Investors anticipating a possible rebound in Nvidia’s (NASDAQ: NVDA) share price might have to wait longer, as technical indicators suggest a grim outlook for the short term.

As a recap, Nvidia ended the September 7 trading session valued at $102, reflecting 24-hour losses of about 4%. Indeed, over the past week, NVDA has been dominated by bearish sentiments, plunging almost 9%.

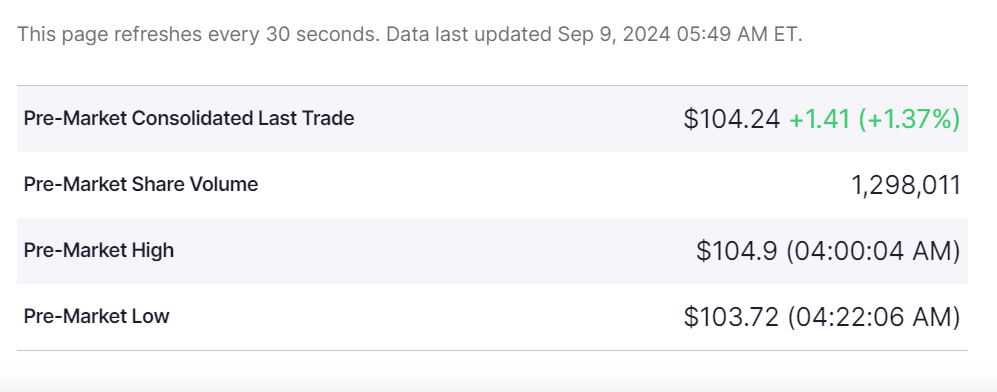

In the meantime, the stock is looking positive ahead of the market opening on September 9. In the premarket, NVDA is trading at $104, a gain of 1.3%.

Picks for you

Nvidia’s price outlook

The short-term projection was highlighted by stock trading expert Peter DiCarlo, who suggested that Nvidia could face a worst-case scenario if it drops by another 4%, he said in an analysis on X on September 9.

The expert noted that the stock has experienced notable selling pressure, with signals of continued bearish momentum. If the worst-case scenario materializes, Nvidia could drop to $97.

However, DiCarlo noted that any sustained drop below $97 could spell more trouble for the technology giant, especially if the value hits $90 to $88. If this level is triggered, the equity will likely need support from institutional investors on Wall Street to recover.

“Expecting another 4% drop in the worst case for NVDA. If we take out $90/$88, we will have a serious problem on our hands,” the expert said.

Additionally, the analysis identified Nvidia’s “Golden Pocket” around the $95-$90 area, which typically serves as a retracement support zone in technical analysis. This zone highlights a critical level where the market could stabilize and potentially bounce back.

On the other hand, an analysis by charting platform TrendSpider suggested that Nvidia’s bullish potential remains if the stock sustains its price above the $90-$95 zone. Notably, the analysts observed that this range was previously a critical resistance zone in past market cycles. If the semiconductor giant stays above this range, it signals strength and the potential for further price increases.

At the same time, the experts noted that if Nvidia remains above the 200 simple moving average (SMA), a long-term bullish trend will likely be validated.

Wall Street Nvidia price prediction

Despite short-term turbulence, Wall Street analysts on TradingView have maintained a ‘strong buy’ rating for NVDA over the next 12 months.

According to the analysts, the chip maker will likely hit an average valuation of $149 within the next year, reflecting 25% growth from the current valuation. They have also set a maximum target of $200, with the lowest forecast at $90.

Currently, Nvidia is trading in line with the overall market sentiment, which has been dampened by concerns regarding signs of a weakening U.S. economy. Indeed, disappointing jobs data has escalated speculation that the Federal Reserve might initiate an interest rate cut, potentially influencing the trajectory of a possible recession.

In summary, given its projected dominance in the booming artificial intelligence (AI) sector, Nvidia may resume its bullish momentum if economic conditions improve. However, bulls need to maintain the price above the critical $100 support level and friend stability whilst avoiding recent swings that have seen the NVDA be equated to a penny stock.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.