Investing in the stock market has often been seen as politically neutral. While political events, like elections or major policy changes, can impact certain sectors, some stocks remain attractive to both sides.

Regardless of whether you lean left or right, certain companies continue to garner support from both political parties. These stocks typically come from industries like technology, healthcare, and defense—essential parts of America’s economic foundation.

In this guide, we explore some of the top stocks that enjoy support from all sides of the political spectrum.

Receive Signals on US Senators' Stock Trades

Stay up-to-date on the trading activity of US Senators. The signal triggers based on updates from the Senate disclosure reports, notifying you of their latest stock transactions.

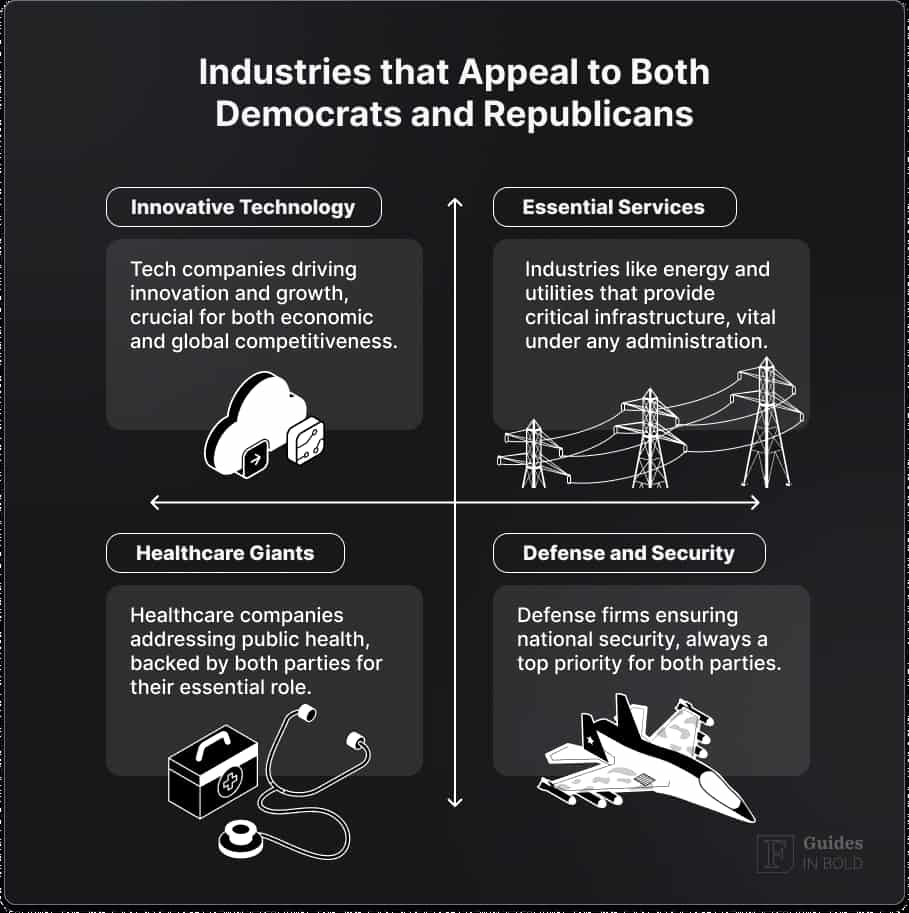

Industries that appeal to both Democrats and Republicans

There’s a common perception that Democrats and Republicans have drastically different ideas about which industries should thrive. While this may be true in some cases, the two major parties agree on the value of certain sectors:

- Essential services: Both parties recognize the need for companies that provide services critical to the nation’s infrastructure;

- Innovative technology: Whether for national security or job creation, technology companies tend to attract support from both sides;

- Defense and security: The government consistently allocates significant budgets toward defense, benefitting companies that supply equipment and services to the military;

- Healthcare giants: With healthcare always a hot political topic, companies contributing to medical innovation and essential care services tend to secure wide-ranging support.

Top 5 stocks held by both Republicans and Democrats

Here are some companies whose stock performance tends to be robust regardless of which political party holds power.

| Company | Industry | Key appeal |

| Apple Inc. | Technology | Innovation, job creation, privacy |

| Microsoft Corporation | Technology | Defense contracts, cloud computing |

| Johnson & Johnson | Healthcare | Pharmaceuticals, medical devices |

| The Boeing Company | Aerospace, defense | National defense, aviation |

| Visa Inc. | Finance, technology | Global commerce, financial inclusion |

#1 Apple Inc.

Apple (NASDAQ: AAPL) has built a reputation as one of the most reliable investments on the market. Its products appeal to a wide consumer base, making it a household name across the political spectrum.

Republicans tend to appreciate Apple’s role in driving job creation, innovation, and US competitiveness, while Democrats often commend the company’s environmental initiatives and its focus on privacy.

#2 Microsoft Corporation

Microsoft (NASDAQ: MSFT) is another tech heavyweight that enjoys admiration from both sides. With its diversified portfolio—including software, cloud computing, and gaming—Microsoft supports a variety of industries.

The company’s work with governments and defense contractors makes it especially valuable. Its Azure cloud computing platform, for example, powers important data management functions for both public and private sectors.

#3 Johnson & Johnson

Healthcare giant Johnson & Johnson (NYSE: JNJ) is favored across party lines for its contributions to medical innovation and essential healthcare products. During the COVID-19 pandemic, its vaccine brought global attention to its scientific prowess.

The company’s pharmaceuticals, medical devices, and consumer health products make it an indispensable part of the healthcare system.

#4 The Boeing Company

Boeing (NYSE: BA) is another joint favorite. The company’s role in national defense and commercial aviation gives it broad appeal. Boeing provides defense equipment to the US government and supplies aircraft for both private and public enterprises.

Democrats and Republicans agree on the importance of Boeing’s contributions to national security and the economy.

#5 Visa Inc.

Visa (NYSE: V) benefits from being at the intersection of finance and technology. As the largest global payment processor, Visa’s services enable worldwide commerce.

Its consistent growth, global reach, and role in powering small businesses in the US make it a safe bet regardless of political affiliation. Both parties appreciate its role in stimulating the economy and increasing financial inclusion.

Why track politician trades?

Stocks that appeal to both sides offer several advantages to investors. These companies usually perform well regardless of who is in power, providing stability during political shifts. Research has shown that political figures, including members of Congress, often invest in industries like healthcare, defense, and technology, which are resilient to political changes.

“The stock market is designed to transfer money from the Active to the Patient.” — Warren Buffett, famous investor

These stocks embody Warren Buffett’s philosophy, offering long-term stability for investors willing to hold through political cycles.

According to a 2004 study by Ziobrowski, Cheng, Boyd, and Ziobrowski, congressional trades can reveal valuable insights into stock performance due to lawmakers’ access to non-public information, making these industries a safer bet for investors.

How to track Congress stock trades?

Receive Signals on US Senators' Stock Trades

Stay up-to-date on the trading activity of US Senators. The signal triggers based on updates from the Senate disclosure reports, notifying you of their latest stock transactions.

Key features of stocks favored by both parties

Here are some key features of stocks that attract both Republican and Democrats:

- Non-partisan appeal: These companies provide services or products essential to a wide range of consumers;

- Global impact: Many of these stocks operate on a global scale, ensuring continued demand and reducing reliance on US politics alone;

- Resilience to regulation: Because these industries are fundamental to the economy, they’re less likely to face sudden regulatory hurdles;

- Strong cash flow: Most of these companies have a strong financial footing, giving them the ability to weather economic downturns.

Why add these stocks to your portfolio?

Diversifying your portfolio is essential to managing risk and securing steady returns. Stocks that attract both political parties serve as a reliable foundation in any portfolio because they tend to remain stable during periods of political uncertainty. By including a mix of technology, healthcare, and defense stocks, you can create a balanced investment strategy.

Here are some tips for diversifying with these stocks:

- Balance between sectors: Ensure your portfolio includes exposure to both technology and essential industries like healthcare and defense;

- Consider dividend yields: Many of these stocks, especially in healthcare and finance, offer dividends that can provide passive income;

- Stay informed: Even though these stocks are politically stable, it’s still important to keep up with market trends and news that could impact their performance.

The bottom line

In summary, stocks that both Republican and Democrats trade are a solid choice for investors looking to shield their portfolios from political shifts. These companies offer stability, consistent growth, and global reach, making them resilient to the ebb and flow of US politics. By focusing on industries like technology, healthcare, and defense, investors can build a well-rounded portfolio that thrives regardless of which party holds power.

If you’re looking to invest in stocks that transcend political divides, consider adding the mentioned companies to your portfolio. They provide reliable performance and can help you navigate the ups and downs of the market with confidence.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about stocks favored by both sides of the aisle

How to track politicians’ stock trades?

You can track politicians’ stock trades through public disclosure reports filed by members of Congress, available via tools like Finbold Signals or the House and Senate websites.

What stocks are Congress buying?

Members of Congress often invest in major sectors like technology, healthcare, and defense, with notable picks including companies such as Apple, Microsoft, and Johnson & Johnson.

What stocks are Democrats buying?

Democrats tend to invest in sectors focused on renewable energy, technology, and healthcare, with companies like Tesla (NASDAQ: TSLA) and Google (NASDAQ: GOOG) commonly appearing in their portfolios.

What stocks are Republicans buying?

Republicans often favor investments in defense, traditional energy, and large-cap tech companies, frequently purchasing stocks in firms such as Boeing, ExxonMobil (NYSE: XOM), and Microsoft.

Which sectors are favored by both Republicans and Democrats?

Industries like technology, healthcare, and defense are typically home to stocks favored by both sides of the political spectrum. These sectors provide essential services and products that both Democrats and Republicans generally support.