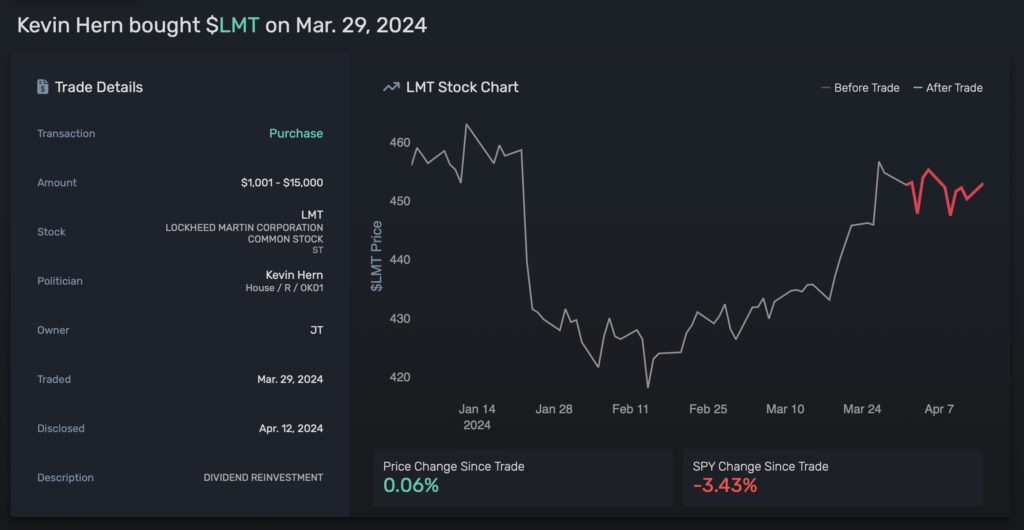

On March 29, U.S. Representative Kevin Hern of Oklahoma purchased shares of Lockheed Martin (NYSE: LMT) stock, a major defense contractor with government contracts, just before Lockheed Martin won a $17 billion contract to develop a critical defense system.

The contract was awarded on April 15, three days after Hern filed his financial disclosure form on April 12, one day before Iran attacked Israel.

The company’s recent contract win, announced amid escalating tensions with nations such as North Korea and Iran, emphasizes its crucial role in national security.

Picks for you

The contract intends to strengthen the United States’ capabilities against intercontinental ballistic missile threats, a pressing concern in the current geopolitical landscape.

Amid ongoing concerns about insider trading in US politics, where various senators, representatives, and politicians hold positions in committees granting them access to market-moving information, Hern’s trade stands out for suspicion.

Lockheed Martin’s strategic partnership with the US government

Putting aside typical political activities, Lockheed Martin and the U.S. government have a longstanding history of cooperation.

As the largest customer, the U.S. government contributed nearly 70% of the company’s revenue in 2018. Lockheed Martin represents 28% of the US Department of Defense’s (DoD’s) overall military procurement.

Furthermore, many of the company’s international clients are U.S. government allies, necessitating U.S. government approval for purchases from Lockheed Martin.

Iran’s missile and drone attack on Israel

Iran’s recent extensive missile and drone strike on Israel, commencing on the evening of April 13, escalated tensions between the two nations to a potentially volatile level.

Historically, Israel and Iran have engaged in a covert conflict, often employing proxy actions.

However, Iran’s retaliatory strike, triggered by an April 1 incident in Syria that it attributed to Israel and resulted in casualties among Iranian officers, marks a significant departure from this pattern.

The manner in which Israel responds to this assault will likely determine whether the conflict escalates into a full-scale war.

Israel maintains a substantial technological advantage over Iran, largely due to ongoing military and financial backing from the United States. This support has been a cornerstone of the US commitment to Israel’s security, ensuring its military superiority in the region.

Notably, Israel stands as the sole Middle Eastern nation to have procured weaponry from Lockheed Martin, further bolstering its military capabilities.

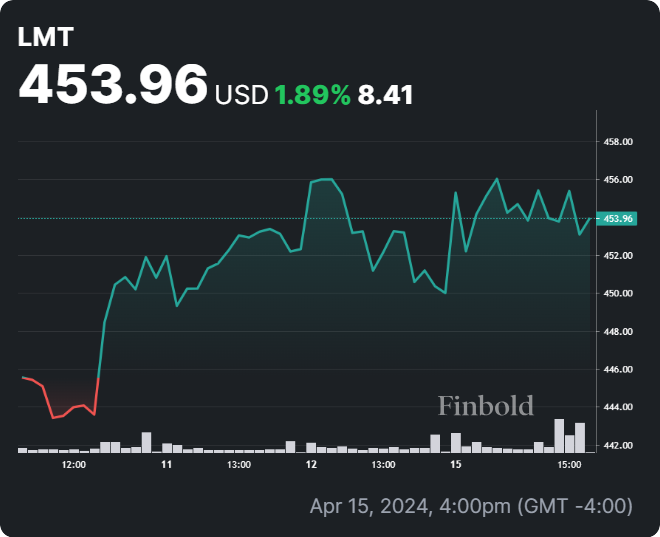

Lockheed Martin stock price analysis

At the time of press, LMT stock was trading at $453.08, showing a rise of 0.60% from the previous day’s close on April 15. Over the last five trading sessions, the stock has appreciated by 1.89%, and it has seen a 4.92% increase over the past month.

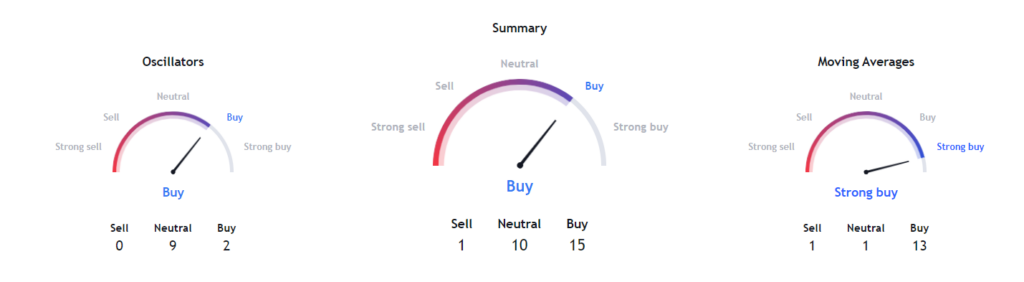

Looking at the technical indicators spells out a decidedly bullish sentiment with an overall ‘buy’ rating. Moving average, along with oscillators, point toward a ‘strong buy.’

However, the broader issue of insider trading among politicians, particularly in the defense sector, raises concerns about transparency and accountability in governance.

Whether the issue of insider trading among politicians will be effectively addressed or whether we will continue to witness instances of lawmakers profiting from privileged information inaccessible to the general public remains uncertain.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.