Since Bitcoin (BTC) attained its all-time high of over $73,000 in early 2024, most of the market consensus has set $100,000 as the next ideal target.

In this context, an analysis by crypto trading expert TradingShot has offered a path regarding how historical patterns are providing timelines for Bitcoin’s journey to $100,000.

The analysis, posted on TradingView on July 3, emphasized the significance of Bitcoin’s long-term time frames and historical cycles, which have shown repeated patterns with variations influenced by current market conditions.

According to the expert, Bitcoin’s price has been consolidating for the past four months, staying above the one-week moving average of 50 (MA50). This alignment with post-halving price actions observed in previous cycles typically precedes the parabolic rally.

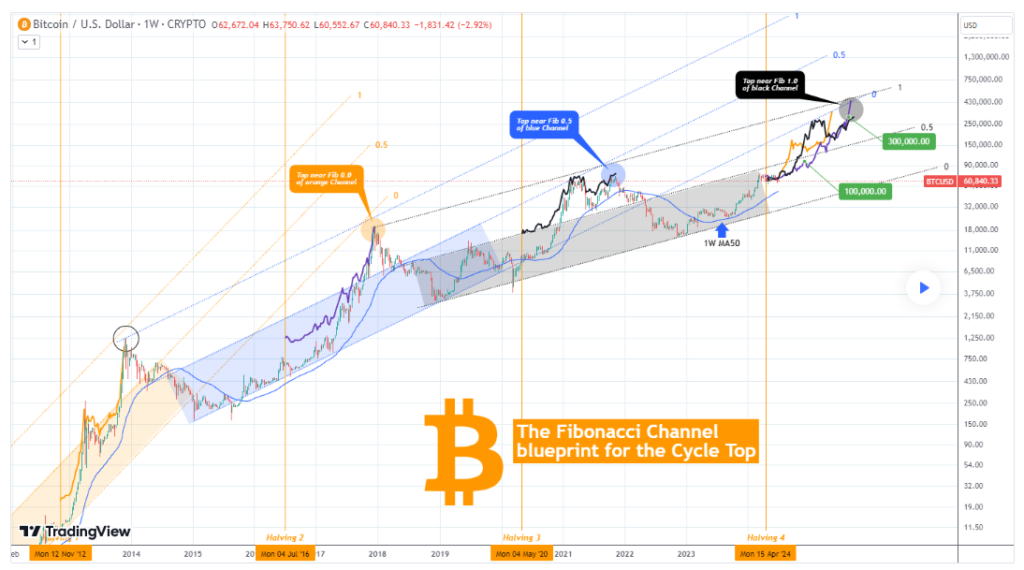

In predicting the price cycle, the analyst noted that historically, Bitcoin’s cycle tops have closely aligned with Fibonacci trend lines from prior cycle channels. For instance, the December 2017 cycle top occurred just below the bottom of the Fibonacci channel, while the November 2021 top was just below the middle Fibonacci channel.

If this pattern continues with a +0.5 Fib progression, the current cycle top might be just below the top of the Fibonacci channel, originating from the December 2018 bottom.

Bitcoin’s path to $100,000

The analysis suggested that the 1.0 Fibonacci level is just under $300,000. Given Bitcoin’s tendency to rally aggressively post-halving, the top of the current bull cycle is projected to reach at least $300,000.

TradingShot identified the 2016-2017 cycle as the most analogous to the current one by comparing the post-halving rallies of the previous three cycles within the current channel. If Bitcoin’s price follows this pattern, it is expected to hit $100,000 by December 2024 and potentially $300,000 by August 2025. These milestones could be achieved even earlier if Bitcoin transitions to a more aggressive cycle model.

“If Bitcoin follows the price action within the Fibonacci Channel, then it should reach $100k by December 2024 and $300k by August 2025. If, instead, it transitions to the more aggressive Cycle models, then it could reach those levels much earlier,” the expert noted.

Indeed, the analysis comes after Bitcoin’s push to claim the $65,000 level suffered another setback, with the maiden cryptocurrency losing the $61,000 support. Notably, despite this short-term correction, the prevailing consensus suggests that Bitcoin has the potential to rally in the coming months.

For instance, banking giant Standard Chartered has predicted that Bitcoin will reach a new record in August. Experts at the bank noted that Bitcoin will likely rise to $100,000 on election day.

Bitcoin price analysis

As of press time, Bitcoin was trading at $60,166, reflecting a correction of over 3% in the last 24 hours. Bitcoin remains over 5% lower than the weekly high of above $65,000.

In the meantime, Bitcoin is showing strong resistance at $63,000 and support around $60,000. Monitoring these levels will be crucial for predicting the next price movements. If the price breaks above the resistance, it could indicate a bullish trend. Conversely, if it falls below the support, it might signal further declines.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk