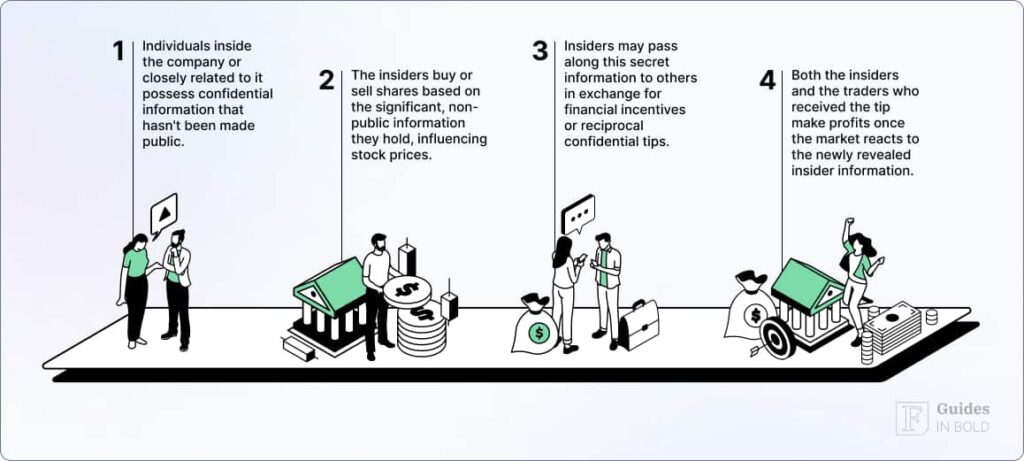

Insider trading often raises eyebrows given some of the questions regarding ethics and legality of the stock market that come with it. Indeed, while some insider trading cases are legal, things are much different when trades are executed based on confidential information not yet public.

While this might not sound like an issue for retail investors to worry about, many still believe that insider information diminishes market confidence among all kinds of investors. Consequently, understanding the effects of insider information on the broader market is crucial for everyone looking to invest in stocks.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

What is insider trading?

“Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.” — Peter Lynch

Although there are legal insider stock trading examples, where insiders lawfully trade and disclose their transactions to regulatory bodies, the term is most often linked with illegal activities that create an unfair market advantage.

The Securities and Exchange Commission (SEC) frequently investigates cases involving corporate officers, government employees, and others who misuse confidential information to curb such activities.

According to the SEC glossary, insiders can be:

- Corporate officers, directors, and employees who have traded securities after gaining access to confidential corporate developments;

- Friends, family members, business associates, and others who have traded after receiving nonpublic information from corporate insiders;

- Employees of law, banking, brokerage, and printing firms who have traded on inside knowledge;

- Those who traded based on information obtained through their government positions;

- Political intelligence consultants who have traded or tipped based on information sourced from government employees;

- Individuals who misappropriated confidential data from their employers, family, friends, or associates for their own benefit.

Understanding insider information

Insider information is considered material, non-public knowledge available only to those within the company and people associated with them. When someone uses this information for trading without disclosing it to the SEC, it constitutes illegal insider trading.

Where can I track insider trading?

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Recommended video: Insider Trading Explained in 2 Minutes

How did Martha Stewart get caught insider trading?

A classic example of insider information sharing is the Martha Stewart and ImClone insider trading scandal that made headlines at the beginning of the millennium.

Following the Food and Drug Administration’s (FDA) rejection of ImClone’s new cancer drug, the company’s stock plummeted rapidly. The SEC discovered that numerous individuals, including company executives and close associates of the chief executive officer, managed to avoid losses by selling their shares ahead of time.

Among them was Martha Stewart, who, tipped off by her broker Peter Bacanovic, sold her stock before the price tanked. Stewart sold approximately $230,000 worth of ImClone shares just one day before the FDA’s decision was announced.

Despite claiming innocence, Stewart was found guilty and sentenced to five months in prison, five months of home confinement, and two years of probation for lying about the stock sale, conspiracy, and obstruction of justice.

“With enough insider information and a million dollars, you can go broke in a year.” — Warren Buffett

The effects of insider information

A study conducted in 2021 suggests that trades conducted by directors, executives, substantial shareholders, and promoters affect stock price and volume but not necessarily returns. The study likewise shows that once outside investors are aware of insider trades, they often engage in purchases, which subsequently drive up stock volume and price.

It is this kind of behavior that allows both insiders and outside investors to achieve abnormal returns. Interestingly, the study reveals that Indian investors, for example,

do not follow the information hierarchy hypothesis. Promoters’ trades are often mimicked in India, even though these trades do not generate significant returns.

Conversely, trades by directors, executives, and substantial shareholders, while not frequently mimicked, tend to yield abnormal returns. The presence of abnormal movements in price, return, and volume following insider trades suggests that the market is not strong-form efficient. Additionally, the study finds no correlation between abnormal returns and abnormal trading volume.

Meme rally stocks

The infamous surge in GameStop’s stock volatility has sparked investigations into potential insider trading and raised suspicions of a pump and dump scheme, illustrating well how insider information can drastically impact market sentiment. Although this rally wasn’t driven by traditional insider information, it can be analyzed through the lens of how the spread of information and collective action influenced the stock price, potentially mimicking the dynamics typically seen with insider information.

The suspected scheme typically involves a group conspiring to buy a low-liquidity stock, inflate its price through misinformation, and quietly sell off shares at an artificially high price. However, in the case of GameStop (GME), the situation deviated in two key ways from past instances of coordinated trading.

First, the effort was driven by a public, crowdsourced campaign on Reddit’s community r/wallstreetbets, yet remained anonymous, making it difficult to pinpoint the individuals behind the movement. This highlights a novel and highly efficient method for organizing collective trading action.

Second, the campaign was driven by more than just profit motives. There was a strong sentimental component, with participants aiming to inflict financial losses on hedge funds and other perceived villains in the finance industry.

Insider information and market confidence

Insider information is often discussed in the context of investor psychology and behavioral finance. The idea is that insider information can create a sense of suspicion among retail investors, who may fear that those with access to privileged information have an unfair advantage. This can lead to emotional reactions, even in the absence of concrete evidence.

Not all take this idea for granted. A study conducted in 2018 highlights several issues with the argument that public attitudes toward insider trading impact market health and performance. Since the argument relies heavily on socio-psychological factors, it encounters the problem of false consciousness, where misguided beliefs about the economic or ethical consequences of insider trading may influence investors’ actions.

Even if insider trading is genuinely harmful, the study found the market-confidence argument empirically groundless, as market data can often support both sides of the debate. In other words, developing a conclusive test for gauging the market-confidence claim was deemed unlikely.

Still, the inability to dispel market-confidence myths often allows them to persist in shaping public opinion. Given these challenges, and without clear empirical evidence linking insider trading to market confidence, the study advises caution about using the market-confidence claim to justify expansive enforcement powers or severe penalties in insider trading cases.

How does insider information affect institutional shareholders?

Despite legal restrictions, frequent insider trading news still makes it evident that trades are often based on private information. As profits generated by such trades can be stellar, insider trading on non-public information has significant implications for institutional shareholders.

For one, institutional investors must carefully consider the pros and cons when deciding whether to monitor or limit insider trading. According to a 2009 study, for example, insider trading based on private information increases the risk of litigation. On the flip side, a 2011 study suggests that being more lenient towards insider trading can lower CEO compensation.

Curiously, a 2018 study found that higher institutional ownership significantly reduced the frequency of insider opportunistic trades (i.e., those more likely to involve private information). This effect is likely due to concerns regarding the aforementioned litigation risks. Additionally, the study shows that firms with higher institutional ownership are more likely to implement or enforce blackout periods, restricting insider trades during sensitive periods.

How is insider trading regulated?

In the US, legal insider trading must be regulated by the SEC, under rules established by the 1934 Securities Exchange Act. Executives, directors, and employees must adhere to these regulations when trading shares in their own companies. Otherwise, the trading is illegal.

The definition of insider trading has changed over the years. One notable recent example is Regulation Fair Disclosure (Regulation FD), passed by Congress in 2000. This law was passed to prevent selective information sharing, requiring companies to make any previously undisclosed information available to all traders at the same time.

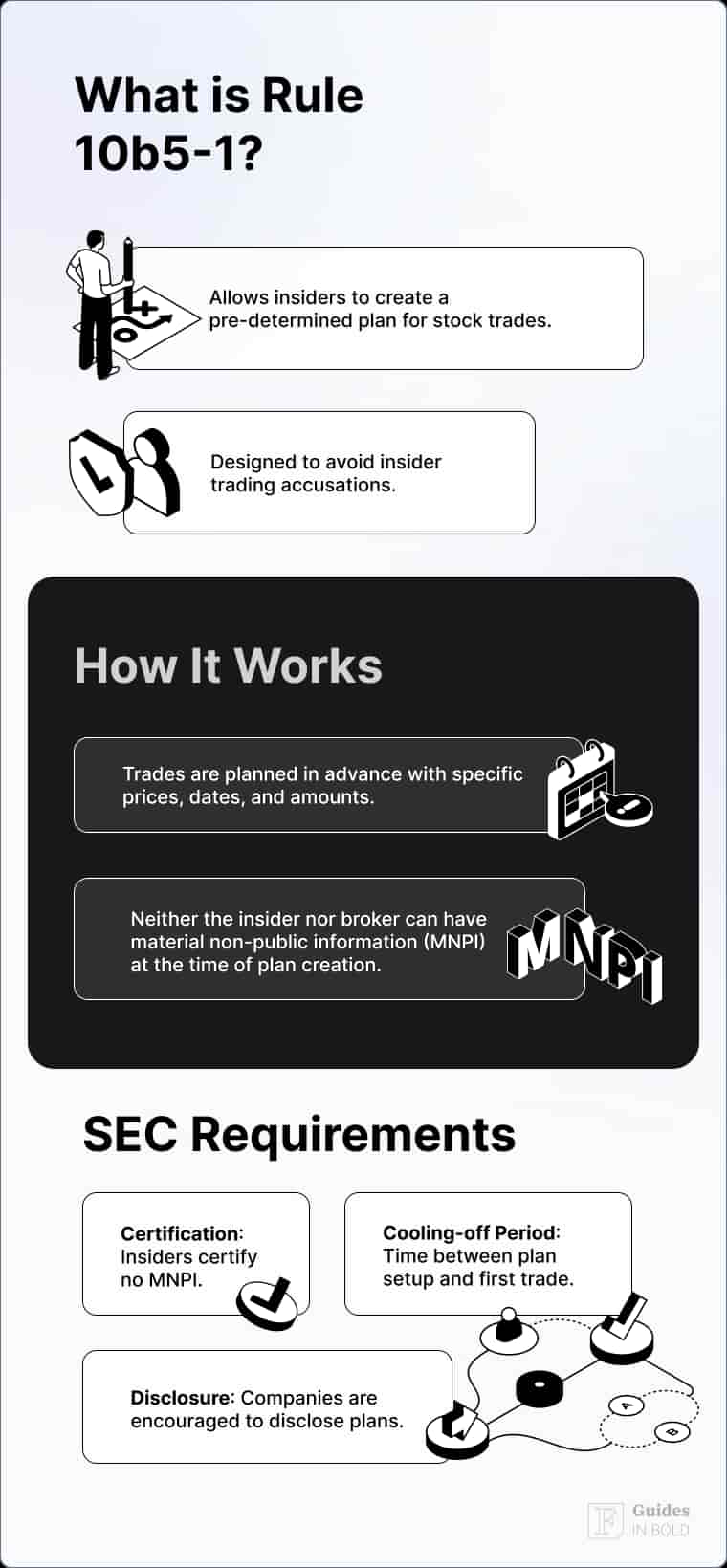

Likewise important for insider information regulation is Rule 10b-5. Under the Exchange Act, Rule 10b-5 is an anti-fraud provision that prohibits individuals from directly or indirectly using false statements, deceptive practices, or omitting crucial information when buying or selling securities.

Consequences of sharing insider information

Those found guilty of investing based on insider information can face fines and imprisonment. According to the SEC, insider trading can result in a maximum prison sentence of 20 years and fines of up to $5,000,000 for individual traders and $25,000,000 for entities such as publicly traded companies.

The bottom line

In conclusion, insider information plays a complex role in stock markets, affecting everything from market confidence to institutional investor behavior. While legal frameworks such as the SEC’s regulations seek to limit the misuse of non-public information, the practice still persists, resulting in genuine legal concerns and scholarly debates trying to dispel some of the myths that have been woven around it.

At the end of the time, the effects of insider trading really can disrupt market fairness, giving insiders an unfair advantage over retail and institutional investors. By understanding the dynamics of insider information and its effects on the financial market, investors can make more informed investment decisions while regulatory bodies continue to hone their approach to ensuring market transparency and fairness.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about insider trading

Is insider trading illegal?

Yes, insider trading is illegal if it involves the buying or selling of securities based on confidential, non-public information. However, certain insider transactions are legal if reported to the Securities and Exchange Commission (SEC).

Why is insider trading illegal?

Insider trading is illegal because it threatens the fairness and integrity of the stock markets. That is, those who make investments based on confidential information have an unfair advantage over other investors not privy to such knowledge.

What is the penalty for insider trading?

According to the Securities and Exchange Commission (SEC), insider trading can result in a maximum prison sentence of 20 years and fines of up to $5,000,000 for individual traders and $25,000,000 for entities such as publicly traded companies.

How common is insider trading today?

Insider stock trading is likely very common. A recent study suggests that only about 15% of all insider trades in the US are reported.

How to find insider trading information?

To track insider trading data, you can use insider trading tracker tools on financial platforms like Finbold.

Who investigates insider trading?

Insider trading is investigated by the Securities and Exchange Commission (SEC).