Summary: This guide delves into the nuances of farmland real estate investment funds (REITs), highlighting two of the industry’s frontrunners. For those intrigued by the opportunities presented by farm REITs and eager to venture into this investment domain, a trusted platform like Interactive Brokers (IBKR) is a solid starting point.

Best Platform for Worldwide Stock Trading & Investing

-

Highly trusted multi-asset broker with clients in over 200 countries

-

Trade on 150 markets globally from a single platform (stocks, ETFs, futures, currencies, crypto & more)

-

Low commissions starting at $0 with no platform fees or account minimums

-

Easily fund your account and trade assets in 26 currencies

-

IBKR pays up to 4.58% interest on cash balances of $10k or more

What are REITs?

As a result, REITs offer individual investors a way to invest in large-scale real estate portfolios without directly purchasing properties or handling property management, all while benefiting from income generation, possible price appreciation, and diversification.

What are farm REITs?

Farm REITs are specialized REITs that acquire and manage agricultural land, generating revenue by leasing it to farmers.

The assets in the portfolio of a farmland REIT can range from land dedicated to annual row crops, permanent crops, and commodity crops like soybeans, cattle, wheat, corn, cotton, rice, and sugar to associated assets like water rights and farming-related infrastructure such as cooling, processing, and packaging facilities. Some REITs even venture into providing loans to farmers, which are then secured by agricultural real estate.

By investing in farm REITs, shareholders can gain exposure to the agricultural real estate market without having to directly buy or manage farmland, providing investors with a unique opportunity to benefit from the steady appreciation and rental income potential of agricultural land while also diversifying their investment portfolios beyond traditional real estate assets.

Best farmland REITs to invest in

Now that you’ve familiarized yourself with the basics of farmland REITs, you might be wondering where to begin your investment journey. To guide you, here are two leading farmland REITs worth considering:

- Gladstone Land (NASDAQ: LAND);

- Farmland Partners (NYSE: FPI).

Each of these REITs offers a unique perspective on farmland investment. It’s recommended to conduct further research and perhaps consult with a financial advisor to determine which aligns best with your investment goals.

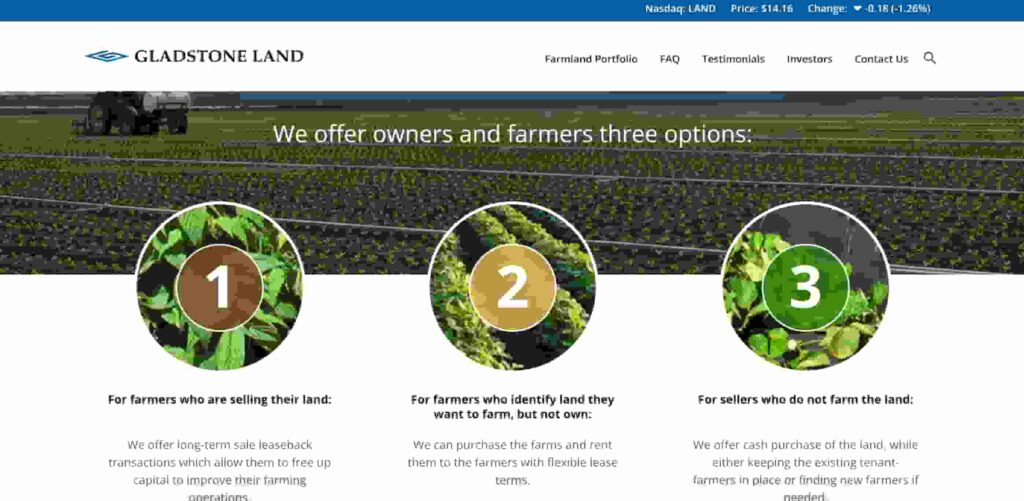

1. Gladstone Land (LAND)

Gladstone Land is a publicly listed REIT that buys and owns farmland and farm-related properties throughout key U.S. agricultural regions.

The company mainly holds farms in areas suitable for cultivating fresh produce like berries and vegetables, which are sown and harvested yearly, as well as land that yields permanent crops, including almonds, apples, cherries, figs, lemons, olives, pistachios, and wine grapes.

Gladstone Land prioritizes fresh produce farms due to their lower risk compared to commodity crops as these farms often have superior water accessibility, are less affected by fluctuations in crop prices, rely less on governmental subsidies and tariffs, incur lower storage expenses, and command higher rental rates.

Gladstone Land is listed on the Nasdaq Exchange with the ticker LAND.

LAND price today

Your capital is at risk.

2. Farmland Partners (FPI)

Farmland Partners Inc. is a publicly traded REIT focused on acquiring, leasing, and managing farmland across North America.

Approximately 70% of the REIT’s portfolio value consists of farms cultivating commodity crops, including corn, soybeans, wheat, rice, and cotton, giving investors a chance to capitalize on the rising global food demand, with the remaining 30% featuring farms that produce specialty crops like citrus and other fruits.

Beyond owning farmland, the REIT offers services like auctioning, brokerage, and third-party farm and asset management. It also earns revenue from solar and wind energy, recreational leasing, sales of crops, and crop insurance from the farms under its operation.

Farmland Partners shares trade on the New York Stock Exchange (NYSE) under the stock ticker FPI.

FPI price today

Your capital is at risk.

How to invest in farmland REITs: Step-by-step guide

Investing in farmland REITs is a great way to tap into the agriculture real estate sector without directly purchasing land. Here’s a concise guide on how to buy farmland REITs:

Step 1: Open a brokerage account

An online brokerage account allows you to trade various securities, including REITs.

Select a trusted brokerage that matches your investment goals and offers access to farmland REITs. We recommend using Interactive Brokers (IBKR) due to its extensive features and services, including:

- Commission-free stock trading;

- Global stock-trading on 90+ market centers;

- Fractional shares available;

- Extra income on fully paid shares;

- Lowest financing rates for margin accounts in the industry;

- No account minimum.

Best Platform for Worldwide Stock Trading & Investing

-

Highly trusted multi-asset broker with clients in over 200 countries

-

Trade on 150 markets globally from a single platform (stocks, ETFs, futures, currencies, crypto & more)

-

Low commissions starting at $0 with no platform fees or account minimums

-

Easily fund your account and trade assets in 26 currencies

-

IBKR pays up to 4.58% interest on cash balances of $10k or more

Step 2: Research farmland REITs

Before diving into specific farmland REITs, it’s essential to have a grasp on the broader agricultural landscape. This includes understanding current trends in farming, crop pricing, demand patterns, and challenges such as climate change or water access. Familiarizing yourself with major crop types (e.g., row crops vs. permanent crops) and their respective market dynamics can also provide insight into the stability and potential growth of the REITs in question. Resources such as the USDA reports, agricultural publications, and industry news outlets can be instrumental in building this foundational knowledge.

Once you have a handle on the agricultural sector, delve into the specifics of potential farmland REITs. Look at key financial metrics such as the REIT’s dividend yield, debt structure, and historical performance. Examine their portfolio composition, including the types of crops they’re involved with, the geographic diversity of their holdings, and their leasing strategies. Also, understand their growth strategies – are they looking to acquire more lands, diversify into different crops, or expand into related services?

Step 3: Place your order

Once you’ve chosen the farmland REIT to invest in, you’ll need to:

- Access the trading or order section on your brokerage platform;

- Locate the REIT using its ticker symbol;

- Indicate the quantity of shares or the monetary value you aim to invest;

- Select the order type (e.g., market order, limit order);

- Review all details and confirm your transaction.

Step 4: Monitor your investment

Here are steps and strategies to effectively monitor your farmland REIT investment:

- Check financial statements: All REITs, including farmland REITs, are required to file quarterly and annual reports. You should, therefore, review these documents to assess the company’s financial health, operational performance, and future strategies;

- REIT’s website: Many REITs maintain an official website with sections dedicated to investor relations. These sections often contain presentations, webcasts, press releases, and other relevant updates;

- Performance metrics: Familiarize yourself with key performance indicators for REITs, such as Funds from Operations (FFO), dividend yield, and occupancy rates. These metrics can provide insights into the REIT’s financial performance;

- Stay updated with industry news: Keeping an eye on the broader agricultural industry can help you understand trends, challenges, and opportunities that might impact your farmland REIT;

- Brokerage account tools: Leverage your brokers’ tools and resources, such as performance graphs and analyst ratings;

- Engage with analyst reports: Financial analysts often cover popular REITs, providing detailed research, ratings, and forecasts. Their reports can give you a sense of market sentiment and potential future performance;

- Monitor dividend distributions: One of the primary appeals of REITs is their dividend payments. Ensure that you’re receiving these dividends as expected and monitor any changes in dividend amounts or frequency;

- Diversification check: Periodically assess your entire investment portfolio to ensure you remain diversified;

- Online communities: Platforms like Reddit, investment forums, and blogs can be useful to gauge investor sentiment and learn from others’ research. However, always take information from these sources with a grain of caution.

Remember, while monitoring your investment is essential, it’s also crucial not to make rash decisions based on short-term market fluctuations. Indeed, holding assets like REITs over the long term often yields better results. For well-informed decisions, consider seeking advice from a financial advisor.

Pros and cons of investing in farmland REITs

Pros

- Portfolio diversification: Farmland investments typically demonstrate returns uncorrelated to traditional asset classes like stocks, bonds, and cryptocurrencies, providing a valuable diversification tool and potentially reducing overall portfolio volatility;

- Inflation hedge: Farmland has historically acted as a strong hedge against inflation, often performing better than other assets such as stocks, bonds, or gold. This correlation helps protect purchasing power during inflationary periods;

- Income generation: The nature of REITs mandates the distribution of a significant portion of their income as dividends, ensuring a stream of income for investors;

- Liquidity: Unlike direct ownership of farmland, shares of REITs are traded on major stock exchanges, making them easy to buy and sell.

Cons

- Interest rate sensitivity: Like all REITs, farmland REITs are susceptible to interest rate fluctuations. As interest rates rise, borrowing becomes costlier for REITs, potentially affecting their growth and overall profitability. Additionally, as rates rise, other income-generating assets might appear more attractive, putting downward pressure on REIT valuations;

- Natural disasters: Unpredictable events such as droughts, floods, wildfires, insect infestations, and other natural calamities can severely impact a farm’s productivity and affect their ability to pay rent;

- Volatile crop prices: The prices of crops, especially commodities like corn, soybeans, and wheat, can be highly volatile. Any negative price movement can impact a farm’s revenue and, in turn, its ability to pay rent;

- Operational challenges: Farming requires specialized knowledge, and mismanagement or adoption of unsuitable farming techniques can result in lower yields and reduced profitability.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about investing in farmland REITs

What is a farmland REIT?

A farmland REIT is a company that owns, operates, or finances income-producing farmlands. So, by purchasing shares in a Farmland REIT, investors can gain exposure to the agricultural real estate sector without directly buying and managing farmland.

What are the top farmland REITs?

The two largest farmland REITs in the U.S. based on market capitalization and prominence in the sector are Gladstone Land and Farmland Partners.

Why should I consider investing in farmland REITs?

Farmland REITs offer portfolio diversification, can act as an inflation hedge, and can deliver attractive returns combining dividends and capital appreciation.

What risks are associated with investing in Farmland REITs?

Like all investments, Farmland REITs have risks. These include the impact of natural disasters, volatile crop prices, and potential financial troubles of farmer-tenants.

How do farmland REITs generate income?

They typically earn revenue through rental income from farmers, a percentage of a farm’s gross revenue (in some cases), and direct operation of some farms.

Are farmland REITs sensitive to interest rate changes?

Yes. Rising interest rates can increase REIT borrowing costs and make other investment alternatives more attractive, potentially affecting REIT valuations.

How to buy farmland REIT stock?

Investing in farmland REITs involves opening an account with a trusted broker like Interactive Brokers and then buying shares of the chosen REIT.

Do farmland REITs pay dividends?

Like other REITs, farmland REITs are required to distribute at least 90% of their taxable income to shareholders annually in the form of dividends. The exact amount and frequency of the dividends can vary based on the REIT’s profitability, operational strategy, and other factors. Always check the specific dividend history and policies of the REIT you are interested in for detailed information.

What factors should I consider before investing in farmland REITs?

Before investing, consider the REIT’s property locations, crop types, tenant diversification, historical performance, dividend yield, and management track record. Also, consider overall market conditions and your personal risk tolerance.

Does Vanguard offer a farmland REIT?

Vanguard does not have a specific farmland REIT. However, Vanguard offers a variety of real estate-focused funds. It’s always a good idea to check their official website or contact Vanguard directly for the most current information.

Best Platform for Worldwide Stock Trading & Investing

-

Highly trusted multi-asset broker with clients in over 200 countries

-

Trade on 150 markets globally from a single platform (stocks, ETFs, futures, currencies, crypto & more)

-

Low commissions starting at $0 with no platform fees or account minimums

-

Easily fund your account and trade assets in 26 currencies

-

IBKR pays up to 4.58% interest on cash balances of $10k or more