The momentum of the artificial intelligence (AI) trend remains robust, with no signs of slowing down, as evidenced by Nvidia’s (NASDAQ: NVDA) recent earnings report. While attention is focused on NVDA stock, Arm Holdings (NASDAQ: ARM) stock is quietly making substantial gains in the background.

Since its initial listing on the Nasdaq stock exchange in September, ARM stock price has increased its value by more than 100%, showcasing robust financials and potential for further growth.

And this is not the only reason Arm Holdings stock is a must-have, as it offered some pretty bullish projections for the next quarter.

Picks for you

Optimistic projections and key role in AI for Arm Holdings

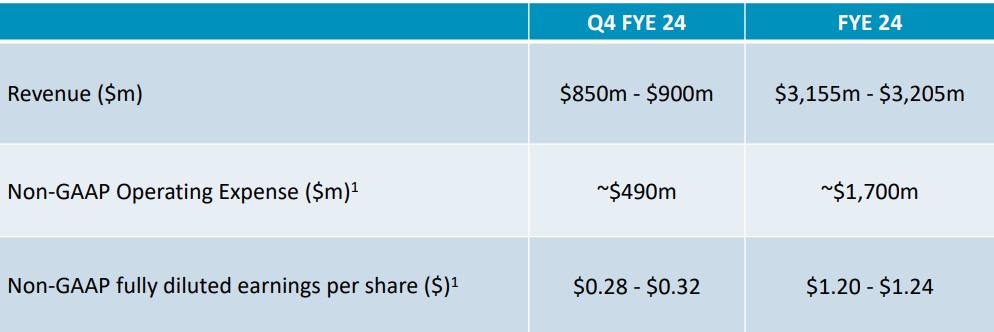

In its impressive earnings report, Arm projected revenue between $850 million and $900 million for the March quarter, surpassing analysts’ forecasts of $778 million.

Additionally, the company anticipated adjusted earnings per share to be around 30 cents, exceeding Wall Street’s estimate of 21 cents. Arm also revised its sales forecast for fiscal 2024 to a range of $3.16 billion to $3.21 billion.

Arm Holdings technology is integrated into various products, including smartphones, cars, and appliances.

ARM sells chip design licenses to manufacturers, providing the essential instructions for communicating software with chips. These manufacturers pay royalties to Arm for each unit shipped. Moreover, Arm offers design blocks utilized by companies such as Qualcomm (NASDAQ: QCOM), Amazon (NASDAQ: AMZN), and Apple (NASDAQ: AAPL) in constructing their processors.

Scarcity in the face of demand as a reason to own ARM stock

For those who may not be familiar, Arm is predominantly owned by Japan’s Softbank Group (TYO: 9984). During the IPO, SoftBank retained more than 90% of Arm’s shares, allowing it to leverage these holdings for borrowing purposes. This strategic move is expected to limit the availability of Arm’s stock over the long term, potentially boosting its value.

Moreover, the company has ample opportunity to raise the royalty rates it imposes on customers utilizing its chip designs, particularly as these designs play an increasingly crucial role in the emerging data center and AI computing infrastructure. Notably, Arm charges manufacturers just $0.50 per phone sold for its mobile CPU designs.

Even slight potential increases in these royalty rates could result in significant boosts to revenue reports. Moreover, the restricted supply of shares enhances the attractiveness of ARM stock.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.