Donald Trump‘s economic policies have a significant impact on the stock market. The three pillars of Trumponomics, tax cuts, deregulation, and tariffs, affect industries and sectors across the board, resulting in new playbooks for investors. This guide will analyze stock trading in the Trump era, forecast market behavior under Trump’s economic policies, and provide tips and strategies to make the best of the new situation.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Trump’s views on the economy and the stock market

Economic policies under Trump’s presidency (so-called ‘Trumponomics‘) profoundly influence the stock market and the economy in general. The most prominent among these include:

- Protectionist trade policy, e.g., the introduction of tariffs and the ensuing trade war with China;

- Broad tax cuts, exemplified by The Tax Cuts and Jobs Act;

- Deregulation, or the reduction of government interference and spending, mainly targeting environmental, financial, and healthcare regulations.

However, Trump’s first presidential term was marked by two events that shaped the stock market much more than his administration:

- Trump inherited the trend of the longest economic growth in U.S. history;

- The COVID-19 pandemic nosedived the expanding economy into a recession.

Since separating the efficiency of economic policies and the intensive effects of outside factors is impossible, we cannot know precisely how Trumponomics transformed the stock market. That said, we can speak with relative certainty about some of the effects Trump’s economic policies had on the stock market between 2017 and 2021.

Stock trading in the Trump era (2017-2021)

One thing was clear from the second week of Trump’s presidency: the stock market had soared.

In fact, the Tax Cuts and Jobs Act passed in 2017 both reduced corporate taxes and increased corporate earnings, boosting investor confidence. This led to record highs in indices like the S&P 500, DJIA, and NASDAQ.

Deregulation also affected the investing public’s confidence, especially within the traditional energy, finance, and technology sectors. However, protectionist trade policies and tariffs caused rising tensions with trading partners, especially China, and made the stock market more volatile. These two factors propped up specific sectors, such as manufacturing and fossil fuels, while hurting previously-subsidized industries, like the renewable energy sector.

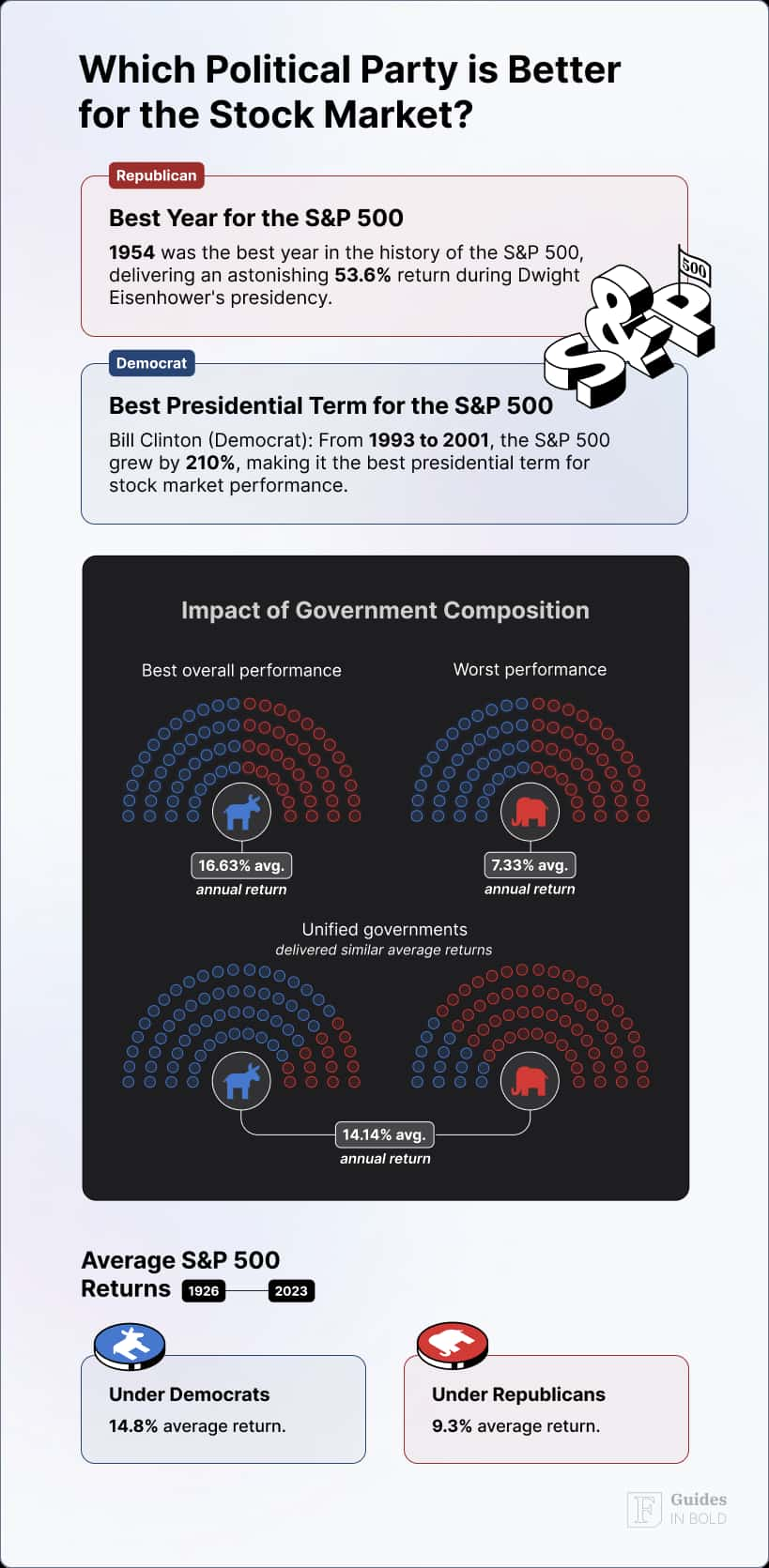

Overall, up until the recession caused by the COVID-19 pandemic, Trump’s presidency witnessed an improved stock market. The average annual return for the S&P 500 was 13.73% for the period, which was the third-highest in modern U.S. history, after Clinton (15.18%) and Obama (13.84).

The stock market’s newest ‘golden age’ was cut short due to the global pandemic in March 2020 when the DJIA went bearish, losing over 20% in less than one month.

In essence, the Trump presidency likely had a net positive effect on the stock market, with tax cuts and deregulation inspiring investor’s confidence and boosting corporate profits. That said, protectionism and trade wars also increased market volatility and uncertainty about the broader economy.

With this tool, you can subscribe to valuable information in near real-time and use it to enhance your investing decision-making process. Furthermore, with Finbold Signals, you can track institutional investors and insider trading activities and receive other relevant updates via email, Discord, and Telegram.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Stock market forecast for Trump’s second term

By all accounts, Donald Trump is likely to pursue economic policies similar to those from his previous presidency. However, unlike during his first term, he will now also have his party control the whole of Congress. As such, he could increase both the intensity and the scope of his protectionist trade efforts.

Speaking of party control and market performance, the stock market has historically behaved differently depending on the composition of Congress. If you compare the average CAGR rates of the S&P 500 index, Democratic presidents outperform Republicans. However, if you compare median values, Republican presidents beat their Democratic counterparts.

As previously mentioned, historical performance is never an ideal measure of future performance. Stock trading in the first Trump era was greatly affected by unforeseeable factors outside his administration’s control.

Still, with the given trajectory and current indicators, we can observe the likeliness of things to come:

1. The traditional energy sector has reasons for optimism

Trump has been a vocal proponent of more oil, coal, and natural gas production. Notably, he strongly opposes clean energy incentives and subsidies enacted by the Biden administration. If he acts on his threats to repeal them, companies in the fossil fuel energy sector will likely benefit, and their stock prices could rise.

That said, the energy sector has received a 22.9% gain under Biden despite his push towards renewable energies. Furthermore, there are particular concerns that Trump’s policies could encourage more oil supply, which could lower the price of oil and thus undermine the sector’s growth.

Overall, the energy sector is poised for an even better performance under Trump’s second term.

2. Automobile industry weary, EVs likely to decline

The ongoing tariffs and a dislike for electric vehicles will likely negatively impact the EV sector. Trump’s policies might reverse many pieces of legislation that encouraged and subsidized the adoption of electric cars and hybrids, notably canceling EV tax credits.

Also, the American car industry depends on other nations for parts and manufacturing, and this symbiosis is likely to suffer under increased tariffs. Furthermore, the tariffs themselves could increase the cost of cars on the U.S. market.

However, companies relying on gasoline carmaking could prosper under these circumstances. Similarly, these policies could likely revive the market for traditional, less-green vehicles.

3. Technology sector is riding the high wave

The technology sector is currently riding on strong momentum, with the trademark technology stocks Amazon, Tesla, Apple, Nvidia, Meta, Microsoft, and Alphabet having an oversized influence. An exceptionally high emphasis is placed on information technology and generative AI.

How will Trump’s policies affect the technology sector? Likely not directly, minus the general tariff effect on imported goods, like semiconductors. That said, Google has previously come under fire from J. D. Vance, who advocated for the dismantling of the web browsing giant. Whether Trump follows up with the anti-monopoly lawsuit will define the company’s stock market future.

4. Vaccine skepticism and deregulation might reshape healthcare

Trump has nominated Robert F. Kennedy Jr. as head of the Department of Health and Human Services, which can hinder major vaccine producers like Merck (NYSE: MRK), Pfizer (NYSE: PFE), and Moderna (NASDAQ: MRNA). Furthermore, if successful, cuts to Medicaid and ObamaCare will negatively affect healthcare providers due to the volume of patients.

On the other hand, deregulation could help pharmaceutical giants by streamlining and hastening FDA drug approvals, which would benefit the likes of Thermo Fisher Scientific (NYSE: TMO). However, all the changes and resets in the sector could cancel each other out to retain the current balance; we must simply wait to find out.

5. Tariffs will be the kingmakers of the stock market

You’ll have noticed by now that tariffs are a significant factor in each of these forecasts. In fact, everything will depend on them as protectionism can redraw the current stock market environment. The general rule is that domestic producers will benefit while import-reliant companies will suffer, but we won’t know the total effect until we know how demanding the tariff rates will be.

We know Trump’s plan, though. In fact, Trump promised to introduce 25% tariffs on goods from Mexico and Canada, with an additional 10% on the existing tariffs on goods from China. These countries have vowed to retaliate with similar measures if the plan comes to fruition, and the extent of this spiraling will not be known until we see them happen.

Tips and strategies for stock trading in the Trump era

Although we still do not know precisely how the stock market will change under Trump, it will certainly do. And judging by the Trump administration’s sentiments, we can expect a protectionist trend in the stock market. So, here’s what we think investors should do:

- Diversify investments. While a diversified portfolio is always good, diversifying is crucial if you expect a change in the stock market. Trump will likely change things, and the more diverse your portfolio, the lesser the effect of that change will be on your total assets;

- Consider shifting to resilient sectors. Some companies face economic uncertainty better than others. Consider investing in staple consumer goods, solid domestic technology companies, and essential utilities;

- Be wary of sectors impacted by tariffs. Overwhelming tariffs might badly hurt industries that rely on global supply chains. Consider moving away from import-sensitive manufacturing and companies that rely on semiconductor imports, like automotive and electronics. The farming industry can experience a downturn in the case of retaliatory tariffs;

- Certain stocks will benefit from tariffs. Companies that compete with imports can see increased demand once foreign goods become more expensive. In this case, it might benefit industries like steel and material production, as well as construction companies;

- Keep yourself informed. It is crucial to remain in the know about trade policies, changes to tariffs, the trade gap, and inflation. Make sure to do your research to stay ahead of the situation;

- Remember the basics. Despite the circumstances, long-term outlook and solid fundamentals will remain the decisive factor in stock investment. Avoid emotional reactions and sacrifices for short-term gains. Always stay on the sound investing course.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs

Was the stock market better under Trump?

During Trump’s first presidential term, the stock market has seen several record highs in benchmark indices. In fact, Trump has presided over the third-best period for the stock market in modern U.S. history, after Clinton and Obama.

When will Donald Trump officially become president?

Donald Trump will officially become the president on January 20, 2025.

How does Trump plan to fix the economy?

Trump’s plan to fix the economy is seen as national, protectionist, and neo-mercantilist. It is designed to safeguard domestic industries at the expense of foreign competition and decrease ‘excessive’ government influence by cutting spending and taxes.

What is Trump's tariff plan?

Trump has repeatedly stated that he wants to introduce a 10% to 20% global tariff plan on all imports, which goes up to 25% or even 60% in some cases, such as Canada, Mexico, and China.