US presidential elections stir up the stock market every four years. As such, investors often wonder which stocks perform best during political change. While there isn’t a formula that guarantees success, certain trends have emerged that offer insights into which sectors and what stocks do well in election years, and that’s what we’ll look into here.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

How do elections affect the stock market?

In short, election years bring uncertainty, as changes in political power can potentially lead to shifts in economic policy. And in turn, investors respond to potential changes in tax rates, regulatory policies, and government spending.

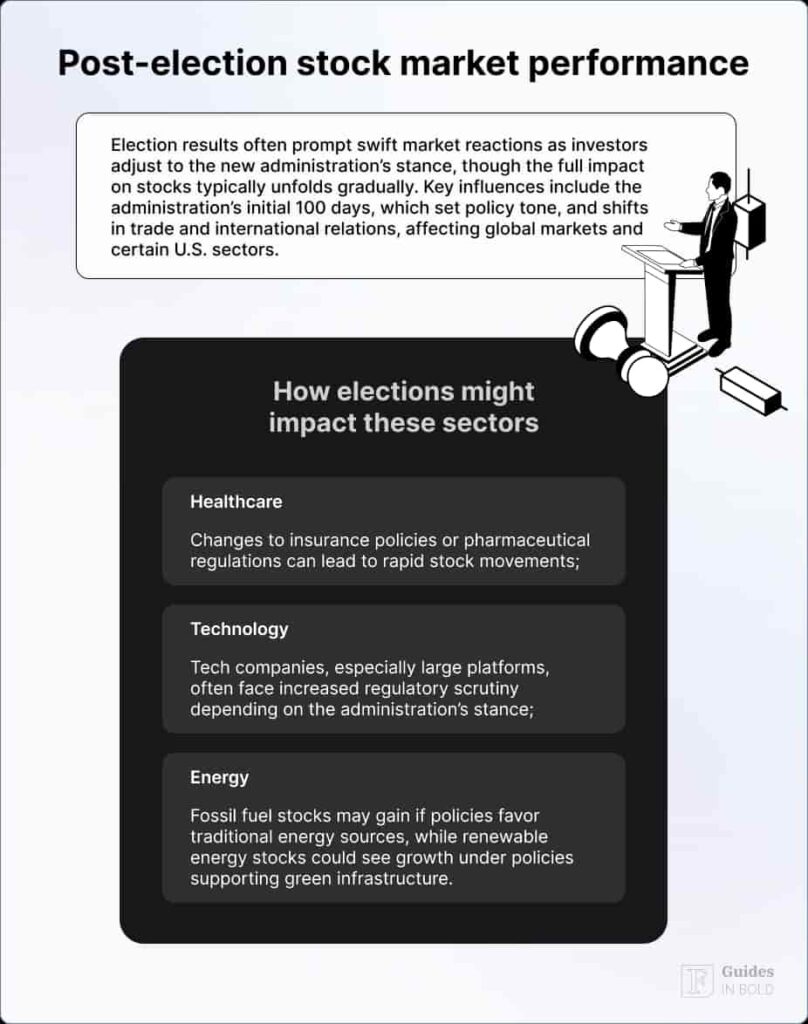

During election years, investors might react to each candidate’s stance on business and fiscal policies, creating market swings. Traditionally, sectors closely tied to government policy, like healthcare, defense, energy, and infrastructure, typically see increased interest.

Stock market during presidential election years

Election years usually show more market volatility than others, especially in the months leading up to the election. The uncertainty over the new administration’s policies can lead to fluctuating prices, with different sectors responding based on anticipated policy changes.

Some examples include:

- The incumbent effect: When the incumbent president or party is expected to win, markets tend to stay stable or rise. Investors see continuity as beneficial, as it maintains current policies. However, when an incumbent president loses, markets can experience temporary volatility due to anticipated policy changes;

- Sector-specific trends: Sectors with significant exposure to government policies—healthcare, energy, and defense—typically respond strongly to changes in leadership. Each party has different views on regulation and funding, which can impact these industries significantly.

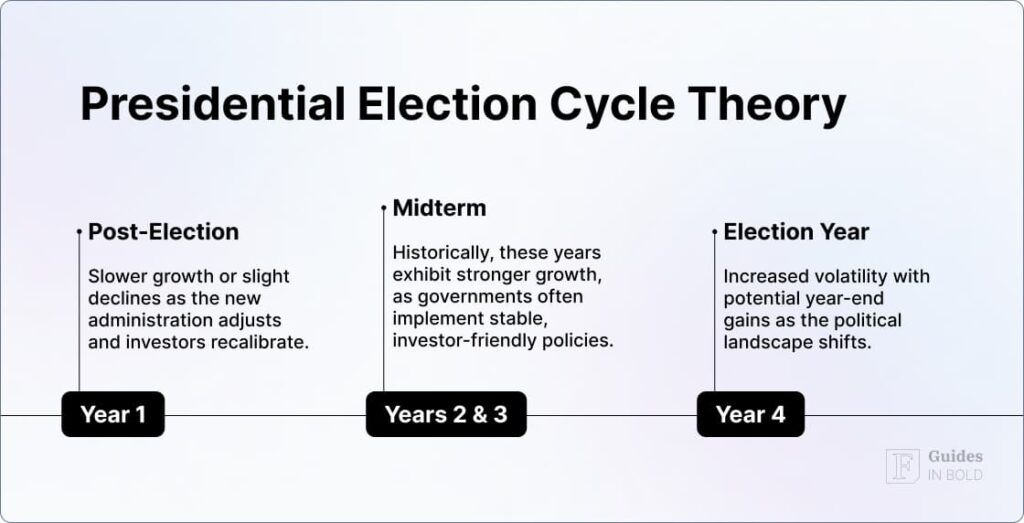

The presidential election cycle theory suggests that US stock markets tend to follow a four-year pattern tied to the election cycle. Historically, markets show weaker performance in the first year of a presidential term, often due to policy shifts, and stronger performance in the second and third years as economic policies stabilize and incumbents aim for re-election.

What sectors to watch during election years?

Here’s a list of the sectors that investors should keep an eye on in election years:

- Healthcare: Both parties in the US tend to have strong stances on healthcare, focusing on insurance, drug pricing, and public health funding. If one party has a policy that increases public healthcare funding or favors pharmaceutical companies, related stocks can benefit. For instance, healthcare companies, pharmaceutical firms, and insurance providers might see spikes if a candidate promotes industry-friendly policies;

- Defense and aerospace: Defense budgets typically rise under certain administrations and fall under others. Aerospace and defense companies often experience growth when government spending in these areas increases. In election years, these stocks tend to respond to candidates’ military policies and proposed budgets;

- Energy: Energy policy varies significantly between administrations, impacting both traditional and renewable energy stocks. A candidate promoting renewable energy may lead to gains in solar, wind, and electric vehicle companies. In contrast, pro-oil policies might support traditional energy stocks;

- Technology: Tech companies can be affected by policies on data privacy, net neutrality, and international trade. In the past few election cycles, the tech sector has shown resilience in election years, driven by increased digital transformation and innovation regardless of election outcomes;

- Infrastructure: Infrastructure spending is a frequent promise in election years, as candidates seek to boost economic growth and employment. Companies involved in construction, materials, and transportation infrastructure may experience a boost if a candidate’s policies lean toward significant infrastructure investment.

What stocks do well in election years?

Certain companies within key sectors tend to benefit from election-year dynamics, as changes in government policies directly impact their markets. In the healthcare sector, UnitedHealth Group (NYSE: UNH) and Pfizer (NYSE: PFE) often see increased interest due to discussions about healthcare reform and drug pricing regulations, which typically come to the forefront during election cycles.

Defense companies like Lockheed Martin (NYSE: LMT) and Raytheon Technologies (NYSE: RTX) also experience heightened attention as candidates outline their defense spending priorities. These companies can signal potential growth depending on the election outcome and expected increases or decreases in military budgets.

In the energy sector, companies like ExxonMobil (NYSE: XOM) and NextEra Energy (NYSE: NEE) may react to policies favoring either traditional fossil fuels or renewable energy sources. Each candidate’s stance on climate initiatives and energy independence can heavily influence these stocks, driving investor interest.

Infrastructure giants such as Caterpillar (NYSE: CAT) and Vulcan Materials (NYSE: VMC) stand to gain if election-year promises of infrastructure investment materialize. Government spending on public projects can drive demand for their equipment and materials, making them key stocks to watch as election results unfold.

How to track politician, insider, and institutional stock trading?

In election years, tracking politician and insider trading activities can provide you with an edge on the stock market. For example, specialized tools like Finbold Signals offer real-time updates on political, insider, and institutional trading activities.

With Finbold Signals, you can keep track of US Senate and Congress trades, as well as activities by corporate insiders, allowing you to make better decisions based on the latest trends in political and corporate sectors.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Political cycles and the stock returns

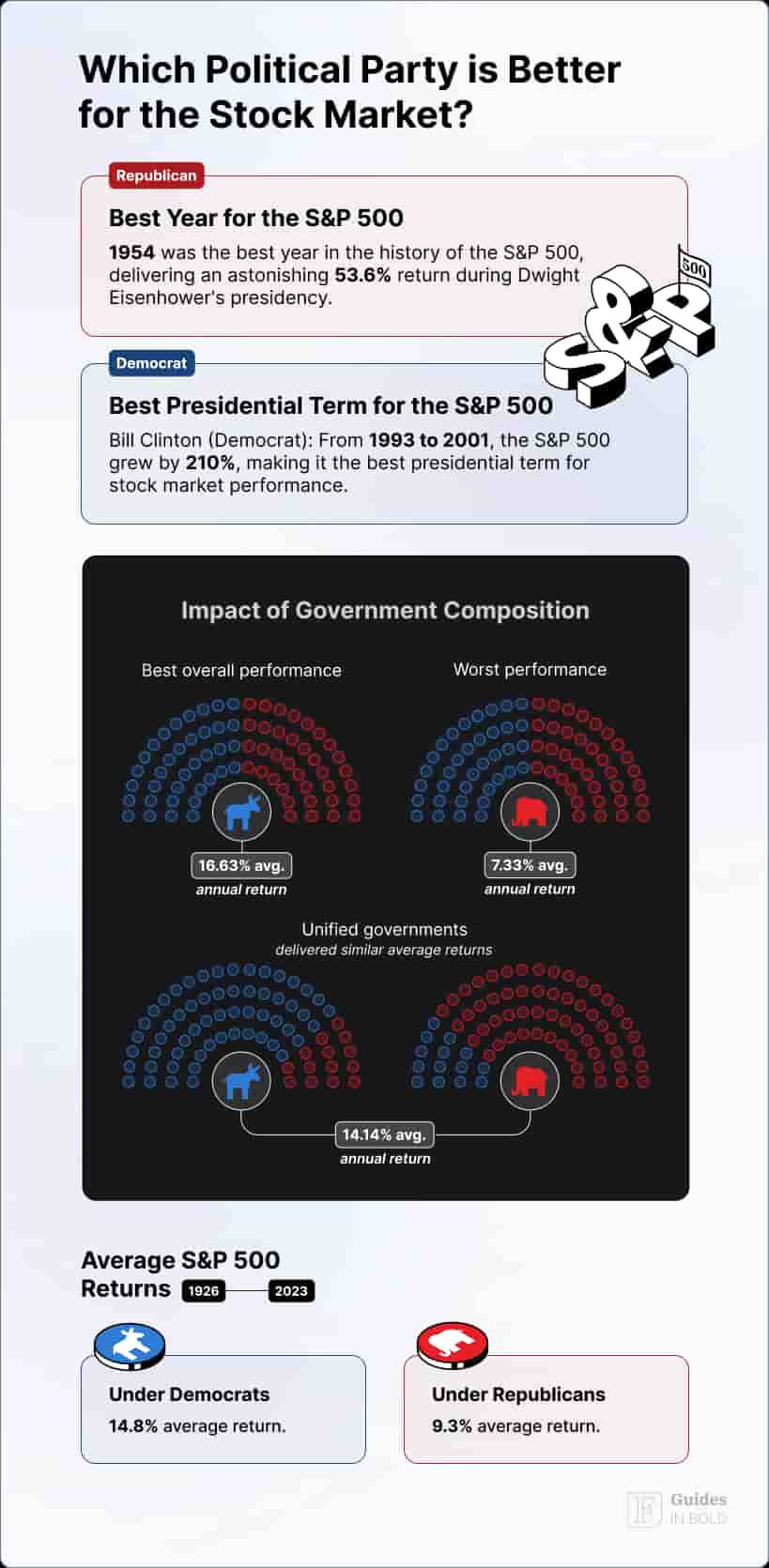

A study by Santa-Clara and Valkanov examined how US political cycles impact stock returns. The researchers found that the stock market, particularly in certain sectors, typically experiences higher returns under Democratic presidents than Republicans.

“Our results suggest that there exists a presidential cycle in stock returns, with stock prices tending to perform better when Democrats hold the presidency.” — Santa-Clara and Valkanov

This trend could be due to differing policies on government spending, taxation, and regulatory frameworks typically pursued by each party, impacting sectors differently.

As an investor, it’s key to understand that party-specific policy tendencies could help in sector-focused investing during election years.

For example, Democrats often emphasize healthcare reform, renewable energy, and infrastructure spending, which may create favorable conditions for companies in these sectors. On the other hand, Republicans focus more on defense spending and reduced regulation, benefiting traditional energy and defense.

The bottom line

Election years create unique investment opportunities, especially in sectors sensitive to government policy changes like healthcare, defense, and energy. So, by focusing on these sectors and leveraging historical trends, investors can make informed decisions in times of heightened market activity.

Tracking insider, institutional, and political trades adds an extra layer of insight, helping investors understand market sentiment. Tools like Finbold Signals provide real-time updates, giving the advantage of timely data to navigate election-year volatility.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs

How do elections affect the economy?

Elections create uncertainty over potential policy changes, affecting sectors reliant on government funding or regulation. Investors react to each candidate’s platform, which can lead to increased market volatility and sector-specific movements.

Which sectors perform best during election years?

Sectors closely tied to government policies (e.g., healthcare, defense, energy, and infrastructure) often show more activity and volatility in election years, as changes in administration can impact regulations, spending, and tax policies.

Is the stock market more volatile during election years?

Yes, election years typically bring increased volatility due to the uncertainty surrounding policy shifts. Investors may see heightened price swings, particularly as the election approaches and policy proposals become clearer.

How can I reduce risk when investing in election years?

Focusing on long-term investment goals, diversifying across sectors, and considering policy-driven industries can help manage risk. You can also use real-time tracking tools, like Finbold Signals, to stay informed about political, insider, and institutional trading.

What tools can help track election-year market trends?

Tools like Finbold Signals provide updates on political and insider trades, allowing investors to stay informed on market sentiment influenced by election developments. This information can help investors make data-backed decisions during volatile periods.

Are election years a good time to invest?

Election years can offer opportunities, particularly in sectors that benefit from policy changes. While volatility may increase, strategic investments in policy-affected sectors can lead to gains if timed well with election-related market movements.

Do stocks go up or down during election year?

Historically, US stocks have averaged a 7% gain during presidential election years since 1952, though individual year performance can vary.

Are election years good for the stock market?

While election years often bring increased volatility due to political uncertainty, they have generally been positive for the stock market, with the S&P 500 averaging a 7% gain during these years.

How will the 2024 election affect the stock market?

The 2024 election’s impact on the stock market will depend on the election outcome and subsequent policy changes, with potential effects on sectors like healthcare, defense, and energy. However, the Federal Reserve’s actions are expected to have a more substantial impact on the market than the election outcome.

What stocks do well in election years?

Sectors closely tied to government policies, such as healthcare, defense, energy, and infrastructure, often show more activity and volatility in election years, as changes in administration can impact regulations, spending, and tax policies.