Bitcoin (BTC) is currently undergoing a sell-off, breaking below the $42,000 support level, prompting uncertainty about how low the asset may go.

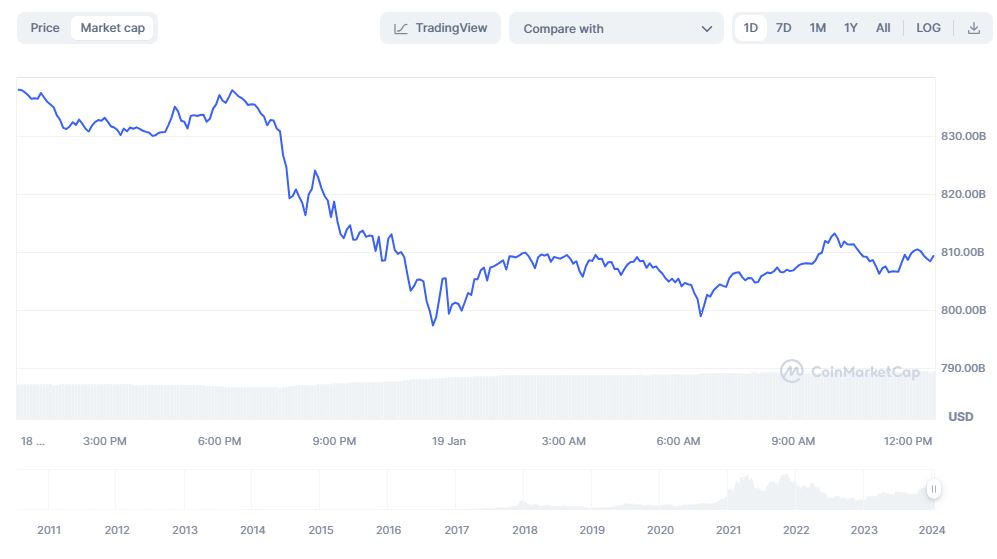

This sell-off became more evident in the last 24 hours, with Bitcoin experiencing an outflow of approximately $32.02 billion from its market cap, which stood at $806.72 billion at the time of writing.

The downward trend follows Bitcoin’s inability to sustain the $49,000 level achieved after the spot exchange-traded fund (ETF) approval in the United States.

Bitcoin profit-taking opportunity

Despite the prevailing bearish sentiments, TradingShot, a cryptocurrency trading expert, identified potential profit-taking opportunities for investors in various Bitcoin cycles in a TradingView post on January 18.

The analyst shared insights into a distinctive pattern observed in Bitcoin’s one-month time frame. According to the expert, this pattern, shaped by distinct characteristics and fundamental events, guides traders and investors in formulating effective strategies for long-term buying and selling on a cyclical scale.

The latest pattern was retraced back to the November 2011 bottom, with each cycle lasting approximately 3.58 or 3.83 years until the one-month Moving Average Convergence Divergence (MACD) bottom. According to TradingShot, the most recent MACD bottom and the initiation of the reversal took place in February 2023, when Bitcoin was trading at an average of $23,000.

Although not as enticing as the November 2022 low of $16,000, this level still provides an opportunity for a long-term dip buy entry compared to the previous all-time high of $69,000.

Currently, the analyst noted that Bitcoin is positioned at the 0.236 Fibonacci level of the current cycle. Historically, this level has been associated with a one to two-month pullback in the price. On the flip side, the tops tend to occur at either the 0.5 or 0.618 Fibonacci levels.

According to the expert’s model, long-term investors could contemplate taking profits in 2025.

“This means that long-term investors could take their profits either in January 2025 or July 2025 if the current cycle lasts again 3.58 years. And as for the next bottom based on the model, it is expected in December 2026, where we can take a (relatively) confirmed buy position again for the long-term.”

Impact of ETF selling pressure

Notably, the recent Bitcoin sell-off is primarily attributed to the Grayscale Bitcoin Trust’s (GBTC’s) profit-taking activity.

Analysts indicate that GBTC investors, who purchased the fund’s shares at a significant discount to net asset value in anticipation of an eventual ETF conversion, are now cashing in their profits. Instead of transitioning to more affordable spot Bitcoin ETFs, they exit the Bitcoin space altogether.

Currently, Bitcoin is valued at $41,351, experiencing daily losses of over 3%. On the weekly chart, BTC is down nearly 10%.

These price movements follow a period of consolidation for Bitcoin after its decline from the $49,000 mark.

In conclusion, Bitcoin investors hope the cryptocurrency maintains support above the $40,000 level, as a breach could indicate a further correction.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.