When engaging in CFD trading, you enter into a contract with a broker to exchange the difference in the value of a financial asset between the time the contract is opened and when it is closed. It’s crucial to understand that in CFD trading, you don’t actually own the underlying asset; instead, you’re speculating on its price movement. This guide delves into the mechanics of CFD trading, offering insights into effective trading strategies, the inherent risks, eligibility criteria for traders, and essential terminology.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Disclaimer: 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. This content is not intended for US users. eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

CFD trading definition

CFD trading enables investors to speculate on various financial markets, such as stocks, forex (foreign exchange market), indices, commodities, and cryptocurrencies. Furthermore, it is an advanced trading strategy that experienced traders generally employ and is not allowed in the United States.

Read also:

Stock Trading for Beginners

Dividend Investing for Beginners

10 Best Stock Trading Books

15 Top-Rated Investment Books

What is CFD trading and how does it work

A CFD investor will never own the underlying security but rather acquire revenue based on the price change of that particular asset. So, for instance, instead of buying actual shares of Netflix (NASDAQ: NFLX), a trader can purely speculate on whether the price of Netflix will go up or down.

Short and long CFD trading

A CFD is composed of two trades. The first trade constructs the open position, which is later closed out through a reverse trade with the broker at a different price. An investor can opt to go long and ‘buy’ if they think the asset’s market price will increase or go short and ‘sell’ if they believe the market price will decrease.

If the trader believes the asset’s price will increase, their first trade will be a buy or long position, the second trade (which closes the open position) is a sell. Conversely, if the investor thinks the asset’s value will decline, their opening trade will be a sell or short position, the closing trade a buy. The trader’s net profit is the price difference between the opening and closing-out trade (minus any commission or interest).

Going long example

Your expectation is that the value of Apple’s (NASDAQ: AAPL) stock will increase, and you want to open a long CFD position to take advantage of this opportunity. You purchase 100 CFDs on Apple shares at $160 a share, so the total value of the trade will be $16,000. If Apple’s share price shoots to $170, you make $10 a share, a $1,000 profit.

Going short example

You believe that Apple stock will decrease in value, and you want to profit from this movement. To do this, you can open a short CFD position (known as short-selling) and profit from a tanking market. This time, you have decided to sell 100 CFDs on Apple at $170 per share, which then proceeds to fall to $160 per share. You will have made a profit of $1,000, or $10 per share.

Leverage in CFD trading

CFD trading is a leveraged product, meaning an investor can gain exposure to a significant position without committing the total cost at the outset. For example, say an investor wanted to open a position equivalent to 200 Apple shares. A traditional trade would mean bearing the full cost of the shares upfront. However, you might only have to put up 5% of the price with a CFD.

While leverage enables the investor to spread their capital further, it is vital to remember that the acquired profit or loss will still be calculated on the total size of the investor’s position. Using the example above, that would be the difference in the price of 200 Apple shares from open til close of the share. Meaning both profits and losses can be massively magnified compared to your outlay, and that losses can surpass deposits. As a result, it is essential to pay attention to the leverage ratio and ensure that you are trading within your means.

Margin in CFD trading

Leveraged trading is at times referred to as ‘trading on margin’ since the margin – the budget required to open and maintain a position – represents only a fraction of its total size.

There are two types of margins within CFD trading. First, to open a position, you need a deposit margin. Additionally, a maintenance margin may be required if your trade is likely to suffer losses that the deposit margin, including any additional funds in your account, won’t cover.

Should this happen, you may get a margin call from your broker asking you to top up your account. If you don’t add adequate funds, the position may be closed, and any losses incurred will be realized.

Hedging with CFDs

CFDs can also be used to hedge against any losses in an existing portfolio of physical shares if you believe they may lose some of their value over the short term. By short selling the same shares as CFDs, you can attempt to counterbalance some of the potential loss from your existing portfolio. Using a CFD hedging strategy means that any drop in the value of the particular shares in your portfolio will be offset by a gain in your short CFD trade.

Key concepts behind CFD trading

Let’s now explain the four key concepts of CFD trading: spreads, deal sizes, durations and profit/loss.

Spread and commission

CFD prices are quoted in two prices: the buy price (offer) at which you can open a long CFD and the sell (bid) price at which you can open a short CFD. Sell prices will consistently be slightly lower than the current market price, and buy prices will be slightly higher. The difference between the two prices is called the spread.

Usually, the cost of opening a CFD position is covered in the spread: buy and sell prices will be adjusted to reflect the cost of making the trade.

Deal size

CFDs are traded in standardized contracts (lots). An individual contract’s size depends on the underlying asset being traded, often mimicking how that asset is traded on the market.

For share CFDs, the contract size typically represents one share in the company you are trading. So to open a position that copies purchasing 500 shares of company X, you’d purchase 500 Company X CFD contracts. This is another way CFD trading is more similar to traditional trading than other derivatives, such as options.

Duration

Unlike options, most CFD trades have no fixed expiry. Rather, a position is closed by placing a trade opposite to the one that opened it. A buy position of 500 silver contracts, for instance, would be closed by selling 500 silver contracts.

An overnight funding charge will be charged from your account if you maintain a daily CFD position open past the daily cut-off time. The amount mirrors the cost of the capital your provider has effectively lent you to open a leveraged trade.

Yet this isn’t always the case, with the main exception being a forward contract. A forward contract has an expiry date at an upcoming date and has all overnight funding charges already included in the spread.

Profit and losses

To calculate the profit or losses made from a CFD trade, you multiply the value of each contract (expressed per point of movement) with the deal size of the position (total number of contracts). Next, you multiply that figure by the difference in points between the price when you opened the contract and when you closed it.

For a total calculation of the return or loss from a trade, you’d also subtract any charges or fees (commission, overnight funding charges, guaranteed stop loss) you paid.

Fees and charges of CFDs

- Spread: When trading CFDs, you must pay the spread, the difference between the buy and sell price. The narrower the spread, the less the price needs to move in your favor before you start to make a profit or a loss if the price moves against you.

- Overnight Funding: An overnight funding amount is either added to or subtracted from your account when holding a position after a specific time (referred to as the “Overnight Funding Time”).

- Currency Conversion Fee: Will typically be charged for trades on instruments denominated in a currency different from the currency of your account.

- Guaranteed Stop Order: A unique order type used to help you manage risks by guaranteeing the stop loss level.

- Inactivity Fee: A possible fee should you not log in to your trading account for a specified period of time by your broker.

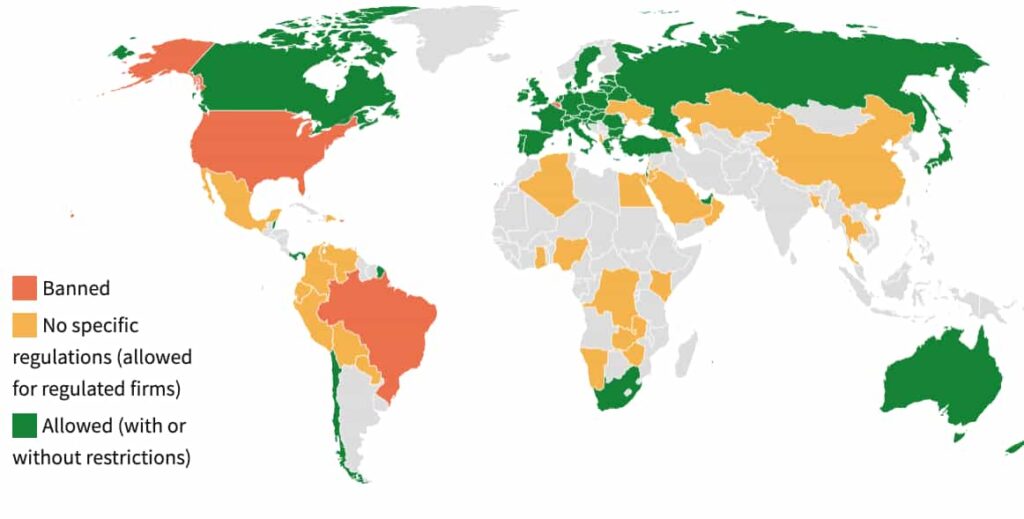

Countries that allow CFD trading

Pros and cons of CFD trading

CFDs offer several advantages over conventional trading methods, providing an appealing opportunity to achieve substantial profits with a lower capital outlay. Nevertheless, despite their potential as a profitable alternative to traditional trading techniques, CFDs also carry inherent risks and challenges.

Pros

- Higher leverage – CFDs provide higher leverage than traditional trading. Lower margin conditions mean less capital input for the trader and beefier possible returns. Nevertheless, increased leverage can also magnify a investors’ losses;

- Global market access from one platform – Many CFD brokers offer products in all the world’s major markets, allowing around-the-clock access. As a result, investors can trade CFDs on a wide range of worldwide markets;

- No shorting rules or borrowing stock – Certain markets have regulations that prohibit shorting and mandate the trader to borrow the financial tool before selling it short, on top of having different margin requirements for short and long positions. However, CFD instruments can be shorted at any time without borrowing costs since the trader doesn’t own the underlying asset;

- No day trading requirements – Certain markets demand minimum amounts of capital to day trade or limit the number of day trades allowed to be made within certain accounts. These restrictions do not apply to the CFD market, and as such all account holders can day trade if they wish to do so;

- A mixture of trading opportunities – Brokers currently offer shares, index, treasury, forex, cryptocurrency, and commodity CFDs. This enables speculators interested in diverse range of financial instruments to trade CFDs as an alternative to exchanges.

Cons

- Investors pay the spread – Paying the spread on entries and exits takes away the possibility to profit from small moves. The spread will also reduce winning trades by a small amount compared to the underlying security and increase losses by a small amount. So, though standard markets expose the trader to various fees, regulations, commissions, and higher capital requirements, CFDs cut investors’ profits via spread costs;

- Weak industry regulation – The CFD industry is not highly regulated. A CFD broker’s credibility is not based on government standing or liquidity but rather reputation, longevity, and financial position. For that reason, it is paramount to investigate a broker’s background before opening an account with them;

- Leverage risks –CFD trading is fast-paced and demands close monitoring. You need to maintain liquidity risks and margins, and if you cannot cover reductions in values, your provider may close your position. You’ll have to cover the loss no matter what subsequently happens to the underlying asset.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Disclaimer: 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. This content is not intended for US users. eToro USA LLC does not offer CFDs, only real Crypto assets, Stocks and ETFs are available.

In conclusion

To sum up, CFDs are a highly flexible tool, offering traders the advantage of capitalizing on the price movements of various securities without actually owning them. That said, the higher leverage associated with CFD trading can be a double-edged sword; it has the potential to significantly increase profits but can also lead to amplified losses, sometimes exceeding the initial investment. This heightened risk profile makes CFD trading particularly challenging for beginners. Successful CFD traders are often those with extensive experience, sharp strategic skills, and a deep understanding of market dynamics.

As a result, while CFDs offer exciting opportunities, they demand a cautious and well-informed approach, especially for those new to the world of financial trading.”

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about CFD trading

What is the difference between CFD vs share trading?

The main difference between trading contracts for difference and share trading is that when you trade a CFD, you speculate on a market’s price without taking ownership of the underlying asset. In contrast to share trading, where you are actually gaining ownership over the underlying stock.

what are the main benefits of CFD trading over normal trading?

CFDs are an extremely flexible tool, providing traders with lower margin requirements, uncomplicated access to global markets, no shorting or day trading rules on top of little or no fees. Finally, CFDs provide you with the possibility to trade virtually anything very quickly and accessibly in your currency.

What risks are involved trading CFDs?

CFDs allow you to have high leverage, which can be both an enormous benefit or the most significant risk factor. Leverage, without a doubt, is a double-edged sword when it comes to CFDs since you are trading with borrowed money, allowing you to gamble with cash you don’t, in reality, have.

What is CFD Trading in Forex?

CFD trading in Forex involves speculating on the price movements of currency pairs without actually owning the underlying currencies.

What is CFD Trading in crypto?

CFD trading in crypto allows traders to speculate on the price movements of cryptocurrencies like Bitcoin or Ethereum. This method enables trading on margin, offering the potential for profit in both rising and falling markets without owning the actual cryptocurrency.

What is CFD trading and how does it work?

CFD trading is a form of derivative trading that lets traders speculate on the rising or falling prices of fast-moving global financial markets, such as forex, indices, commodities, shares, and treasuries. It involves an agreement to exchange the difference in the price of an asset from when the contract is opened to when it is closed.

What are some essential CFD trading tips for beginners?

Firstly, understand the basics of CFDs and how they work. Educate yourself about the financial markets and the assets you’re trading. It’s also vital to use a demo account to practice before risking real money. Develop a trading strategy and stick to it, while also setting clear risk management rules. Keep informed about market news and events that could impact asset prices. Lastly, regularly review and learn from your trades to refine your strategy and improve your skills in CFD trading.

What is the difference between CFD trading vs spread betting?

CFD trading involves contracts that pay the difference between the opening and closing prices of an asset. It allows for direct market access and use of leverage. Profits from CFDs are subject to capital gains tax. Spread betting, on the other hand, is a form of wager on the direction of an asset’s price movement. It’s tax-free in some jurisdictions like the UK and doesn’t provide direct market access. Both allow long and short positions but are taxed differently and have different regulatory frameworks.

What are some of the the best CFD trading platform?

For a more detailed analysis and specific recommendations tailored to different needs, you can refer to our comprehensive guides. For a general overview of top platforms, check out our guide at Best CFD Trading Platform. If you’re interested in mobile trading, our guide on CFD Trading Mobile provides insights into the best mobile platforms. And for traders in the UK, our dedicated guide at CFD Trading UK offers localized information relevant to the UK market.

How to profit from CFD trading?

To profit from CFD trading, it’s essential to have a deep understanding of the markets and the specific assets you’re trading. Start with thorough research and use risk management strategies like stop-loss orders to protect against significant losses. Leverage can amplify profits but also losses, so use it cautiously. Additionally, keep up-to-date with market news and economic events that can affect asset prices. Developing a solid trading strategy and continuously learning from both successes and failures can also enhance profitability in CFD trading.

Is CFD trading legal in US?

CFD trading is banned and illegal for citizens of the USA.

Why did US ban CFD?

The US banned CFD trading to protect investors from the high risks associated with these leveraged products, including significant potential losses. Regulatory concerns from bodies like the Securities and Exchange Commission (SEC) led to stricter regulations on derivatives, resulting in the prohibition of CFDs.

Is CFD trading real or fake?

CFD trading is a real form of trading that allows individuals to speculate on the rising or falling prices of fast-moving global financial markets or instruments such as shares, indices, commodities, currencies, and treasuries.

Is CFD just gambling?

CFD trading involves high risk and leveraged positions in financial markets, requiring skill, analysis, and an understanding of market movements. While it shares risk and speculation attributes with gambling, CFD trading is based on financial strategies and market analysis, distinguishing it from pure gambling, which relies on chance. However, without proper risk management, trading can resemble gambling in its potential for loss.

Can you be rich from CFD trading?

It is possible to achieve significant financial gains from CFD trading due to the leverage it offers, which can amplify both profits and losses. However, it’s important to note that the high leverage associated with CFD trading will also increases the risk of substantial losses.

Are CFDs better than forex?

Whether CFDs are better than forex depends on your trading goals and preferences. CFDs offer more versatility, allowing you to trade on a wide range of assets, whereas forex focuses solely on currency pairs. CFDs might also provide more leverage and flexibility, but they come with higher risks due to market volatility. Forex trading is generally more straightforward and might suit those who prefer focusing on currency markets.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Disclaimer: 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. This content is not intended for US users. eToro USA LLC does not offer CFDs, only real Crypto assets, Stocks and ETFs are available.