrections.

If Tesla maintains its position above the broken resistance, key levels to watch are around $300 and $400. Conversely, the overbought RSI raises the risk of a pullback, with potential support levels near $200 or lower.

Overall, analysts remain bullish on Tesla, regardless of the Q3 earnings result. For instance, following the Q2 2024 production and delivery report, they have raised Tesla’s price target to $300.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.