Congress stock trades often spark debate and interest because lawmakers can access sensitive information, and their trades could influence their decision-making. Fortunately, it’s easier than ever to monitor Congress stock trades. In this guide, we will introduce you to the tools and techniques that make tracking Congress stock trades simple and straightforward.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Why track Congress stock trades?

Some investors monitor Congress stock trades as part of an investment strategy. Lawmakers often have access to non-public information that could influence market trends, and their trades can offer insights into industries or companies that may benefit from upcoming legislation.

While this approach carries ethical concerns, many believe that following the trades of high-profile lawmakers can help spot lucrative investment opportunities before broader market shifts occur.

However, it’s important to note that not all congressional trades outperform the market, and investors should combine this strategy with other market analyses for more reliable results.

Like everyone else, Congress members are supposed to follow the law. However, because they can make decisions directly impacting markets, their stock trading activities are typically seen as a potential conflict of interest.

Why do Congress trades matter?

Congress holds significant power in shaping laws, regulations, and economic policies. If a lawmaker invests in a company they later regulate, it can raise ethical concerns. Monitoring these trades helps the public keep them accountable.

A National Bureau of Economic Research study from 2021 found that lawmakers, on average, have access to privileged information that often results in higher-than-average returns on their investments. The paper highlights the potential for conflicts of interest when lawmakers trade stocks, further suggesting that monitoring these trades can help the public hold elected officials accountable and ensure their actions align with ethical standards.

“Our findings suggest that politicians, prior to the STOCK Act, often traded on non-public macroeconomic information, but the legislation significantly reduced their ability to predict market returns based on such insider knowledge.” — NBER study

According to the STOCK Act of 2012, Congress members must report their stock transactions within 45 days of making them. Still, there’s a catch. The reports are usually made in lengthy, difficult-to-read documents, and that’s where online databases come into play to simplify the process.

Where to track Congress stock trades?

One of the most effective tools for monitoring Congress stock trades is Finbold Signals. It simplifies the process by providing real-time data on stock trades made by lawmakers and delivers updates via Telegram, Email, or Discord.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

How to track Congress stock trades?

With the right tool at your disposal, tracking trades is simple and doesn’t require advanced knowledge of the stock market. Here’s how in four simple steps:

- Find a source: First, select a reliable tool such as Finbold Signals. Log in with your account, or if you don’t have one, sign up and choose your signal type (you can choose to track US Congress members as well as Senators). For more details, you can also access reports from the Secretary of the Senate or Clerk of the House websites for trade disclosures;

- Set up alerts: Many platforms allow you to set up signals for politician stock trades, making it much easier than manually checking SEC reports. Instead of digging through filings, you can receive notifications when important trades happen, keeping you informed of market movements without the hassle of constant monitoring;

- Analyze patterns: After following a few trades, you might notice patterns. Do certain lawmakers trade more often than others? Are they focusing on a particular sector, like tech or energy? Recognizing these trends can give you insight into how policy decisions might impact industries;

- Cross-check with news: Once you see a trade, you can cross-reference it with current news events. Did Congress recently pass a bill that affects the stock a member just traded? These connections could be valuable in understanding market movements.

Tips for beginners

Ethical concerns and public scrutiny

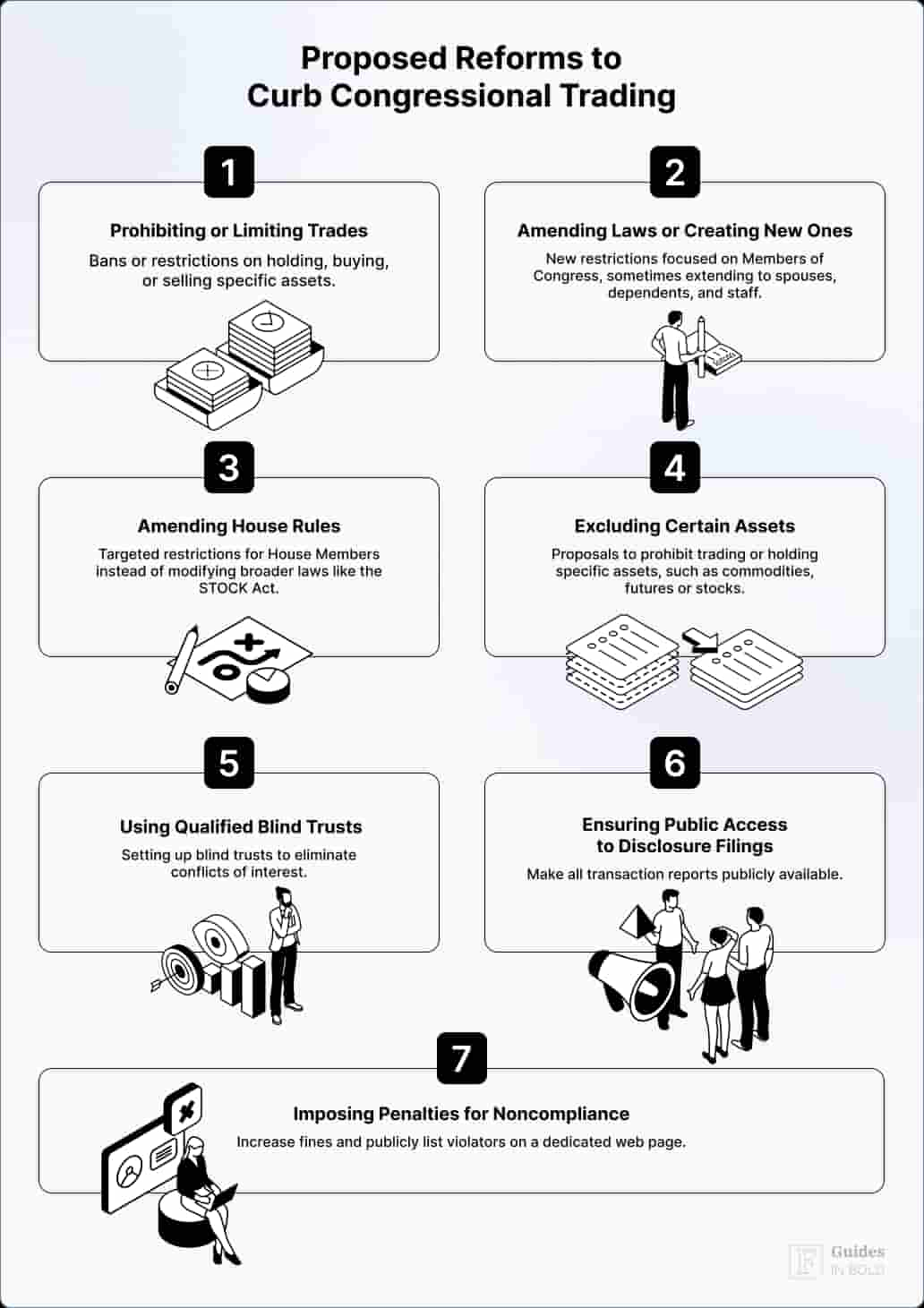

The main reason people monitor congressional stock trades is to ensure transparency and ethical behavior. Namely, critics argue that politicians should avoid trading altogether while in office to prevent potential conflicts of interest. Some have even pushed for laws banning members of Congress from trading stocks entirely while they serve.

Several legislative efforts emerged to address these concerns. The TRUST in Congress Act seeks to require lawmakers, their spouses, and dependent children to place investments in blind trusts, preventing them from having direct control or knowledge of their holdings. This would reduce the risk of insider trading and eliminate potential conflicts of interest.

In the Senate, the Ban Congressional Stock Trading Act proposes an even stricter measure, prohibiting members of Congress and their families from buying or selling individual stocks. Instead, they would be limited to investing in broad-based funds or using blind trusts, which are viewed as safer alternatives.

“If the American people see members of Congress trading in ways that make them suspicious, that’s bad for trust in government. And trust in government is essential for democracy.” — Robert Jackson, former SEC commissioner

What to watch for

If you’re new to monitoring Congress stock trades, here’s a list of what to watch for:

- Large trades: These can signal significant shifts or expectations of market changes;

- Sector-specific trades: Keep an eye on patterns within industries like healthcare or defense. These are often more closely tied to legislation;

- Timing: If a major piece of legislation passes and a member of Congress suddenly makes a relevant trade, that could raise ethical concerns.

The bottom line

Monitoring Congress stock trades is a relatively easy way to stay informed about the financial dealings of lawmakers. Thanks to user-friendly tools and platforms, anyone can track stock trades in real time and adjust their investment strategy accordingly.

By using tools like Finbold Signals, setting up alerts, and analyzing patterns, you can make informed observations about the financial activities of Congress members. In the end, being aware of these trades isn’t just about finances—it’s about holding elected officials accountable and ensuring they act in the public’s best interest.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about how to monitor Congress stock trades

What is the STOCK Act?

The STOCK Act requires Congress members to publicly report stock trades within 45 days to prevent insider trading among lawmakers. It requires members of Congress to publicly disclose their stock trades within 45 days, increasing transparency. However, critics argue that reporting delays and relatively light penalties mean the act isn’t always effective in preventing unethical behavior.

What tools can I use to track Congress stock trades?

To track Congress trades, you can use Finbold Signals and get the latest updates via Telegram, Email, or Discord.

What should I watch for when tracking Congressional stock trades?

Pay attention to large or sector-specific trades made just before or after significant legislation or policy decisions. Also, watch for frequent trades by the same lawmakers, especially if they’re tied to industries under their legislative purview. These patterns can be red flags for potential conflicts of interest or insider knowledge influencing decisions.

Are members of Congress allowed to trade stocks?

Yes, lawmakers are allowed to trade stocks, but they must disclose their trades under the STOCK Act. However, due to public pressure and ethical concerns, there have been proposals to ban or restrict stock trading by members of Congress, such as the TRUST in Congress Act and the Ban Congressional Stock Trading Act.

Can tracking these trades help with investing?

While tracking congressional stock trades can provide insight into market trends, it should be used cautiously. Lawmakers’ trades may reflect privileged information, but their stock-picking abilities are not always reliable, and many studies show that their portfolios often perform no better than average.

What happens if a Congress member fails to report a trade?

If a lawmaker fails to report a trade within the 45-day window mandated by the STOCK Act, they can face fines. However, the penalties are often small, and critics argue that the law lacks sufficient enforcement mechanisms to deter delayed or inaccurate reporting.