Ethereum (ETH) could be poised for a new record high as the second-ranked cryptocurrency by market cap mimics Bitcoin’s (BTC) past bull run.

Ethereum has yet to hit a record high in the current market cycle, while Bitcoin has reached an all-time high shy of the $100,000 milestone.

Now, Ethereum’s current technical setup is mimicking Bitcoin’s 2014-2017 trajectory, where both assets experienced a similar bear market phase, followed by the early stages of a bull cycle, according to trading expert TradingShot’s analysis shared in a TradingView post on November 29.

Therefore, Ethereum might follow a well-established path to new highs if this price movement were to play out.

According to the analysis, the cycle begins with Ethereum’s bottom formation below the 200-week moving average (MA), followed by a rally supported by the 50-week moving average. Next is a second rally within the 0.786 to 0.5 Fibonacci range.

The defining moment emerged with Ethereum’s bullish crossover in October 2024, which mirrors Bitcoin’s October 2016 signal that led to a parabolic surge.

Ethereum’s price next target

Looking ahead, Ethereum might be targeting the final phase of this movement, potentially reaching the 2.382 Fibonacci level—an astonishing price above $50,000, although the timeline has not been specified.

“For Bitcoin that peaked near the 2.382 Fibonacci extension. If that seems unrealistic for Ethereum’s price today (the 2.382 Fib is just above 50k!!) in terms of market cap (and rightly so), just consider the impact that the ETFs’ capital inflows have on the market. It remains to be seen, but nonetheless, ETH has enormous upside,” the expert noted.

If Ethereum hits this price target, the asset will control a market capitalization of over $6 trillion, placing the digital currency as the second-ranked asset globally behind gold, provided other asset classes experience minimal growth.

While such a valuation may sound ambitious, considering the recent institutional interest, the asset could see capital inflow.

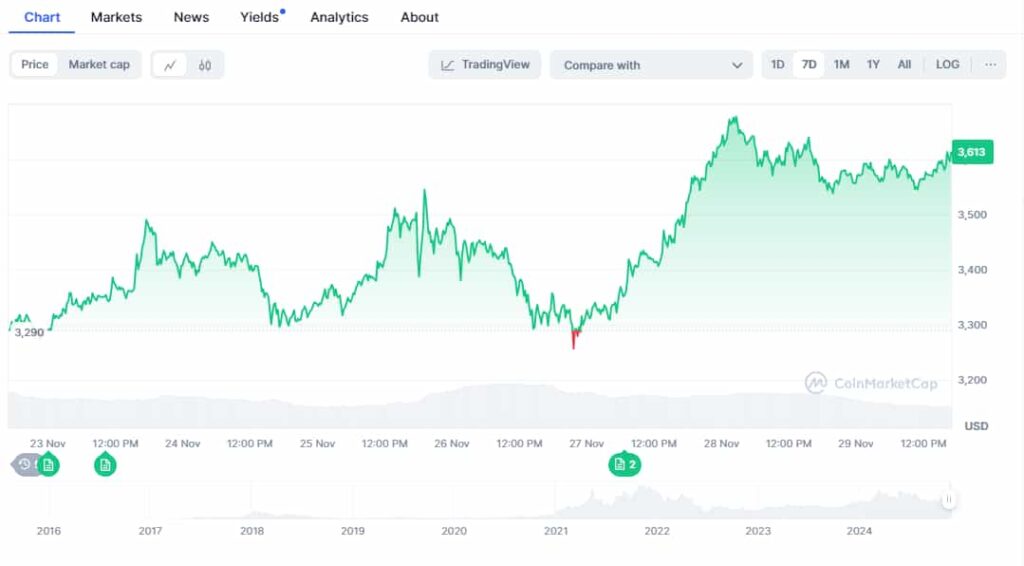

For instance, significant inflows into the Ethereum spot exchange-traded fund (ETF) helped ETH breach the $3,600 resistance for the first time in over five months.

To this end, as reported by Finbold, prominent on-chain cryptocurrency analyst Ali Martinez noted that this price movement could push Ethereum to $6,000 in the short term, with a higher target of $10,000 in sight.

In keeping with the bullish sentiment, cryptocurrency content creator Trader Tardigrade has noted that Ethereum has officially confirmed a bullish breakout from its inverse head-and-shoulders pattern, a technical setup often pointing to major upside potential.

If this pattern continues, the analyst projects that Ethereum could target the $5,800 level. However, the analysis warned investors to anticipate a possible pullback to the $3,538 to $3,445 zone, which could present a buying opportunity.

At the same time, crypto trading expert CrediBULL warned that Ethereum will likely crash towards the $3,000 level. He noted that the asset’s price trajectory will mainly be dictated by how Bitcoin trades.

ETH price analysis

By press time, Ethereum was trading at $3,609 with daily gains of about 0.1%, while on the weekly timeframe, ETH is up almost 10%.

In summary, Ethereum looks bullish in the short term, but the $3,600 resistance needs to hold to validate the bullish sentiment.

Featured image via Shutterstock