The price of Hedera (HBAR) has surged dramatically in the short term, at one point experiencing triple-digit gains within the last 24 hours amidst alleged connections to the world’s largest investment firm, BlackRock (NYSE: BLK).

The frenzy began when Hedera announced the tokenization of BlackRock’s ICS U.S. Treasury money market fund in partnership with Archax and Ownera. However, despite Hedera’s announcement, some supporters misinterpreted the situation, believing that BlackRock had chosen Hedera to tokenize its fund directly.

The misunderstanding reached a fever pitch when the HBAR Foundation, the organization overseeing the Hedera network, shared an X (formerly Twitter) post that implied a direct partnership between BlackRock with a video fuelling further speculation, suggesting that the investment giant was actively involved in the venture.

Picks for you

As a result of the confusion, HBAR prices skyrocketed, hitting a high of $0.13 per token. However, the excitement was short-lived as it became clear that BlackRock was merely “aware” of the tokenization on-chain and was not directly involved in the project.

Archax CEO Graham Rodfort also clarified that the decision to select Hedera came from their assessment rather than being influenced by BlackRock.

What next for HBAR?

As of press time, HBAR was valued at $0.129, experiencing daily gains of 48%. After trading in a relatively consolidated pattern on the weekly timeframe, the cryptocurrency has surged by almost 65% on the chart.

Following the short-term price movement, attention is focused on whether HBAR can sustain its momentum. For instance, in an X post on April 24, CrediBULL Crypto noted that Hedera is potentially poised for a significant upward movement based on a discernible pattern in its price action.

The analysis pointed towards a notable pattern termed a “nice 5 wave impulse off the lows,” indicating a robust upward movement in Hedera’s price from its recent lows. This pattern is often interpreted as a bullish signal, signifying a strong buying momentum in the market.

However, the analysis highlighted that the initial step towards triggering this anticipated upward surge involves a lower timeframe market structure break. This break is a catalyst, igniting the momentum necessary to propel Hedera’s price upward.

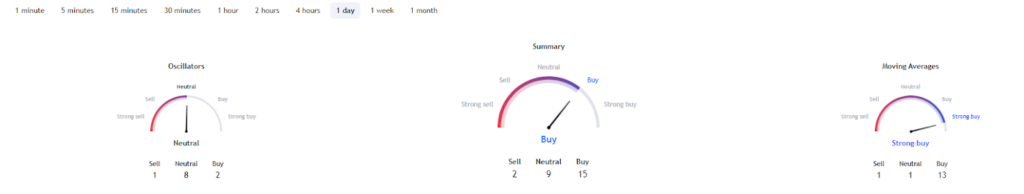

Elsewhere, technical indicators for HBAR remain bullish despite the confusion stemming from the BlackRock situation. According to the summary of one-day gauges retrieved from TradingView, Hedera is experiencing a ‘strong buy’ sentiment at 15, which mirrors the moving averages‘ assessment at 13. Oscillators, however, are currently classified as ‘neutral’ at 8.

Impact of Blackrock

It’s worth noting that following the approval of the spot Bitcoin (BTC) exchange-traded fund (ETF), BlackRock has expanded its presence in the crypto world. For instance, last month, the company entered the real-world asset (RWA) tokenization sector by launching its USD Institutional Digital Liquidity Fund on Ethereum.

Therefore, considering BlackRock’s stature in the financial world, it would have a monumental impact on the project if the company were to be directly involved with Hedera.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.