Despite the overall market trending positively, decentralized finance (DeFi) project Cardano (ADA) has predominantly experienced losses in recent weeks with a notable drop of almost 20% in the last 30 days.

Notably, as ADA continues to trade below the $1 mark, the community is partially relying on network activity to stimulate price growth.

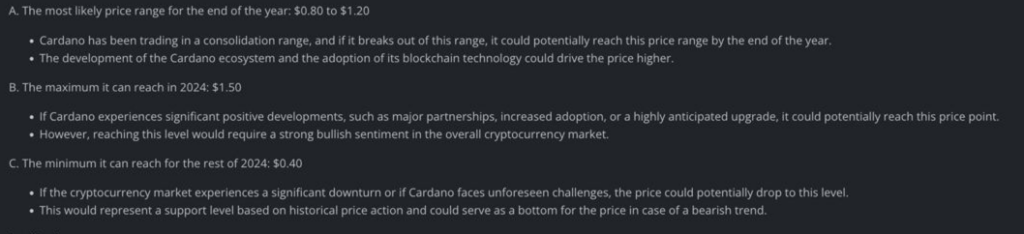

In an effort to gauge ADA’s potential trajectory in the coming months, Finbold sought insights from Anthropic’s Claude 3 Opus AI platform, which is emerging as a formidable competitor to OpenAI’s ChatGPT. The tool provided various scenarios regarding ADA’s price by the end of 2024.

ADA AI price prediction

To begin with, the AI platform offered the most likely scenario, acknowledging that ADA is undergoing a consolidation phase and suggesting the possibility of a breakout. Should this materialize, the tool suggests a likely price range of $0.80 to $1.20 by the year’s end.

This forecast takes into account ongoing developments within Cardano’s ecosystem and the increasing adoption of its blockchain technology.

Under conditions of substantial positive developments such as significant partnerships, heightened adoption rates, or notable upgrades, Cardano could potentially soar to $1.50. To attain this level, ADA will need to rally over 150% of the current price. However, achieving this peak would hinge on a bullish sentiment prevailing across the broader cryptocurrency market.

On the other hand, in the event of adverse market conditions or unforeseen challenges could lead to a downturn, driving Cardano’s price to a minimum projection of $0.40. This level is perceived as a historical support threshold, potentially serving as a floor amid bearish trends.

The rationale behind Claude 3 Opus AI’s predictions lies in Cardano’s robust community and dedicated development team, factors poised to fortify its ecosystem.

ADA fundamentals

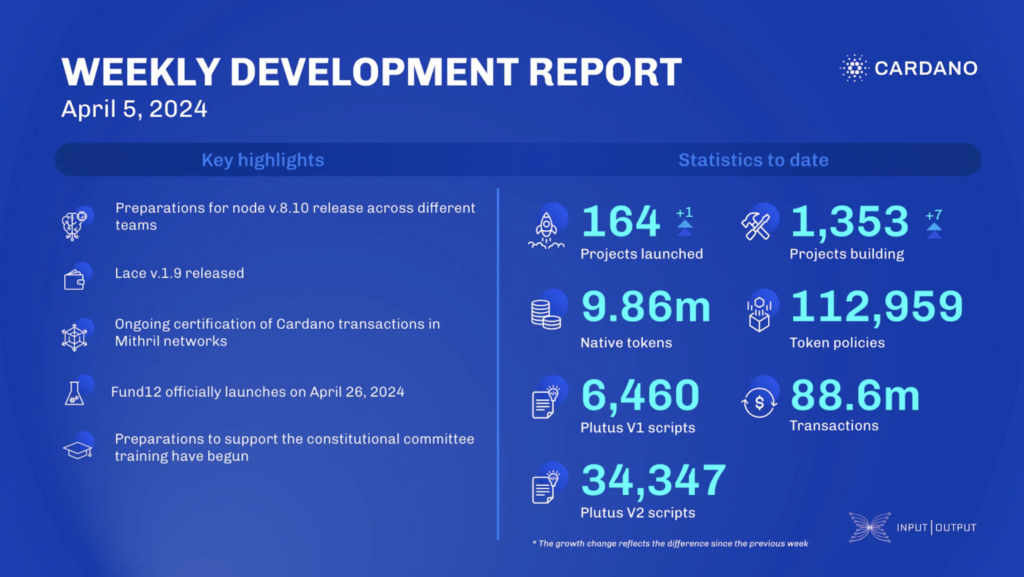

It’s worth noting that the Cardano community is primarily banking on the growth of its in-chain activities to stimulate price growth partly. Notably, data released by the platform’s developer, IOHK, indicates significant growth.

For instance, data published by the platform for the week ending April 5 showed a staggering 88.6 million transactions, with 1,353 new projects launched on the platform.

Additionally, the platform is relying on partnerships and collaborations to enhance its popularity. For example, Frederik Gregaard, CEO of the Cardano Foundation, disclosed that several U.S. states have approached the organization to establish a voting system using blockchain technology.

Another factor likely to impact ADA’s price is its association with institutions. In this context, Grayscale Investments announced the removal of Cardano from its Digital Large Cap Fund during the fund’s quarterly rebalancing. The decision to adjust GDLC’s portfolio involved selling ADA and using the proceeds to acquire existing fund components in accordance with their respective weightings.

Meanwhile, ADA is currently trading at $0.59, reflecting daily gains of over 2%. However, on the weekly chart, the token has experienced a decline of over 8%.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.