In recent months, insiders of semiconductor giant Nvidia (NASDAQ: NVDA) have been under scrutiny for sustained stock selling after months of significant gains.

Among the executives is CEO Jensen Huang, who sold a substantial amount of his stake in July alone.

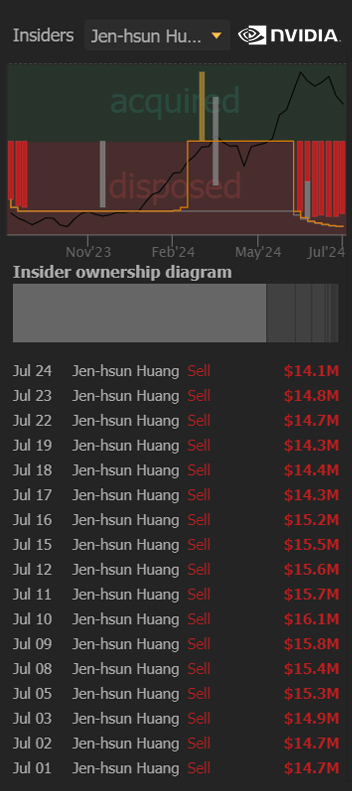

Particularly, according to data by TrendSpider shared in an X post on July 27, Huang executed 18 sell transactions, totaling an astonishing $259.7 million. The breakdown of his sales reveals a consistent offload of shares, with the largest transaction occurring on July 10, when he sold $16.1 million worth of stock.

The most recent offloading occurred on July 24, with a sale worth $14.1 million.

NVDA insider transactions accelerate

Indeed, as reported by Finbold, July saw one of the most sales activities by Nvidia insiders. The report indicated that the insiders offloaded 2.961 million NVDA shares worth $376.68 million in 11 separate transactions.

In another report, it emerged that over the past three months, Nvidia saw 72 insider trades, including 60 sales and 12 open-market buys. Insiders sold a staggering 5.7 million shares, representing 77% of the 7.46 million shares sold over the last 12 months.

Notably, the ongoing sell-off has raised eyebrows among investors and analysts alike. Although this might be standard practice for executives to diversify their portfolios or cover personal expenses, it could also signal a lack of confidence in the equity at the moment.

Notably, the insiders are cushioned with the Rule 10b5-1 trading plan, which the company adopted on March 14, 2024. This initiative enables insiders to sell a predetermined number of shares at a predetermined time, providing a legal cushion against potential accusations of insider trading.

In the meantime, NVDA is attempting to recover after hitting new lows in recent days due to a myriad of factors, including geopolitical concerns.

NVDA stock price analysis

At the close of markets on July 26, the stock was trading at $113, having made minor daily gains of 0.6%. In the five-day timeframe, the stock is down over 6%.

NVDA investors should closely monitor the $110 support level, as dropping below could trigger significant consequences.