While the overall cryptocurrency market is currently experiencing a short-term decline, there is optimism that most assets will likely recover in the coming months. Notably, bullish fundamentals, including events like the upcoming Bitcoin (BTC) halving and potential interest rate cuts by the Federal Reserve, contribute to this positive outlook.

In anticipation of a potential rally, several projects show promise in reaching key support levels, notably around $100. In this context, Finbold has identified three cryptocurrencies likely to experience a surge towards the $100 mark.

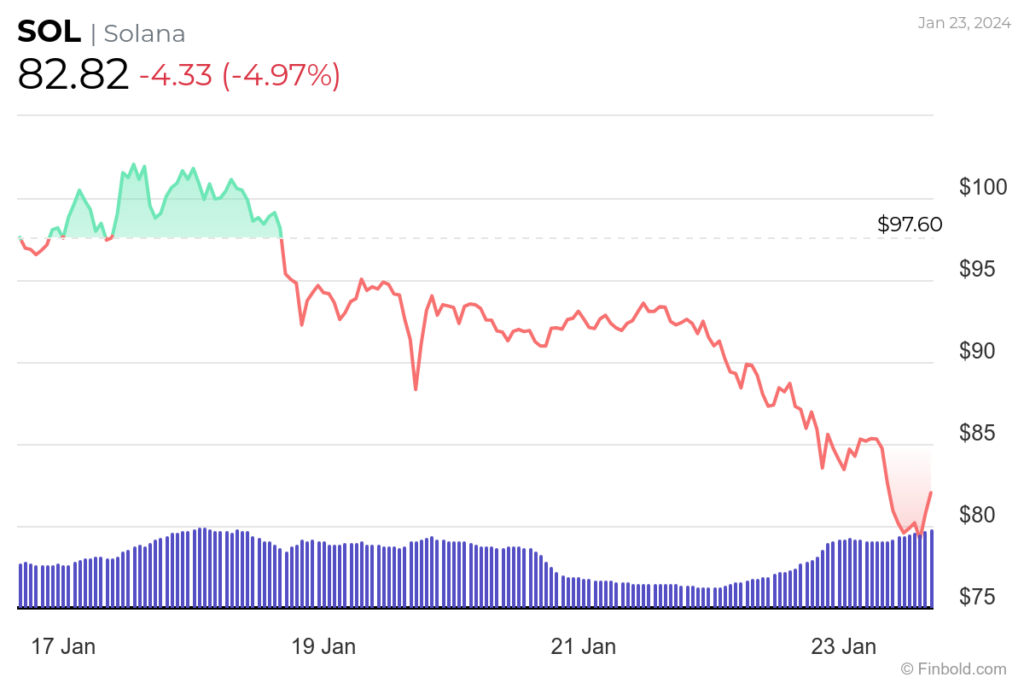

Solana (SOL)

Solana (SOL), recognized for its high-performance blockchain technology, has gained significant traction in recent months despite facing the threat of a significant drop due to its association with the collapsed FTX exchange. Indeed, the cryptocurrency significantly recovered from late October 2023, surging to a high of $121 in late December.

Picks for you

In December alone, the token recorded an impressive growth of 105%. This surge was attributed mainly to the fear of missing out (FOMO) surrounding Solana’s SPL token airdrops.

Although the cryptocurrency currently trades in line with bearish market sentiments, it still has a real chance of reclaiming the $100 mark. This potential is guided by Solana’s combination of technological advancements, increased demand for decentralized finance (DeFi) projects, and a growing community of developers contributing to its ecosystem.

The renewed demand and ongoing upgrades to address past network outages could further propel SOL toward higher ground.

By press time, Solana was trading at $82.82 with daily losses of 4%, while on the weekly chart, the token is down 14%.

Avalanche (AVAX)

Avalanche (AVAX), renowned for its scalability and interoperability, continues to attract DeFi projects seeking relief from Ethereum’s (ETH) congestion.

Recent developments surrounding AVAX, including strategic partnerships and collaborations, have significantly enhanced its reputation. For instance, the platform partnered with Alibaba Cloud to create a blockchain-based metaverse deployment platform called Cloudbase.

Additionally, it forged another high-profile collaboration with Amazon Web Services (AWS).

The expansion of its ecosystem and the integration of new projects fuel optimism among investors, likely propelling AVAX toward the $100 milestone.

At the same time, the Avalanche Foundation is broadening the scope of its “Culture Catalyst” initiative to include financing for the acquisition of meme coins. Initially focused on non-fungible tokens (NFTs), the $100-million investment fund revealed a shift in allocation, with a portion designated for memecoins.

Indeed, considering the tendency of meme coins to rally significantly, AVAX has the potential to build on the foundation’s push and rally toward $100, en route to reclaiming its record high of $134 attained in 2021.

By press time, AVAX was valued at $28.59 with over 5% losses in the last 24 hours, while on the weekly chart, the token is down 20%.

Ethereum Classic (ETC)

Ethereum Classic (ETC), the hard fork of Ethereum that retained the original Proof-of-Work (PoW) consensus mechanism, occupies a unique position in the crypto landscape. As Ethereum shifted to Proof-of-Stake (PoS), ETC has become a refuge for miners and PoW enthusiasts. The recent scaling challenges faced by Ethereum could potentially drive users towards ETC, providing a potential boost to its price.

Furthermore, the ability of ETC to rally is closely tied to its compatibility with existing Ethereum projects. This compatibility positions Ethereum Classic as an alternative investment for those seeking exposure to Ethereum’s ecosystem but with a different risk profile.

On the other hand, ETC could receive a boost from regulatory developments. Specifically, with the recent approval of the spot Bitcoin exchange-traded fund (ETF), attention has now turned to a similar product for Ethereum.

Consequently, the approval of a spot ETH ETF would likely have an impact on ETC. In this scenario, positive news of this nature could propel ETC towards potentially reclaiming its all-time high of $127, which was recorded in 2021.

As of the latest update, ETC was down 4% on the daily chart, trading at $22.37.

In conclusion, the prospects of Solana, Avalanche, and Ethereum Classic reaching $100 in 2024 appear promising, driven by a combination of technological advancements, market trends, and growing investor interest. While these projections present exciting opportunities, it’s worth noting that their success will largely depend on overall market sentiments.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.