In finance, we are often so wrapped up in models and strategies that we forget that educating ourselves about history can better help us see the big picture and contextualize current events. Indeed, valuable lessons can be found by exploring the causes and outcomes of past tragedies. After all, history is the constant that can guide us through ambiguity in a world of changing governments, products, and services. Thus, in this guide, we will examine the Great Depression, how it came about, its effects on the United States economy as well as the eventual path to recovery.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

– The Great Depression (1929–1939) was the longest and deepest economic downturn;

– Triggered by 1929 stock market crash; Dow fell ~90%;

– Caused by speculation, bank failures, Fed mistakes, gold standard, and tariffs;

– 25% unemployment, 30% GDP drop, 20% of banks collapsed;

– FDR’s New Deal created jobs, welfare programs, and market regulations;

– WWII spending accelerated recover;

– Legacy: Govt. took broader role in managing the economy.

What is The Great Depression?

The stock market crash of 1929 was what carried the U.S. into the Depression, wiping out millions of investor dollars and sending Wall Street into a frenzy. Over the next several years, public spending and investment plummeted, causing steep industrial output and employment declines as failing businesses laid off workers.

By 1933, when the Great Depression reached its lowest point, nearly 25% of Americans were unemployed, and the financial system had nearly fully deteriorated. The end of the Depression came in 1941, the same year the United States entered World War II.

Recommended video: 5-minute history lesson on the Great Depression

Related reads:

- The Great Recession

- Dot-com Bubble

- What is a Recession?

- What is a Bear Market?

- What is a Bull Market?

Causes of the Great Depression

Though the stock market crash paved the way for America’s Great Depression of the 1930s, most historians and economists concur that the crash alone did not cause the eventual economic downturn.

Instead, various specific events and policies contributed to the Great Depression and helped prolong it, including banking panics that shattered the public’s trust in financial institutions, attachment to the gold standard, and failures by the Federal Reserve (Fed) and government to impose appropriate measures.

Let’s now look at the elements that contributed to the collapse of the United States economy in the 1930s in detail.

The stock market crash

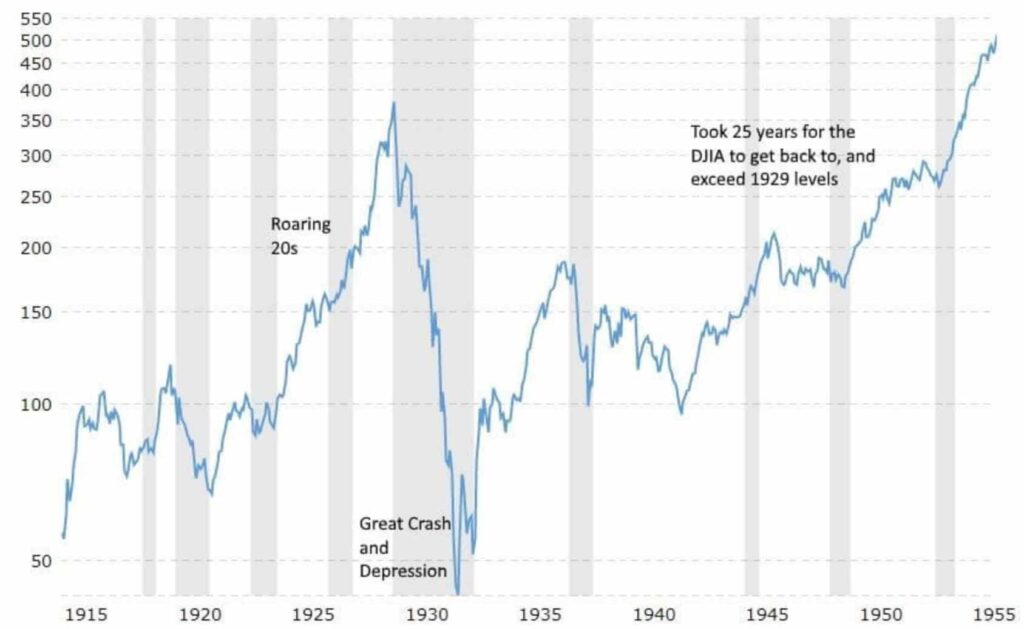

The Dow Jones Industrial Average (DJIA) increased six-fold from 64 in August 1921 to 381 in September 1929. The crash that started later that fall, in October of 1929, lasted until 1932, eventually commencing in the Great Depression, a period in which stocks had lost nearly 90% of their value. The Dow didn’t fully recover until November of 1954, suffering another recession from 1937 to 1938.

The leadup to the crash

The New York Stock Exchange (NYSE) on Wall Street was the scene of indulgent speculation, where loose money supply and margin trading (with borrowed money) helped fuel an unprecedented increase in asset prices. The reckless spending pushed the stock market to undergo rapid expansion, reaching its peak in August 1929.

At the same time, industrial production declined, and the agricultural sector struggled as consumer spending slowed and unsold goods began to pile up. As a result, during the summer of 1929, the American economy entered a mild recession. Yet stock prices continued to rise and, by the autumn of that year, had reached stratospheric levels that expected future earnings could not justify.

So, the robust growth in equity prices, coupled with the benchmark Dow Jones Industrial Average (DJIA) increasing 500% in just five years, finally caused the stock market to crash.

The bubble bursts

The bubble burst on October 24, 1929, a day that came to be known as Black Thursday. The Dow opened at 305.85 but immediately fell by 11% as nervous investors began selling overpriced shares en masse (12.9 million shares traded that day). Then, a brief rally occurred on Friday the 25th and during a half-day session on Saturday the 26th where Wall Street bankers feverishly bought shares to prop it up. As a result, the Dow rose by 0.6% to 301.22.

However, the following week brought Black Monday (October 28) and Black Tuesday (October 29), causing the DJIA to fall more than 20% over those two days. Panicked investors ended up selling an unprecedented number of shares, 16,410,030 to be exact.

Consequently, millions of shares ended up worthless, and those investors who had bought stocks on margin were wiped out completely, exasperating the fall in prices even further. The stock market would ultimately fall almost 90% from its 1929 peak.

Consequences of the crash

The crisis generated considerable uncertainty about future income and substantially reduced American aggregate demand (the total demand for goods produced domestically) for goods and consumer purchases, as well as business investments. Even though the loss of wealth brought about by the decline in stock value was relatively minor, the crash may also have depressed spending by decreasing consumer confidence.

Finally, real output (total value of production), which had already been declining up to this point, fell swiftly in late 1929 and throughout 1930 due to the severe decline in consumer and business spending. Therefore, while the Great Crash of the stock market and the Great Depression are two entirely separate events, the decline in stock prices contributed to both declines in production and employment in the United States.

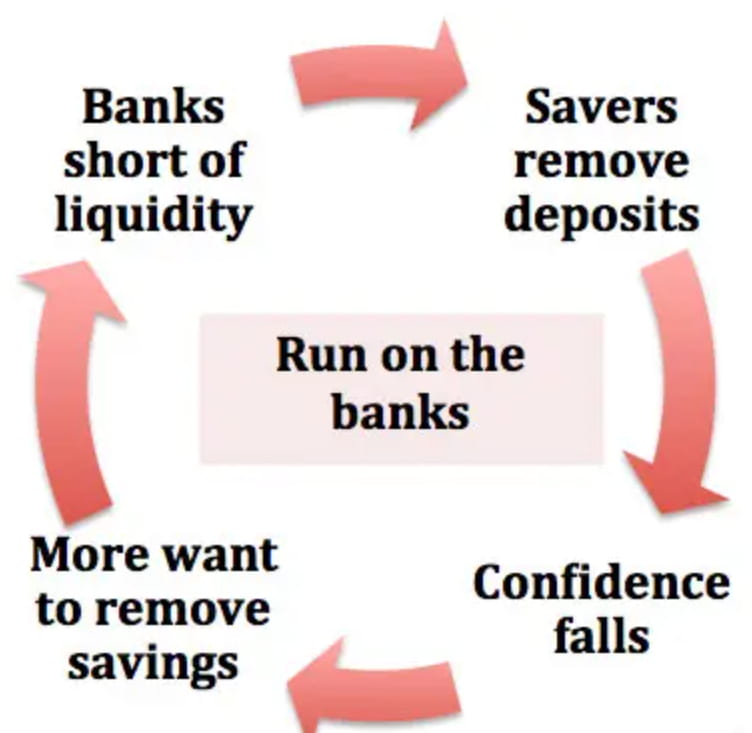

Banking panics

The stock market crash was followed by four waves of banking panics that swept across the United States from 1930 to 1932. The final wave of panic extended until the winter of 1933 and culminated with the national “bank holiday” issued by President Franklin D. Roosevelt (FDR) on March 6, 1933, by which all banks were closed and only permitted to reopen if considered solvent by government inspectors.

Naturally, the panics took a severe toll on the American banking system, such that by 1933, one-fifth of the banks had failed.

Economic historians have blamed the crippling banking panics on the substantial increases in farm debt in the 1920s, which, combined with U.S. policies that encouraged small, undiversified banks, created an environment whereby such crises could ignite and spread.

The heavy farm debt stemmed partly from the high prices of agricultural goods during World War I, spurring extensive borrowing by American farmers wishing to expand production by investing in land and machinery. Unfortunately, the surplus and sharp decline in prices of farm commodities following the war made it difficult for farmers to maintain their loan responsibilities.

The incompetence of the Fed

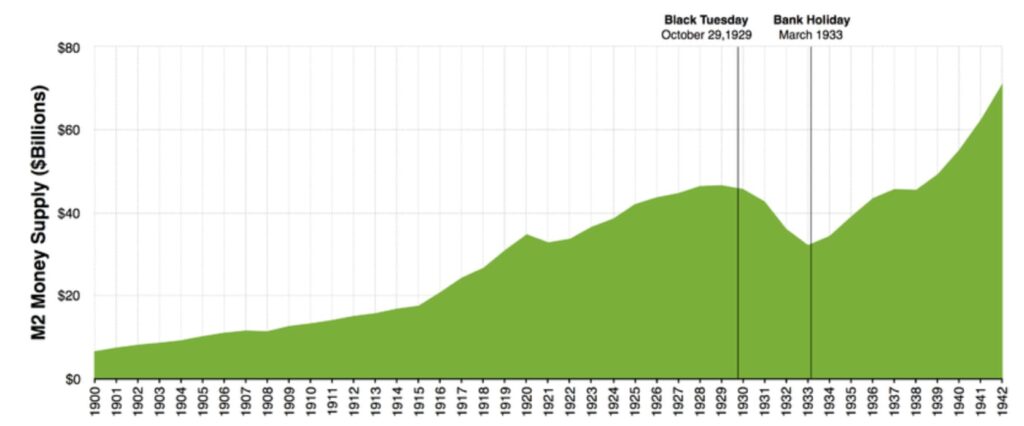

By boosting the money supply and maintaining the low-interest rates during the decade, the Federal Reserve essentially provoked the rapid growth that preceded the collapse. But unfortunately, the Fed did little to contain the banking panics that followed.

After the bubbles burst and the market crashed, they took the opposite approach and withheld from putting money in circulation to help the economy bounce back. Instead, the Fed allowed the total supply of U.S. dollars to fall by a third. This shrinkage caused severe liquidity issues for many small banks and obliterated any hopes of a quick recovery.

According to economists like Milton Friedman (monetarist view), later acknowledged by Ben Bernanke (former chairman of the Federal Reserve), the central bank helped create the Depression by using tight monetary policies when it should have done the opposite. As per Bernanke’s 2002 address, these were the Fed’s critical mistakes:

- The Fed began increasing interest rates in the spring of 1928 and kept raising them through a recession that started in August 1929: This, in turn, depressed interest-sensitive spending in areas such as construction and automobile purchases, which in turn reduced production;

- The Fed raised its discount rate sharply to prevent the outflow of gold: After the crash, investors turned to the currency markets and began trading their dollars for gold in September 1931. And because the dollar was on a gold standard at that time, it created a run on the dollar (selling dollars en masse, causing the value to plummet);

- The Fed raises interest rates again to preserve the dollar’s value: This further restricted available funds for businesses, creating more bankruptcies;

- The Fed didn’t increase the supply of money to combat deflation;

- The Fed ignores banks’ struggle as investors are withdrawing deposits: The failure of the banks created more panic, ultimately destroying any of consumers’ remaining confidence in financial institutions. Most people just withdrew their cash, further decreasing the money supply.

- Monetarists: A money supply reduction caused by significant policy mistakes by monetary authorities (the Fed) that led to a banking crisis, decline of credit, and bankruptcies;

- Keynesians: Insufficient demand and fiscal spending from the private sector driven by the consumers’ widespread loss of confidence in the financial system.

The gold standard

The gold standard set the stage for the Depression by heightening the fragility of the international financial system and was the primary transmission mechanism of the destabilizing impulse from the USA to the rest of the world. Moreover, it was the central obstacle to neutralizing action as it constrained lawmakers from preventing the collapse of banks and containing the spread of financial panic.

In short, because the currency (e.g., the U.S. dollar) could not be devalued since it was attached to the gold standard, the money supply to the economy could not be manipulated (e.g., increase the money in circulation).

For example, under the gold standard’s price–specie flow mechanism (trade imbalances can be automatically adjusted under the gold standard), nations that lost gold but wanted to maintain the gold standard still had to allow their money supply to decline, and domestic price levels to drop (deflation).

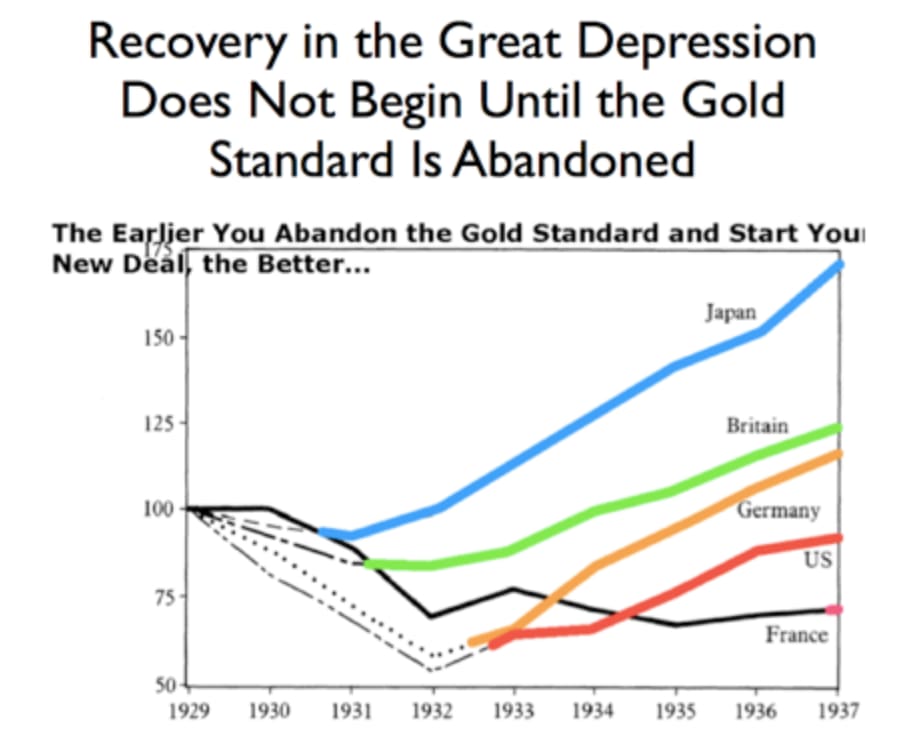

Every major currency abandoned the gold standard during the Great Depression. And according to later analysis, how early a country left the gold standard reliably predicted its economic recovery.

For instance, The UK and Scandinavia, which left the gold standard in 1931, recovered much faster than France and Belgium, which continued on gold much longer. China, on the other hand, which had a silver standard, almost avoided the Depression entirely.

Ultimately, the international gold standard was a fundamental factor in the worldwide Depression and its eventual recovery.

High prices and the crackdown on international trade

President Herbert Hoover, who rode into power in 1929 because of his success during World War I and the Roaring Twenties, eventually had his presidency consumed by the Great Depression.

Hoover advocated for laissez-faire economics (an economic system of free-market capitalism that opposes government intervention), that an economy based on capitalism would self-correct and that business prosperity would eventually trickle down to the average person. But unfortunately, this philosophy was not effective against the Depression.

Hoover’s main concern was cut-wages following the economic downturn. He claimed that prices needed to stay high to ensure high paychecks in all industries. Therefore, consumers would need to pay more to keep those prices high.

But the public had significantly suffered in the crash, leaving many people without the resources to spend extravagantly on goods and services. Moreover, companies, too, couldn’t count on overseas trade, as foreign countries were just as unwilling to buy overpriced American goods as Americans were.

Hoover’s failed measures to curb the crisis

The dismal reality forced Hoover to use legislation to prop up prices and, thus, wages, by stifling cheaper foreign competition. Pursuing the tradition of protectionists (policy of protecting domestic industries against foreign competition) and against the protests of more than 1,000 prominent economists, Hoover signed the Smoot-Hawley Tariff Act of 1930.

The act was initially a way to boost agriculture by reducing foreign competition but swelled into a multi-industry tariff. Nearly three dozen countries retaliated with their own tariffs, deflating international trade by 67% by 1934. Not surprisingly, economic conditions worsened worldwide. In addition, GDP growth fell 6.4%, while the unemployment rate rose to 15.9%.

In 1932, the economy shrank by 12.9%. However, Hoover raised the top rate (tax) to 63% to curb the deficit. Ultimately, his commitment to a balanced budget worsened the Depression.

Hoover’s desire to maintain jobs and individual and corporate earnings was understandable. Nonetheless, he encouraged businesses to raise wages, avoid layoffs and keep prices high in a period when they naturally should have dropped. And because the country could not sustain these artificial levels, and with global trade effectively halted, the U.S. economy disintegrated from a recession to a depression.

Sources of recovery

In the U.S., recovery from the Great Depression began in early 1933. Though economists lack consensus regarding the driving force behind the economic upsurge, most economists view FDR’s New Deal policies as either causing or accelerating the recovery (though the policies are also seen as not aggressive enough to pull the economy out of the crisis entirely).

However, the advent of World War II, particularly the U.S. getting involved in 1941, seemed to finally mark the end of the Great Depression by either masking the effects of the Depression or ending the Depression. Ultimately, at least, accelerating recovery.

Let’s investigate further how both factors played into the eventual recovery from the crisis.

The New Deal

In 1932, Franklin D. Roosevelt won an overwhelming victory in the presidential election, promising to form federal government programs to end the Great Depression. So within 100 days, he signed the New Deal into law, creating an unprecedented 42 new agencies throughout its lifetime.

These programs were designed to bolster American business, stabilize industrial and agricultural production, create jobs, stimulate recovery as well as provide worker protections. Many still exist today, helping safeguard the economy and prevent another depression.

Loosely based on Keynesian economics, the New Deal was motivated by the concept that the government could and should intervene to stimulate the economy. Accordingly, it set ambitious goals to create and maintain the national infrastructure, employment, and livable wages. These goals were pursued through regulations on price, wage, and production.

Federal taxes tripled between 1933 and 1940 to afford these social security programs, including increases in excise, personal income, inheritance, corporate income taxes, as well as an excess profits tax.

Newly established regulations in the New Deal

FDR kept a rigid focus on price supports and minimum wages and removed the country from the gold standard, forbidding the public to hoard gold, instead ordering them to exchange all gold for dollars. He increased the price of gold to $35 per ounce, which doubled the value of the gold held in the U.S, making the country the world’s largest owner of gold.

In addition, FDR prohibited monopolistic business practices and created dozens of new public works programs and other job-creation agencies.

Importantly, FDR sought to reform the financial system that exacerbated the crisis, creating the Federal Deposit Insurance Corporation (FDIC) to protect depositors’ accounts and the Securities and Exchange Commission (SEC) to regulate the stock market and prevent practices that led to the eventual crash.

Roosevelt’s administration introduced the Agricultural Adjustment Act (AAA) in 1933 to curtail farm production, reduce export surpluses, and raise prices. This legislation paid farmers to destroy produce to inflate prices. Under the AAA, farmers could receive payment for not producing food. As one of the most depressing conundrums of the period, unfortunately, this occurred as millions of Americans were unable to afford food.

The tactic was heavily scrutinized as well as challenging for farmers to reconcile, having committed themselves to provide for their communities and the rest of the country. In the end, Americans had to pay a lot more for goods, and the U.S. ended up actually importing millions of pounds of crops that they were paying farmers not to produce.

Eventually, the AAA was amended to start the Federal Surplus Relief Corporation (FSRC), which distributed agricultural products to organizations to feed hungry Americans. Like modern food banks now, these organizations packaged and distributed dry and canned goods across the country. Many AAA subsidies farmers got from the Great Depression are still around today due to farmers lobbying to keep them.

World War II

When World War II finally broke out in both Europe and Asia, the U.S. tried to avoid being drawn into the conflict. But they could only prevent involvement for so long. So when Japan attacked the U.S. Naval base at Pearl Harbor on December 7, 1941, the U.S. found itself in the war it had managed to evade for more than two years.

The war had a profound and multifaceted impact on the American economy. It seemed to lift the nation out of the Great Depression suddenly. In 1940, unemployment stood at 14.6 %, but by 1944, it had fallen to an incredible 1.2 %, and the GDP had more than doubled. Moreover, national income soared from $73 billion in 1939 to $183 billion in 1944.

Though unemployment dropped drastically, mainly because more than 16 million Americans were conscripted to the Armed Services, the real unemployment rate increased during the war in the private sector.

As the war mutilated foreign countries, American defense spending and mobilization began to send the economy to new levels of prosperity. For example, by 1944, the U.S. accounted for about 40% of all war goods produced globally; by 1947, the country made almost half of the world’s manufactured goods, three-fifths of the world’s oil and steel, and four-fifths of the world’s automobiles. Moreover, newer industries such as aviation, petrochemicals, and electronics, as well as new technologies, grew in importance because of the war.

On the other hand, the standard of living fell due to wartime shortages generated by rationing, and taxes rose fiercely to finance the war effort. As a result, private investment fell from $17.9 billion in 1940 to $5.7 billion in 1943, including a decrease of almost 50% in total private-sector production.

So even though the notion that the war ended the Great Depression is a broken window fallacy, the conflict did steer the U.S. on the road to recovery. Ultimately, the war reopened international trading channels and reversed price and wage controls. As a result, government demand opened up for cheap products, that demand creating a massive fiscal stimulus.

In the first 12 months after the war ended, private investments rose from $10.6 billion to $30.6 billion. And finally, the stock market broke into a bull run in a few short years.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

In conclusion

The Great Depression resulted from an unfortunate combination of factors, such as questionable monetary policies, protectionist tariffs, and inconsistent government interventions. We now know that this period could have been capped or even avoided by changing any of these factors.

While there is a lack of consensus as to whether the interventions were appropriate (though certainly revolutionary in American economic policy at the time), many reforms and programs from the New Deal, such as Social Security, unemployment insurance, regulations on the stock market, and agricultural subsidies, exist to this day.

As a result of the New Deal, the American public came to believe that the government has a responsibility to guarantee the health of the economy as well as the welfare of its citizens (especially during a crisis). And precisely, this legacy– the shift in government philosophy– is one of the reasons the Great Depression is considered one of the formative episodes in modern American history.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about the Great Depression

What was the Great Depression?

The Great Depression, which began in the United States in 1929 with the stock market crash and quickly spread worldwide, was the most prolonged and severe economic downturn in modern world history. It was characterized by steep declines in industrial production and prices (deflation), mass unemployment, banking panics, and increased poverty.

What caused the Great Depression?

Economists and historians generally agree that several mitigating factors led to this period of downturn as well as helped prolong it, including banking panics that shattered the public’s trust in financial institutions, attachment to the gold standard, and failures by the Fed and government to impose appropriate measures.

How did the Great Depression affect the U.S. economy?

In the United States, industrial production between 1929 and 1933 fell by nearly 47%, GDP declined by 30%, and unemployment reached almost 25%. In addition, because of banking panics, 20% of banks in existence in 1930 had failed by 1933.

How did the American economy recover from the Great Depression?

First, abandonment of the gold standard and currency devaluation enabled some countries to increase their money supplies (by devaluing the currency), which spurred spending, lending, and investment. Secondly, fiscal expansion in the form of increased government spending on jobs and other social welfare programs (e.g., the New Deal) arguably stimulated production by increasing aggregate demand. Lastly, military spending and mobilization helped to reduce unemployment and energize the economy.

Who was blamed for the Great Depression?

The Great Depression is attributed to multiple factors rather than a single cause. Key contributors include the 1929 stock market crash that eroded wealth and confidence, banking failures and flawed policies leading to massive financial losses, and detrimental government policies like the Smoot-Hawley Tariff Act and adherence to the gold standard. Economic structural weaknesses, such as under-consumption and over-investment, identified by theorists like John Maynard Keynes, also played a role. This convergence of factors, coupled with a then-limited understanding of economic dynamics, led to the depth and duration of the Depression.

What was a main indicator of the spread of homelessness during the Great Depression?

A significant indicator of the spread of homelessness during the Great Depression was the emergence and growth of “Hoovervilles.” These were shantytowns named sarcastically after President Herbert Hoover, who was widely blamed for the Depression. Hoovervilles consisted of makeshift shelters constructed by homeless people using scrap materials. These settlements sprang up across the United States, often in or near large cities, and their rapid growth visually represented the increasing prevalence of homelessness during this era.

How did Roosevelt's response to the Great Depression focus more on relief than Hoover's?

FDR’s New Deal was a significant departure from Hoover’s response to the Great Depression, focusing heavily on direct relief and government intervention. Hoover’s efforts, including public works and the Reconstruction Finance Corporation, were seen as too limited and delayed. In contrast, Roosevelt quickly implemented the New Deal upon taking office, aggressively involving the government in various sectors. This approach included creating jobs, regulating banks, and assisting agriculture, showcasing a comprehensive strategy to tackle the economic crisis of the time.

What effects did the government response to the great depression have on the credit industry?

The government’s response to the Great Depression, particularly under the New Deal, had a profound impact on the credit industry. The Home Owners’ Loan Corporation (HOLC) helped stabilize the housing market by refinancing troubled mortgages, preventing further declines in home prices and foreclosures. The Emergency Banking Act of 1933 restored public confidence in banks by allowing their reopening once deemed financially secure, contributing to the reestablishment of a stable banking system. Additionally, federal spending on public works and relief programs boosted economic activity, though the effects on private employment were mixed.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.