Amid the ongoing Bitcoin (BTC) resurgence, the cryptocurrency could reach a record high in the coming months, with a valuation of at least $100,000 being monitored.

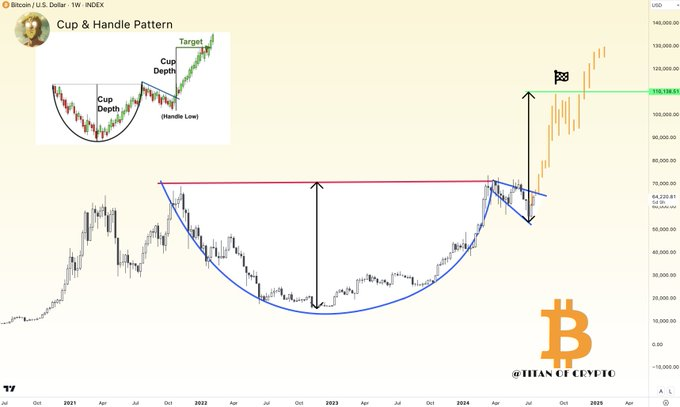

In anticipation of this, a technical analysis shared by trading expert Titan of Crypto in an X post on July 16 suggests that Bitcoin’s chart points to a price target of $110,000.

The pattern in question is the “Cup & Handle,” a bullish continuation pattern that indicates a significant price increase once completed.

The pattern consists of two parts: the cup, a rounded bottom that forms after consolidation, and the handle, a smaller consolidation period that follows the cup, creating a downward-sloping channel or a sideways move. The handle typically forms in a shorter duration compared to the cup.

In the analysis, the deep trough formed between late 2021 and mid-2023, marked by a prolonged period of consolidation and gradual price increase. From mid-2023 to mid-2024, Bitcoin entered the “handle” phase, characterized by a brief consolidation before breaking out.

According to the expert, the height of the cup provides a projection for the potential price target. In this case, the depth of the cup suggests a significant upward move, which, when added to the breakout point, targets the $110,000 level for Bitcoin, potentially by the end of the year.

“Bitcoin $110,000 Target!.This Cup & Handle pattern could catapult BTC to $110k by the end of 2024,” the expert said.

Bitcoin ramp-up set to begin

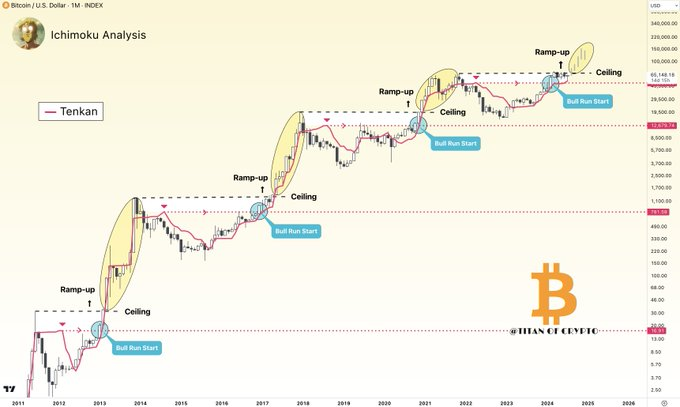

In a separate post, the analyst maintained a bullish outlook for Bitcoin in the coming days.

Leveraging the Ichimoku indicator, the analyst suggested that Bitcoin may be on the verge of a new bull run.

The expert pointed out a repeating pattern over the past decade: rapid “ramp-up” phases followed by consolidation “ceiling” phases, preceding significant price increases.

“Bitcoin Ramp-up is about to begin. Once BTC gets above the ceiling, it will escalate very quickly. Fasten your seatbelt,” the expert added.

Currently, Bitcoin is in a ceiling phase with a potential ramp-up on the horizon. A significant price increase could be imminent if history repeats, signaling a new bull run.

This consistent pattern provides a compelling case for optimism around Bitcoin in the coming months.

Currently, Bitcoin aims to establish its price above the $65,000 resistance, having failed to maintain gains above this mark. The asset was valued at $64,758 by press time, reflecting a price growth of over 11%.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.