U.S. politicians are known for trading stocks and other assets based on their insider knowledge of companies and legislations that could impact the future performance of specific stocks.

July has been exceptionally profitable for U.S. Congress, Senate, and House members, who earned millions from trading companies’ shares.

This fact is more impressive given that there are still two weeks until the end of July, and the average annual congressional salary is $174,000.

The U.S. politicians made millions in just two weeks

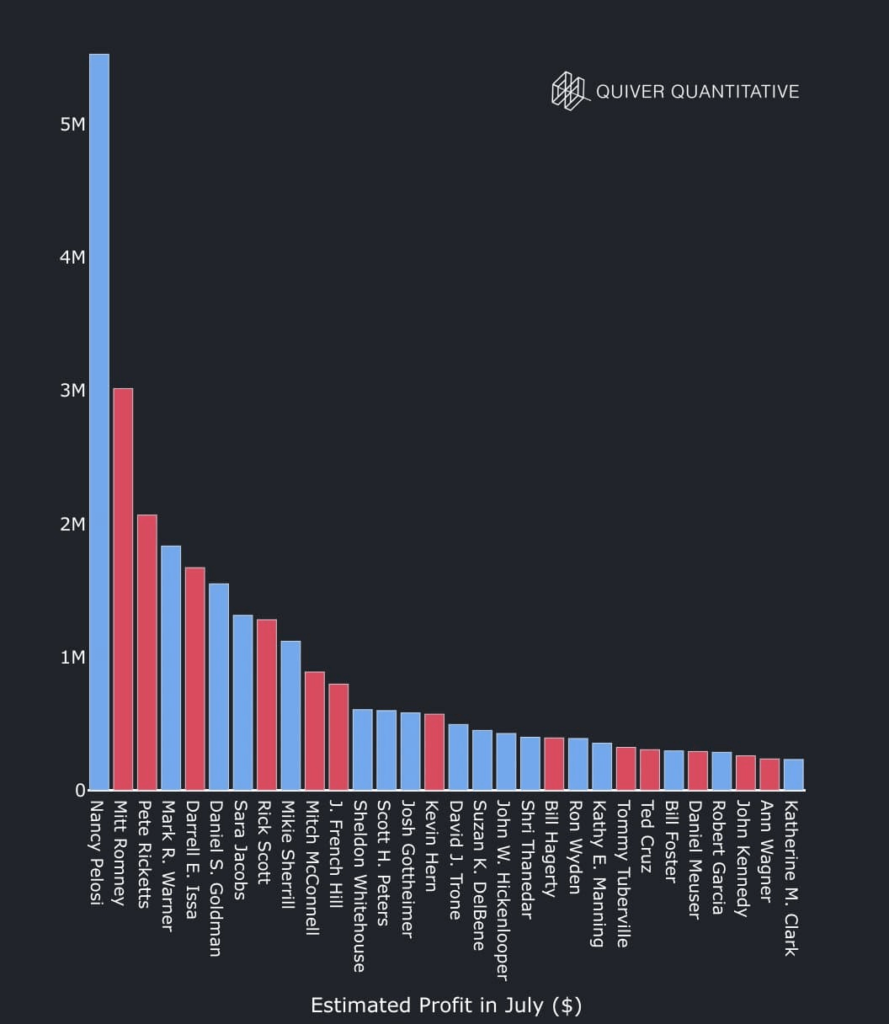

Both members of the Democratic and Republican Party contributed approximately $32.9 million in profit from trading stocks in the first half of July.

Unsurprisingly, Former House Speaker Nancy Pelosi boasts the most significant gains of over $5.5 million thanks to the strong performance of her most extensive holdings, such as Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), and the newest acquisition in June, Broadcom (NASDAQ: AVGO).

Pelosi is followed by her Republican Counterpart, Utah Senator Mitt Romney, who doesn’t own individual stocks. Still, she has a stake in various mutual funds and between $250,000 and $500,000 worth of golden bullion, which recently reached its new all-time high, earning him $3 million so far in July.

Third place goes to Republican Senator from Nebraska Pete Ricketts, who earned $2 million this month thanks to his stake in a Vanguard Vanguard Wellington Fund and stock holdings in Lowe’s Companies (NYSE: LOW) and Microsoft (NASDAQ: MSFT).

Notably, members of the Democratic Party performed better, with a combined 17 places on the list, compared to 13 Republicans who managed profits larger than $500,000.

Meanwhile, a new ban on congressional trading is proposed

On July 10, a bipartisan group of Senators, including Oregon Democrat Jeff Merkley, Michigan Senator Gary Peters, Georgia Democrat Jon Ossoff, and Missouri Republican Josh Hawley, proposed the “ETHICS Act” to ban Congress members, their spouses, and dependent children from trading individual stocks.

This measure aims to prevent lawmakers from potentially profiting from insider knowledge. Despite existing laws like the 2012 STOCK Act, critics argue they are poorly enforced. The ETHICS Act requires immediate cessation of new stock purchases and mandates divestment from individual assets by 2027.

The proposal has mixed reactions. Supporters view it as crucial for maintaining public trust, emphasizing significant fines for non-compliance and shifting to mutual funds instead of blind trusts for simplicity.

Skeptics, including Pelosi, have resisted similar reforms. However, proponents are optimistic about attaching the bill to must-pass legislation this year, addressing the public’s strong support for banning stock trading by members of Congress.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.