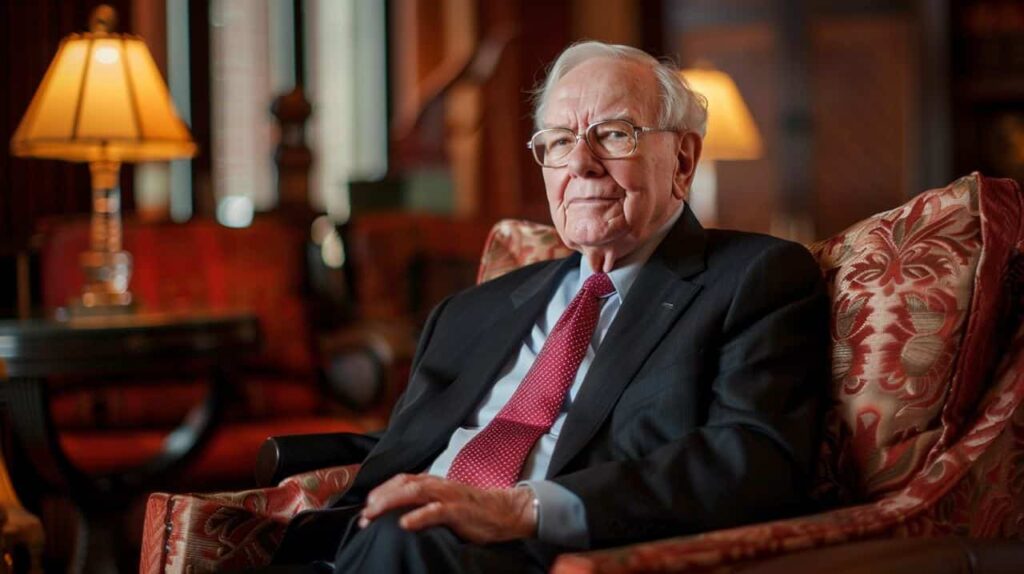

Arguably the most important Apple (NASDAQ: AAPL) bull, the famous investor Warren Buffett, has always been a fascinating figure whose portfolio often gives invaluable insights into some of the safest and most promising stocks available on the market.

Throughout his long career, The Oracle of Omaha has made billions in the stock market and famously and recently struck gold – with a return rate higher than 600% – by investing in AAPL in 2016.

Still, recent years have brought significant changes to the dynamics of the market, with perhaps the starkest example being – as some vocal investors have pointed out on X – that certain blue chips such as Nvidia (NASDAQ: NVDA) now regularly have daily price movements more akin to penny stocks than S&P 500 firms.

Given the past successes and current happenings, Finbold decided to take a look at how Buffett’s portfolio is doing 2024 so far by looking at its three biggest holdings.

Apple (NASDAQ: AAPL)

For several years, Apple has been the single biggest holding in Warren Buffett’s portfolio. The most recent update brought few changes, and AAPL accounts for approximately 50% of the portfolio.

Historically, The Oracle of Omaha’s investment in the big tech company has paid off significantly but in 2024, Apple has been facing significant pressure in the stock market.

Simultaneously, the company has been slow to roll out its own artificial intelligence (AI) offering, has given up on its electric vehicle (EV) project – which may have been a prudent choice given the state of the industry in the U.S. – and is facing disappointing demand in the historically important Chinese market.

In total, AAPL shares are down 6.81% since January 1. The more recent performance has been somewhat more positive, and the weekly chart shows a 2.36% price increase.

Apple ended the latest full trading day 1.09% in the green at $173.

Bank of America (NYSE: BAC)

Buffett’s second-largest holding, Bank of America (NYSE: BAC), has been performing reasonably well through the first trimester of 2024.

America’s second-largest bank has always been a relatively stable investment for the Oracle of Omaha and has had the benefit of offering a decent annual dividend yield of 2.69%.

Since the start of the year, BAC shares have performed only slightly worse than the benchmark S&P 500 index – Buffett’s recommended holding for everyday investors – and is up 5.28%.

The most recent performance has been notably more mixed, with the weekly chart showing a 0.50% decline and Bank of America’s shares dropping 1.08% to $35.69 in the latest full session.

American Express (NYSE: AXP)

Buffett’s second-biggest bank holding – American Express (NYSE: AXP) – has been doing remarkably well in 2024. The company’s shares saw their biggest jump late in January on particularly strong guidance for the year and have held steady since.

The Oracle of Omaha also benefitted from AXP’s recently-increased dividends which went from $0.60 to $0.70 per share earlier this year.

Since 2024 started, American Express stock is up 17.08% and the late January spike translated into a sustained upward trajectory.

The last 30 days saw APX climb 3.74%, but the more recent time frames feature more volatility. The weekly chart records a decline of 1.58% and American Express shares ended Thursday’s trading 1.05% in the red at $220.47.

How is the rest of Buffett’s portfolio doing?

Given his preference for well-established companies, it is hardly surprising that many of Buffett’s other major holdings have generally held steadily in the green without offering much growth with the fourth-biggest firm in the portfolio – CocaCola (NYSE: KO) being a prime example with a 1.14% YTD climb.

There have been some outliers, however, with Kraft Heinz (NASDAQ: KHC) being one of the most dramatic, as it is 9.97% in the red since the start of 2024.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.