Amid a recently sparked meme stock rally, which has seen shares of GameStop (NYSE: GME), AMC Entertainment (NYSE: AMC), and BlackBerry (NYSE: BB) make massive price increases, the CEO of GameStop, Ryan Cohen, has grown his fortune by an impressive $1 billion in just two days.

Specifically, Cohen, GameStop’s CEO, chairman, and largest individual shareholder with his 12% stake, has made nearly $1 billion (in unrealized gains) in the stock market over the course of mere 48 hours during the meme rally’s peak, according to the information shared by Insider Tracker in an X post on May 14.

How GameStop’s Ryan Cohen profited

Indeed, the 38-year-old investor and entrepreneur’s current net worth amounts to $4.8 billion, increasing by over $1 billion from the previous Forbes data which placed his net worth at $3.4 billion, which means that it the recent stock developments have greatly contributed to his fortune.

As a matter of fact, in just the last 24 hours, Cohen’s riches have soared by $656 million or 15.73%, and Forbes reported that GameStop’s CEO had become $480 million richer, “expanding his fortune to $4.2 billion,” arguing that it was “still billionaires who gained the most” on May 13.

Combining these figures, the result arrives at a staggering $1.14 billion in gains for the young investor, who purchased 1.2 million GME shares in 2020 and then acquired another 443,852 GME shares nearly three years later in 2023, as per Insider Tracker information.

Meanwhile, Ryan Cohen isn’t the only one who has greatly benefitted from the recent meme stock craze resurrection, with Jim Simons’ hedge fund Rennaissance Technologies having raked in substantial gains thanks to over 1 million GME shares bought at an average price of $15.02, as Finbold reported.

GameStop stock price analysis

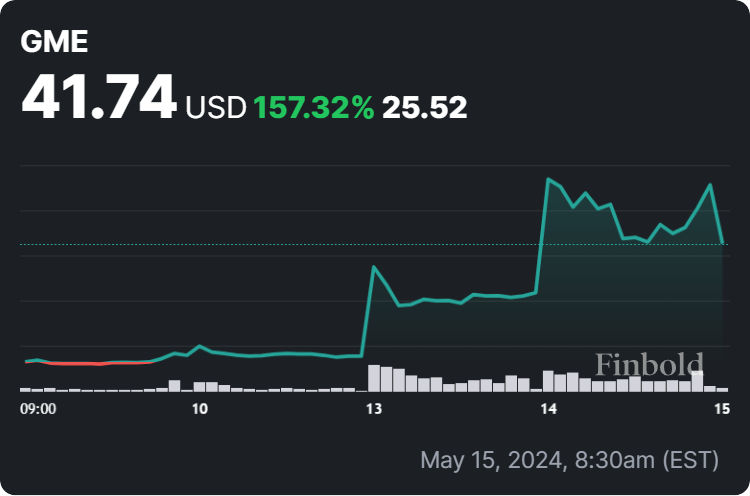

Currently, GME shares are trading at $41.74, recording a whopping 157.32% gain in the past week and adding up to the advance of 315.02% on its monthly chart but reversing these increases in the last 24 hours by dipping 15.84% in the premarket, according to the most recent price data on May 15.

It is also worth pointing out that, despite recent price surges, Wedbush analyst Michael Patcher has maintained his ‘underperform’ rating from March 27 and slashed the GME stock price from $6 to $5.6, while other analysts are still holding back their updates amid short squeeze.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.