In the past seven days, the cryptocurrency market, predominantly led by Bitcoin (BTC), has primarily maintained a consolidated stance as investors await any significant breakout. Overall, the market remains on the edge, anticipating a sustained bullish run, particularly with the impending Bitcoin halving event awaited for April.

Notably, a few cryptocurrencies have captured attention, largely owing to their distinct underlying fundamentals. Against this backdrop, the following three cryptocurrencies warrant close observation from investors this week.

Dogecoin (DOGE)

Dogecoin (DOGE) investors anticipate another week of possible bullish sentiments to propel its price surge. It is worth noting that recent on-chain metrics and community discussions point to potential advancements in the token’s valuation, particularly with significant interest in its integration with X (formerly Twitter) for crypto payments.

Fueling speculations, prominent Dogecoin developer “Mishaboar” sparked conversations about integrating DOGE into X’s payment system. Since Elon Musk acquired the social media platform, discussions regarding DOGE’s incorporation have flourished. While the timeline remains uncertain, Mishaboar, in an X post on March 28, hinted at potential collaborations with exchanges or brokerage platforms to facilitate seamless integration.

At the same time, on-chain analysis indicates a surge in the DOGE transaction count, signaling heightened investor activity and a growing demand for the meme coin. Data from crypto analysis platform Santiment indicates transactions skyrocketing from 1.22 billion to 9.20 billion DOGE within a mere 48 hours as of March 27.

However, amid the excitement, attention remains on whether DOGE can sustain its recent price gains, with the token having reached one of its highest levels since December 2021, and investors are closely monitoring its ability to maintain this momentum.

As of press time, DOGE was trading at $0.21, with daily losses of about 2.5%. Nonetheless, over the past seven days, the token has surged by almost 30%.

XRP

XRP braces for a pivotal week driven by both on-chain metrics and regulatory dynamics that could significantly impact its valuation. Despite the broader market trends, XRP has notably failed to keep pace, remaining in a consolidated phase below the $0.70 mark.

Investor attention zeroes in on XRP this week as its parent company, Ripple, gears up to unlock 1 billion tokens on April 1. This routine sell-off, part of Ripple’s monthly schedule since 2017, raises concerns about potential downward pressure on XRP’s price in the near term.

Adding to the uncertainty is the shift in token release methodology, with Ripple employing different accounts for this month’s unlocking. This move amplifies existing questions about XRP’s price trajectory and its impact on the ongoing consolidation phase.

Furthermore, notable activity has been observed on the network, particularly in terms of whale transactions. A recent transfer of 210 million XRP between unknown whale wallets, valued at $128.9 million, has fueled speculation, further heightening anticipation regarding XRP’s movement.

In tandem with these developments, Ripple continues its legal battle with the U.S. Securities and Exchange Commission (SEC), which seeks hefty penalties against the company.

Allegations of conducting unregistered XRP offerings have led to a proposed penalty of $1.95 billion. Ripple’s CEO, Brad Garlinghouse, and Chief Legal Officer, Stuart Alderoty, have strongly criticized the SEC’s actions, signaling that any developments in the case could sway XRP’s price.

As of press time, XRP was trading at $0.62, marking slight weekly gains of just above 1%.

Cardano (ADA)

Cardano (ADA) has asserted its prominence in the cryptocurrency market with sustained network development aimed at establishing itself as a formidable competitor to entities like Ethereum (ETH). Spearheaded by IOHK, recent updates underscore significant progress across various aspects of the platform.

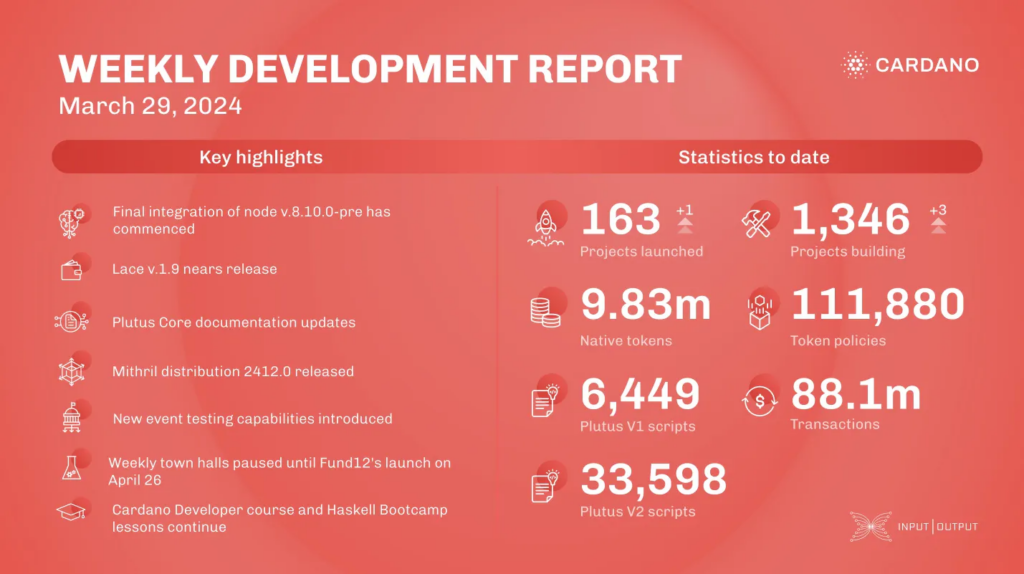

Notably, data released for the week ending March 29 revealed substantial efforts towards integrating the latest node release, v.8.10.0-pre, into SanchoNet for governance testing. Additionally, the ledger team has advanced in enhancing test frameworks and data quality, reinforcing Cardano’s pursuit of stability and reliability.

The platform’s expanding ecosystem is evident through notable project metrics, including 163 projects launched, 6,449 smart contracts deployed, and a remarkable 88.1 million transactions recorded by the week ending March 29.

This week, all eyes are on ADA’s potential to approach the $1 mark. The network’s activity serves as a critical factor in propelling the token towards this milestone, with its ability to sustain prices above the $0.6 support level being closely monitored.

As of press time, ADA was trading at $0.65, boasting weekly gains of over 4%, signaling growing investor confidence in Cardano’s trajectory.

In summary, it’s worth noting that the mentioned cryptocurrencies remain susceptible to other market sentiments beyond their underlying fundamentals.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.