Meta’s (NASDAQ: META) stock has surged by 400% since hitting its low of $88 in October 2022, despite initial skepticism surrounding cash burn and investments in the unproven Metaverse.

Since January 2023, Meta stock has successfully reversed its fortunes, with momentum shifting from a negative relative strength momentum (RSM) that hit a low of -55 in October 2022, to a high of 59 in August 2023, before settling at its current valuation of 41. Throughout this process, it has crushed the broader index in performance.

Remarkably, the stock rebounded to become the second-best performer of the Magnificent Seven in the S&P 500 in 2024, trailing only Nvidia (NASDAQ: NVDA).

Robust financials as drivers of success

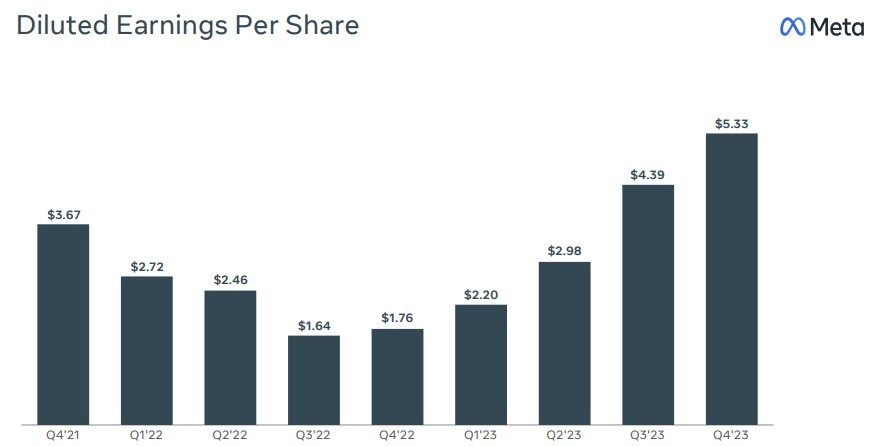

Meta’s Q4 earnings report, unveiled in early February, brought joy to investors.

The stock surged by 21% after the company exceeded analyst expectations by nearly $1 billion, reporting revenue of $40.1 billion, marking a 25% year-over-year increase.

Putting its substantial cash reserves to good use, Meta authorized a new $50 billion stock buyback program, in addition to the existing $30.9 billion program. This move is expected to reduce outstanding shares by another 6.7% at current stock prices.

To sweeten the deal for investors, Meta announced its inaugural quarterly dividend of $0.50 per share. Although the current yield is modest at 0.42%, historical trends indicate that companies often ramp up dividends in their early stages.

A growing user base is good news for META stock

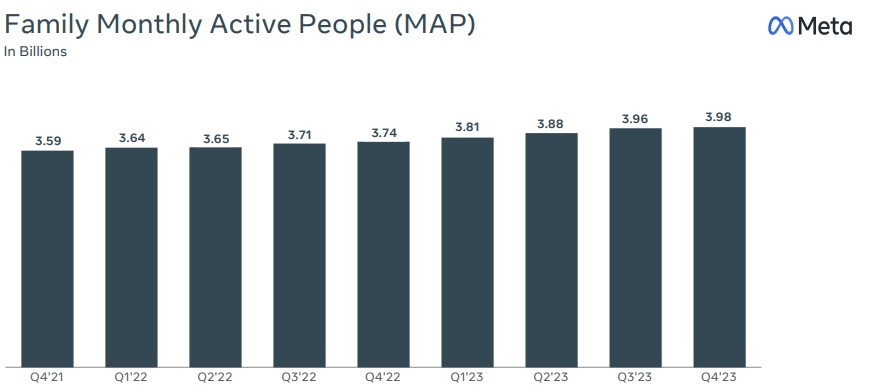

Meta’s suite of apps, which includes Facebook, Instagram, and WhatsApp, boasts a staggering 3.98 billion active users.

This means that nearly half of the world’s population is actively engaged with one of their products. The company’s reach is truly staggering, giving it considerable influence.

This is particularly noteworthy as we approach the 2024 elections, expected to draw a record-breaking 4 billion voters globally. Such a massive audience presents a significant advertising opportunity not only for Meta but also for Alphabet Inc (NASDAQ: GOOGL).

Despite its already extensive user base, Meta’s monthly active users continue to grow, with a 6.4% year-over-year increase.

The growing adoption and retention of users, whose social networking needs are fully satisfied in every aspect, along with rising revenue from advertisements, and news of a potential TikTok ban in the US, all bode well for the future of Meta Platforms.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.