While Tesla (NASDAQ: TSLA) is widely recognized for its electric vehicles (EVs), a new analysis from William Blair, a $17 billion investment firm, suggests that the company’s energy storage business may be its next growth driver.

Instead of focusing on the company’s EV business, the firm highlighted the unrealized potential of Megapack and Powerwall products, which could be significant future growth drivers, when initiating coverage of TSLA shares with an “outperform” rating in a note released on August 29.

“We view Tesla Energy as the most underappreciated component of the Tesla story and expect the narrative will shift toward the energy storage business in light of tempered EV expectations in the near term.”

Tesla’s energy storage business could be “Apple-esque”

Emphasizing the importance of Tesla’s energy business, analysts from William Blair highlight its investment potential through three factors.

First, there is a need for grid stabilization, as the rising demand for electricity from the industrial sectors and the growing population could strain mainstream energy suppliers and resources such as oil, coal, etc., where Tesla’s energy storage could prove to be a beneficial replacement in hard-to-reach areas.

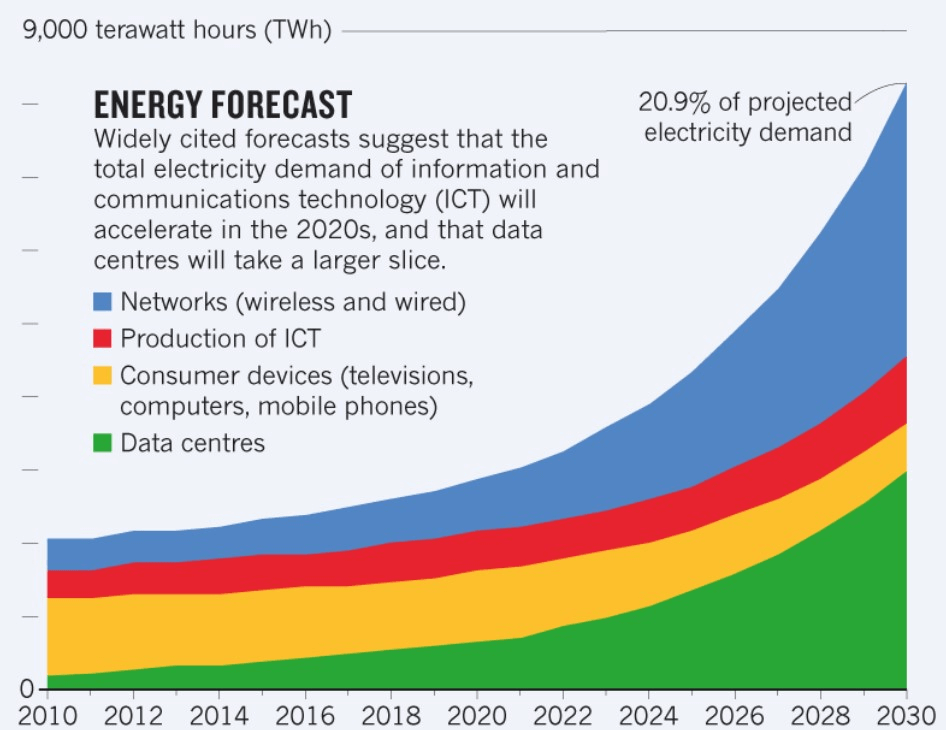

Second, expanding data centers, which experienced a boom because of the artificial intelligence (AI) revolution, are putting an additional strain on the energy sector, requiring almost 50% of information and communications technology (ICT) demand by 2030.

Third, Tesla Energy perfectly fits the renewable energy narrative, promoting using clean energy resources.

Analysts draw parallels between Tesla’s energy business and Apple’s ecosystem, suggesting that Tesla is building a comprehensive platform that could dominate the future of energy, much like Apple has done with consumer technology.

All three factors, coupled with Tesla’s focus on robotics, robotaxis, and AI, are positioning Tesla as the technology leader in the EV sector, with William Blair analysts calling it an “Apple-esque ecosystem for the future of energy.”

William Blair goes against the Tesla stock narrative on Wall Street

Although the majority of Wall Street investment firms see the current Tesla stock price valuation as hard to justify, as they assign it a “hold” rating and a price target of $211.46 with only 0.17% upside from the latest closing price of $205.75, experts from William Blair argue that such approach doesn’t do justice to EV maker stock.

Experts argue that “using traditional comparable analysis with auto or even tech, we understand the difficulty justifying the valuation, but in our opinion, this misunderstands the Tesla story.”

However, focusing on the previously highlighted Tesla Energy and the entire ecosystem company built around the energy-focused solutions strengthens the argument that investment in TSLA stock is not just an investment in the EV part of the company but many other, lesser-known avenues of income.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.