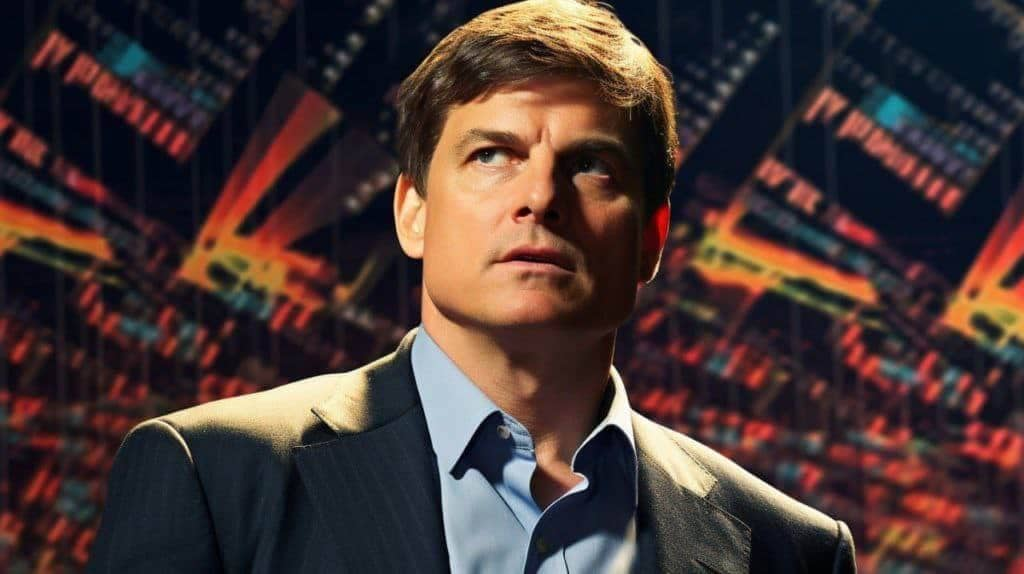

Michael Burry‘s meteoric rise to prominence began with his astute prediction of the 2008 financial crisis.

Foreseeing the impending collapse of the subprime mortgage bond market, Burry strategically invested in credit default swaps against risky subprime deals. While his prescience during the crisis earned him a fortune, recent years have seen investors closely tracking Burry’s market insights and trades through his hedge fund, Scion Asset Management.

Despite several bold forecasts in recent years, the outcomes have often deviated from his predictions, marking 2023 as another year where reality diverged from the expectations set by the famed investor.

Burry’s recession prediction

Michael Burry’s first noteworthy forecast came at the very start of 2023 when the hedge fund manager warned that the US economy would likely enter a recession this year.

Notably, the investor predicted that despite surging as high as 9.1% in 2022, inflation will reach a new peak when the Federal Reserve begins cutting interest rates to spur economic growth.

“Inflation peaked. But it is not the last peak of this cycle. We are likely to see [the consumer price index] lower, possibly negative in 2H 2023, and the US in recession by any definition. Fed will cut and the government will stimulate. And we will have another inflation spike. It’s not hard.”

– he said in a tweet at the start of January.

Fast forward to December 26, the US economy is far away from a recessionary environment. The country’s gross domestic product (GDP) rose at a revised annualized pace of 4.9% in Q3, the fastest since Q4 2021.

However, the Fed is expected to implement the first rate cuts in 2024, although there are no clear indications this would tip the economy into a recession. In fact, the majority of economists are feeling optimistic about the next year’s prospects.

The two ‘Big Shorts” in 2023

That the US economy would fall into recession in 2023 was Michael Burry’s only actual forecast for this year.

However, his recent stock trades can also be viewed as market predictions.

Q2 securities filings released in August revealed that Michael Burry made a major bearish bet against the US equity market. Notably, the investor bought $1.6 billion (notional value) put options tied to two major stock exchange-traded funds (ETFs), SPY and QQQ.

But US equities continued their rally in the following months, forcing Burry and Scion to close this position at a 40% loss. Similarly, the hedge fund opened another bearish position against the semiconductor sector in Q3.

It is safe to say this move isn’t reaping any rewards either, with the semiconductor ETF that Burry shorted recently hitting an all-time high.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.