In recent months, and particularly after he closed his controversial 2023 bet against the semiconductor industry, Michael Burry’s similarly contentious Alibaba (NYSE: BABA) bet – technically the single largest holding in his portfolio – has taken the bulk of attention.

Despite the struggling investment which has seen the stock continuously remain below the purchase price, ‘The Big Short’ investors took a significant number of winning long positions, particularly during the ‘buying spree’ in last year’s final trimester.

Among the dozens of assets purchased in the quarter, the shares of Alphabet (NASDAQ: GOOGL) are certainly among the most noteworthy, given the company’s involvement in the artificial intelligence (AI) boom and overall stock market performance, which saw the technology giant break above $2 trillion in capitalization weeks ago.

How much did Burry make on his GOOGL stock investment?

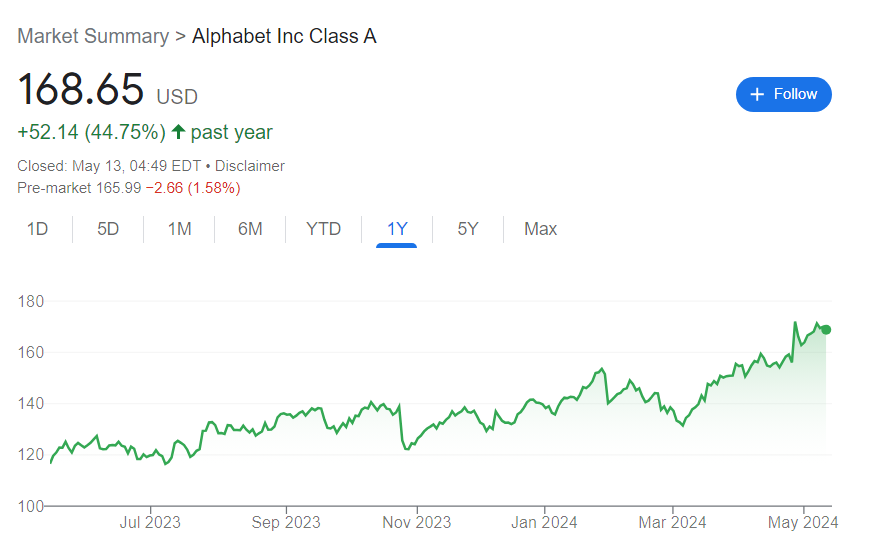

While it is difficult to tell the exact purchase price of Burry’s GOOGL shares, the blue-chip stock was trading in the rough range between $123 and $140 in the relevant trimester.

Given the range and the fact that the shares spent most of the quarter trading in the vicinity of $135 – despite the outlying fluctuations at certain points – setting said level as the purchase price offers a plausible scenario.

If Michael Burry indeed bought GOOGL at $135, he would have invested approximately $4.7 million to get his 35,000 shares. Since the big tech company rose about 26% since the start of Q4 2023, and Google stock price today stands at $168.65, ‘The Big Short’ investor’s position is, at press time, worth $5.96 million.

Assuming Burry’s indeed made the purchase at a price of approximately $135 per share, he is, by the time of publication, about $1.2 million in the green on his GOOGL bet.

Another possibility worth considering, particularly given the famous trader’s track record, is that he used the dip following the release of Google’s earnings report for the third quarter of 2023 as a buying opportunity.

Assuming he acquired near that particular bottom, he would have initially invested $4.3 million. Such a scenario would mean that Burry made approximately $1.6 million on his Google bet by the time of publication on May 13, 2024.

If ‘The Big Short’ investor indeed followed the latter scenario, his GOOGL investment would be among his biggest recent successes and just shy of his Amazon (NASDAQ: AMZN) profits on a trade made in the very same quarter.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.