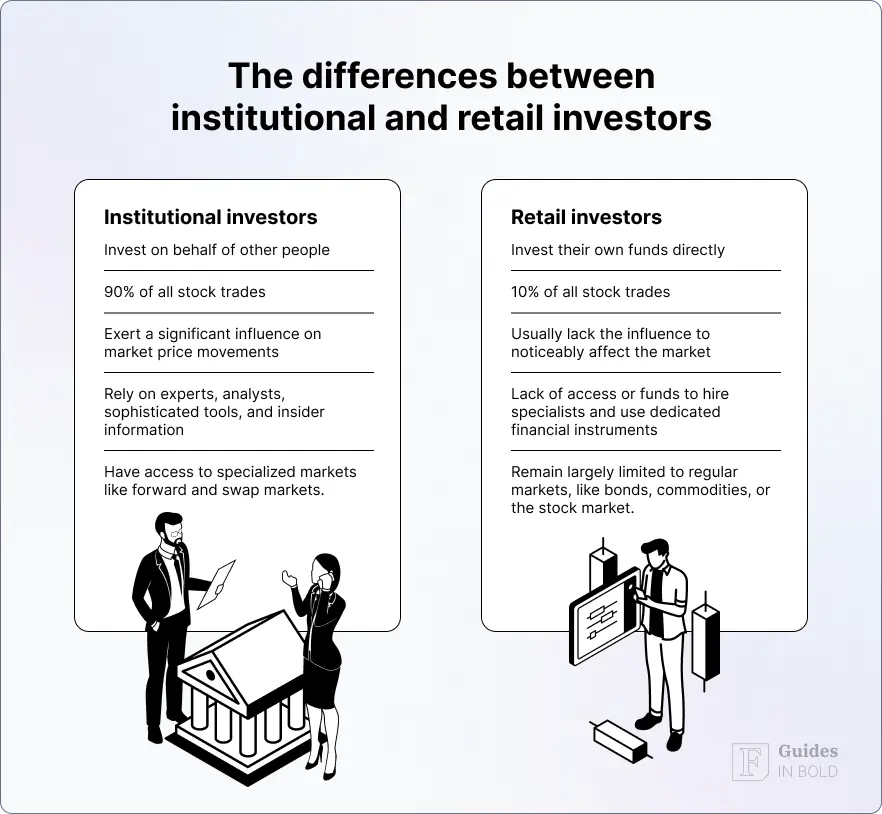

Compared to individuals who invest with their savings or excess money, institutional investors are on a whole new level. Institutional investing makes up the vast majority of all trades in the stock market (more than 90%), leveraging tools and methods that are mainly unavailable to the rest of the investing public. This guide will explain how to leverage institutional investing for your trading decisions.

What is institutional investing?

What is an institutional investor?

In short, institutional investing is conducted by large companies and expert organizations, such as hedge funds, mutual funds, and ETFs.

By contrast, retail investors are individuals who invest their own funds, either through a broker or directly. As retail investors drive less than 10% of market volume, their influence is almost negligible compared to their institutional counterparts, who manage more assets and rely on expert professionals and sophisticated tools to trade.

Furthermore, institutional investors can access specific markets and financial assets restricted to retail investors, including pre-IPO shares, specific assets like forward and swap markets, and private markets known colloquially as “dark pools.”

We’ll stay clear of inaccessible areas and focus on how you can use institutional investing to your advantage.

Why should you track institutional investing?

As we said, institutional investing represents the bulk of the global stock trade. With size and volume alone, their transactions reshape the market landscape whenever the “whales of Wall Street” move.

“Large institutional trades, even in the absence of important news about fundamentals, generate significant spikes in returns and volume.”

— Gabaix, Gopikrishnan, Plerou, and Stanley

To illustrate, for every share in a blue-chip company a retail investor buys, an institutional investor buys up to one hundred. The effects of these transactions ripple across the sector, changing stock prices and upsetting ongoing market trends (and creating new ones).

Furthermore, institutional investors have many ties in the financial sector and often obtain insider information that can inform their trade. For example, a 2023 study showed that hedge funds base their decisions on opportunistic insider trades and rely on insider information to boost their financial performance.

Recommended video: What is Insider Trading? Explained in 2 Minutes

Coupled with sophisticated tools and specialized financial expertise, these factors tend to make institutional investing more effective. Therefore, it is generally beneficial to track institutional investors and leverage it for your benefit.

How do you track institutional buying and selling?

Most institutional investors operate as regular public companies and, therefore, have to file financial reports with the U.S. Securities and Exchange Commission (SEC) and make them publicly available.

Form 13F

Forms filed by institutional investors like mutual funds and ETFs are available on EDGAR, the SEC’s official database. That said, browsing through such an exhaustive registry can be extremely time-consuming and effort-intensive. Fortunately, there’s a more practical way to gain insight into institutional investing with institutional stock trade tracker, such as Finbold Signals.

How to use institutional investing to inform your trade decisions?

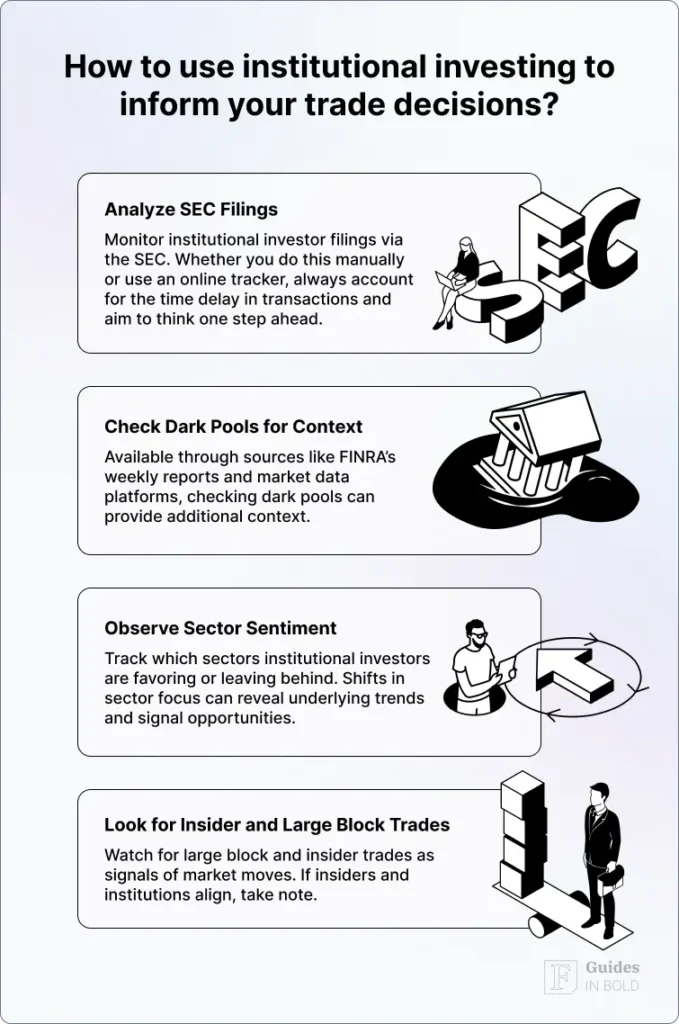

Once you decide on your tracking method, you can take the following steps to turn them into insights that can help your trades:

- Analyze the SEC filings. Continuously monitoring institutional investors is paramount, whether you manually rummage through the official databases or use an online institutional stock trading tracker. The SEC filings are the basis of every institutional investing tracking: although there is a significant time delay between transactions and reports, you can still make use of them by looking for patterns and underlying strategies;

- Check the dark pools for additional context. Dark pools are essentially private stock exchanges, with little information available to the public about the ongoing transactions. Institutional investors resort to dark pools to reduce the effect on the stock price that is usually tied to significant trades. Still, you can access some information through the Financial Industry Regulatory Authority (FINRA) and from specific market data platforms like Bloomberg;

- Observe the sentiment towards different sectors. Successful institutional investors tend to share their stock favorites. In fact, the big whales often have favorite industries and sectors that they prefer above others. Pay attention to companies and sectors with large trading volumes, especially if they indicate trends and entry or exit points;

- Look for insider and large block trades. Institutional investors tend to avoid bulk stock trading, but sometimes, they have no other choice. Such transactions cannot be hidden from a keen eye, and catching them early allows you to work the market fallout to your advantage. Additionally, insider trading has to be disclosed to be legal, and when both institutional and insider traders align, it might be best to follow in their footsteps.

Tracking the right institutional investors

Although the general understanding of “smart money” usually implies a uniform bloc of hedge funds that all trade in a similar way, institutional investors are diverse and use different investment strategies. When making your choice about tracking a suitable candidate, consider the following:

- Sector focus and versatility: While institutional investors have their preferences regarding a particular sector or industry, they still differ in some of their choices. For example, more aggressive hedge funds might invest in future technologies like nuclear fusion, while conservative mutual funds remain reluctant to leave the tried-and-true technology sector. Make sure that your preferences align with the tracked investors;

- Alignment with your investing strategy: There are various strategies within the wider institutional investing. While there are aggressive and conservative approaches, you will also witness specific methods like value investing and growth investing. Ensure that the tracked investors fit your investing style;

- Investment period: Some big players embrace short-term strategies while others rely on approaches that favor the long run. This ties in with the broader polarization between the level of risk and potential profit margins: make sure that investment horizons between you and the institutional investor match before leveraging their strategy;

- Consider previous performance: Numerous hedge funds and other institutional investors record enviable returns before they fall into the red. Always check how long the investor has been in the business and double-check its current yields with its historical performance.

The bottom line

The fact that most of the tools and expertise employed by institutional investors remain out of your reach does not mean that you cannot use institutional investing to inform your trade decisions. On the contrary, going in the steps of the Wall Street whales can positively impact your investing.

That said, it is not enough to simply copy what institutional investors do. You need to make a coordinated effort to analyze their transactions and derive conclusions that you can then implement with your portfolio.

By relying on a service like Finbold Signals to deliver suitable forms and notify you about significant institutional investing developments, you can turn the ways of smart money into informed decisions and replicate the success of the foremost institutional investors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs

What is an institutional investor?

Institutional investor is a company or organization that pools funds and invests that money on behalf of other people in various assets and financial instruments, including stocks, bonds, real estate, and others.

Who are the key institutional investors?

The five largest institutional investors in the world are BlackRock, The Vanguard Group, UBS, Fidelity Investments, and State Street.

Why track institutional investors?

Institutional investors rely on exhaustive research, specialized tools, and professional expertise to guide their investing. Although individual investors usually can’t access any of these, they can still benefit from them indirectly by tracking institutional investors.

Which institutional investors to track?

When opting for an institutional investor to track, ensure they align with your investing style, such as long- or short-term time horizon and similar target companies and sectors.

How can I track institutional investors?

Repositories like the SEC’s EDGAR database provide access to individual forms, and stock trading trackers like Finbold Signals give real-time updates on institutional investor activity.

What are the institutional trading methods?

Value investing, long-term strategy, fundamental and technical analysis, and mass-trading models are the most common institutional trading methods.

How do I know what institutional investors are doing?

While you can manually browse through the financial reports on the EDGAR repository of the SEC, it is easier and more efficient to use a stock trading tracker like Finbold Signals.