Tracking institutional investors can be a solid investment strategy since these investors play a crucial role in the stock market, influencing prices, trends, and even the direction of industries. These large players—such as mutual funds, pension funds, hedge funds, and insurance companies—control vast amounts of capital, and their investment decisions can shift market dynamics.

But how does one, as an individual investor, track what these financial giants are doing? This article will guide you through institutional stock trading and explain how you can follow the moves of major institutional investors effectively.

What is institutional investing?

Institutional investors often have access to detailed financial analyses, research teams, and sophisticated trading tools that individual investors don’t usually possess. This makes them influential in shaping market trends and opportunities.

What are the different types of institutional investors?

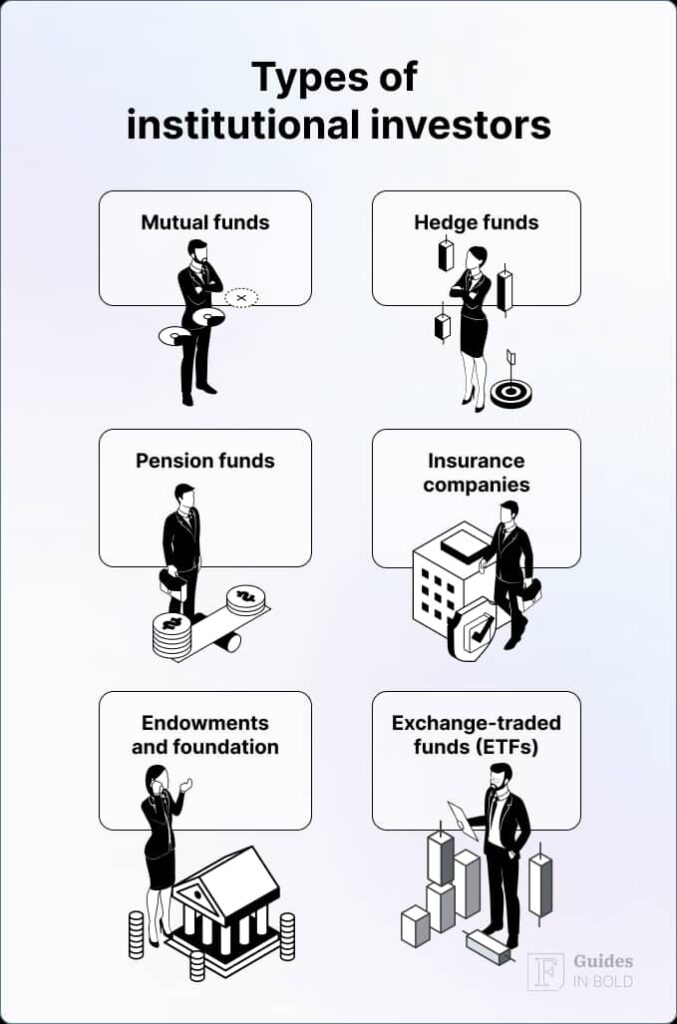

Institutional investors come in various forms, each with distinct purposes and investment strategies. Still, they all have a significant influence on the stock market due to the large sums of money they manage. The types of institutional investors include:

- Mutual funds: Investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities, managed by professional fund managers;

- Hedge funds: Private, actively managed investment funds that use various strategies, including leverage and short-selling, to generate high returns, often targeting sophisticated investors;

- Pension funds: Investment pools that collect, manage, and invest retirement savings for employees, providing income to them after retirement;

- Insurance companies: Financial institutions that provide risk management by pooling premiums from policyholders and investing these funds to cover potential claims;

- Endowments and foundations: Large, charitable funds that invest donations with the goal of generating income to support their ongoing activities and missions over the long term;

- Exchange-Traded Funds (ETFs): Investment funds traded on stock exchanges that hold a diversified portfolio of assets, typically tracking an index, allowing investors to buy shares in the fund like a stock.

Why should I track institutional buying and selling?

Tracking institutional stock trading can offer valuable insights for individual investors. The thing is—when large institutional investors buy or sell stocks, they often do so in significant volumes. This can create ripples or even waves in the stock market, affecting stock prices and market sentiment.

That said, here’s why you should keep an eye on institutional buying and selling:

- Market sentiment: Institutions often have access to more information, so their trades might reflect deeper insights about a company or industry;

- Stock price movement: Large institutional trades can directly impact stock prices;

- Investment opportunities: Identifying the top stocks among institutional investors may help you spot trends and invest early.

Institutional investors and market impact

Institutional investors can significantly influence stock market volatility through their large trades. Due to the size of their transactions, they often move markets, especially in less liquid environments.

The 2005 study by Gabaix, Gopikrishnan, Plerou, and Stanley examined how large institutional trades can cause notable spikes in stock returns and trading volumes, even when there isn’t any major new information about a company or the market.

The authors derive a theory that explains these market movements by exploring the relationship between institutional investor size and the trading behavior that leads to excess volatility.

In markets with lower liquidity, institutional trades often have a larger impact, causing sudden market shifts that individual investors can sometimes miss. The study emphasizes the complexity of institutional investing and how it can contribute to market fluctuations.

“Large institutional trades, even in the absence of important news about fundamentals, generate significant spikes in returns and volume.” — Gabaix, Gopikrishnan, Plerou, and Stanley

Insider trading and institutional investing

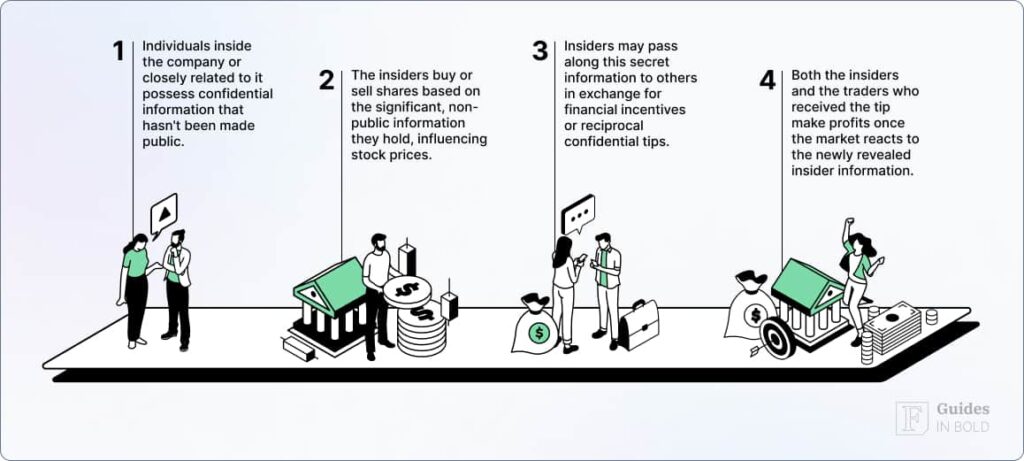

When discussing institutional investing, it’s essential to differentiate between legal institutional trading and insider trading.

Namely, insider trading refers to buying or selling stocks by individuals with access to non-public information about a company, and it’s illegal. On the other hand, institutional trading is entirely legal and regulated, though institutions must disclose their holdings regularly.

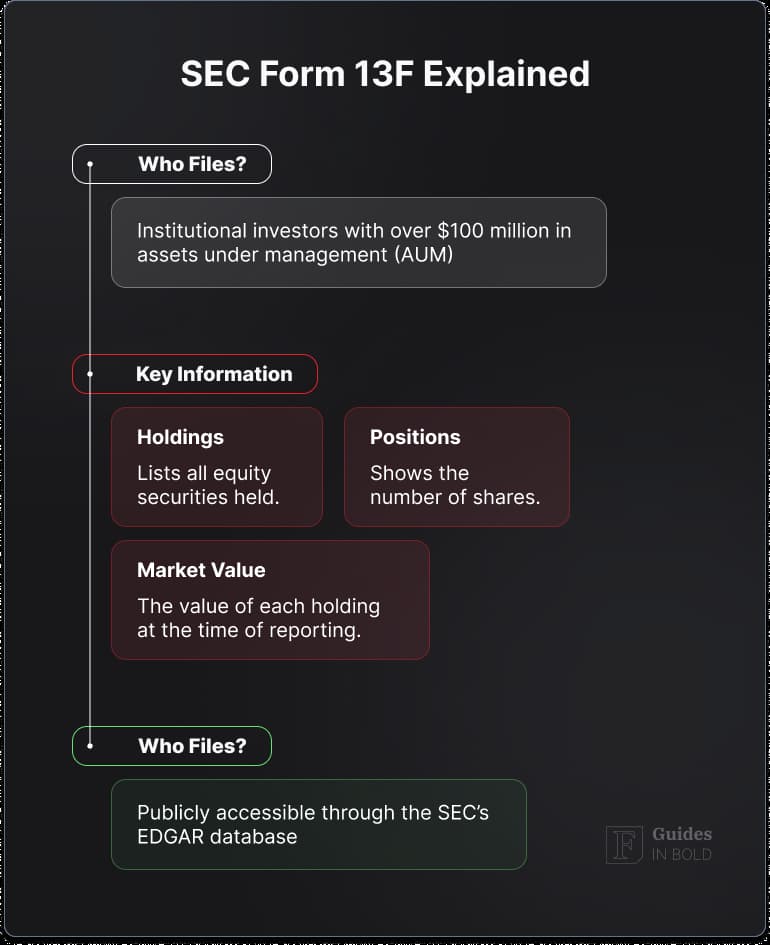

You can track institutional investors’ movements through their 13F filings, a quarterly report that institutional investment managers with over $100 million in assets must file with the US Securities and Exchange Commission (SEC). These filings give you a clear picture of where big money is moving, and tools are available to make these reports accessible and actionable.

Recommended video:

How to track institutional stock trading?

There are several ways you can track the stock movements of institutional investors. Here are two of the most straightforward resources that you can use:

1. SEC filings

The SEC requires institutional investors to file quarterly reports, known as 13F filings. These filings provide details about the stocks, bonds, and other investments held by institutions at the end of each quarter. You can find this information on the SEC’s EDGAR database.

2. Finbold Signals

Various platforms provide tools to track institutional trading activity. One such option is Finbold Signals, which gives real-time updates via email, Telegram, and Discord.

With Finbold Signals, you can stay on top of the latest institutional buying trends and market shifts, helping you make more informed investment decisions. Signals is user-friendly and provides the essential alerts that help you follow the market closely.

What to watch out for when tracking institutional buying and selling?

Institutional trading has specific indicators that you can monitor to determine when large investors are entering or exiting positions. By understanding these indicators, you can react faster to market changes. As such, you should keep an eye on:

- Unusual volume: One of the easiest signs to track is a significant uptick in stock trading volume, which might indicate institutional interest;

- Price gaps: A sudden price jump or drop in a stock might signal that a large institutional player has made a significant move;

- Fund flow data: Data showing money moving in or out of mutual funds and ETFs can help you understand where institutions are putting their money.

| Indicator | What it means |

| Unusual volume | Indicates high institutional interest |

| Price gaps | A sudden shift in price due to large institutional trades |

| Fund flow data | Shows how much money is moving in and out of institutional funds |

| 13F filings | Quarterly reports revealing institutional holdings and trading activity |

Common mistakes to avoid when tracking institutional investments

When tracking institutional investments, it’s important to avoid common pitfalls that can lead to poor decision-making.

- One mistake is relying solely on 13F filings, as they provide a snapshot of holdings at the end of each quarter, which may already be outdated by the time they’re published;

- Another error is assuming that just because institutions are buying a stock, it guarantees future success—institutions can and do make mistakes;

- Additionally, following trends without considering your own investment strategy and risk tolerance can lead to misaligned decisions;

- Lastly, neglecting other key factors, such as market conditions, company fundamentals, and industry trends, can lead to an incomplete view of why institutions are investing in a particular stock.

The bottom line

Tracking institutional stock trading can provide a valuable edge in understanding market movements and making informed investment decisions. With the right tools—such as SEC filings and services like Finbold Signals—you can stay updated on the actions of institutional investors.

Watching indicators like unusual trading volume and price gaps can also give away clues about when institutions are making significant moves. So, by staying informed, you can align your strategies with institutional trends and make more confident investment decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs on how to track institutional stock trading

Why is it important for investors to pay attention to institutional holdings?

Tracking institutional stock trading gives individual investors insights into market trends and stock movements. Large institutional investors, like hedge funds and mutual funds, have access to extensive research and resources, so their trades can indicate valuable investment opportunities. Additionally, institutional buying or selling can significantly impact stock prices, providing cues for potential shifts in market sentiment.

What is 13F filing for?

13F filings are quarterly reports submitted by institutional investment managers who manage over $100 million in assets. These filings disclose the stocks, bonds, and other securities that institutions hold. By analyzing 13F filings, you can see which stocks institutions are buying or selling, providing valuable information about big money.

How can I track institutional stock trading in real time?

There are several platforms that provide tools to track institutional trading activity in real time. For example, Finbold Signals offers real-time updates via email, Telegram, and Discord. This makes it easy for individual investors to stay informed about institutional stock movements as they happen. Additionally, financial news websites and investment research platforms offer detailed insights into institutional trading.

How often are 13F filed?

Institutional investors are not required to disclose their trades immediately. They file 13F reports quarterly, meaning the information may already be outdated when published.

How do you spot institutional trading?

Institutional trading can be spotted by monitoring large, block trades or unusually high trading volumes that move the market significantly. Tools like 13F filings, stock screeners, or specialized services such as Finbold Signals help track these trades in real time.