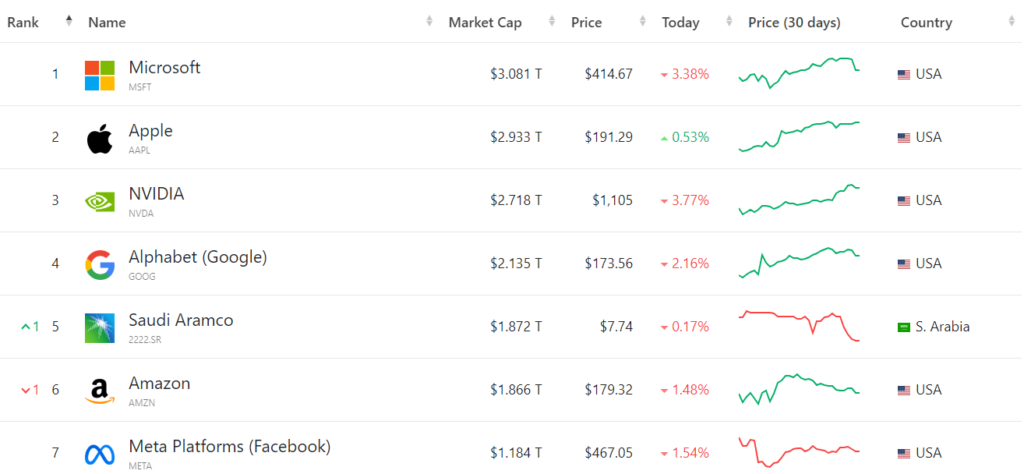

A decade ago, Nvidia (NASDAQ: NVDA) was a relatively small player in the tech industry, valued at less than 2% of Apple (NASDAQ: AAPL). Today, Nvidia is on the verge of surpassing Apple to become the world’s second-most valuable company, with the potential to overtak Microsoft (NASDAQ: MSFT), the current leader in market capitalization.

This dramatic shift underscores Nvidia’s remarkable growth and strategic positioning in the artificial intelligence (AI) revolution.

Nvidia’s market cap currently stands close to $2.8 trillion, just 3% shy of Apple’s $2.9 trillion and 11% short of Microsoft’s $3.08 trillion. This marks a shift from 2014, when Nvidia was valued at $11 billion, compared to Apple’s $643 billion and Microsoft’s $382 billion.

Nvidia’s remarkable rise

Nvidia continues its impressive growth, surging above the $1,000 mark for the first time last week, bringing its market cap above $2.5 trillion.This milestone makes Nvidia larger than the combined market cap of the Italian and Australian stock markets.

Nvidia’s CEO, Jensen Huang, announced a long-anticipated 10-for-1 stock split, effective June 7, which will award shareholders nine additional shares for each share previously owned, making the stock price more accessible to new investors.

Market analysts view this move as a significant milestone in the chipmaker’s history.

To further increase the appeal of its stock, Nvidia has raised its quarterly dividend from $0.04 to $0.10, aiming to attract dividend-focused investors such as Warren Buffett.

Nvidia reported adjusted earnings per share of $6.12, surpassing the consensus estimate of $5.59. The company’s revenue for the quarter reached $26.04 billion, exceeding the expected $24.65 billion. Nvidia projected its sales for the upcoming quarter to be $28 billion, while Wall Street anticipated earnings per share of $5.95 on sales of $26.61 billion.

The AI boom and Nvidia’s strategic position

Nvidia’s pivotal role in the AI revolution has significantly boosted its earnings potential. Over the past four quarters, the company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) reached $54 billion, a sixfold increase from the $10 billion EBITDA for the year ending April 2023.

In contrast, Apple has seen its profit growth stall, with a 20% drop in free cash flow in the most recent quarter.

Nvidia CEO Jensen Huang has compared the current AI advancements to the early stages of a “new industrial revolution.” Rosenblatt analyst Hans Mosesmann, who has a $1,400 price target for Nvidia, describes this period as the “Mother of All Cycles.”

Significant endorsements and demand have fueled Nvidia’s rise. For instance, Elon Musk’s announcement that his AI firm, xAI, would require 100,000 Nvidia semiconductors to build a supercomputer sent the company’s shares soaring.

NVDA stock year-to-date analysis

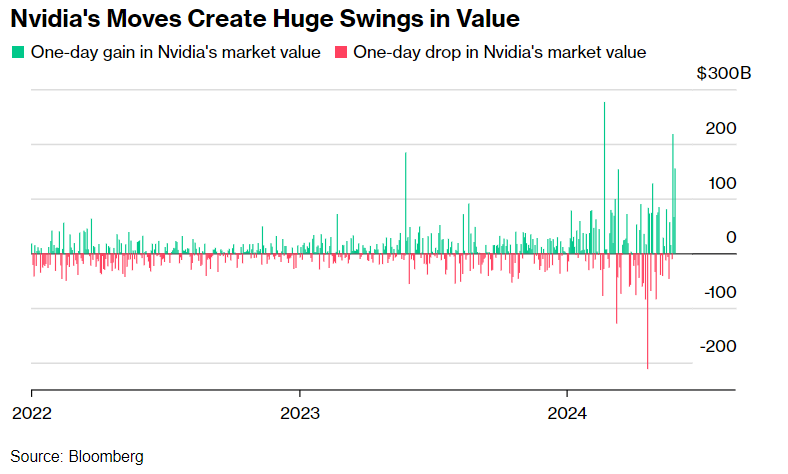

Nvidia stock has shown remarkable resilience and growth year-to-date, with a 125% gain attributed to its cutting-edge innovations and robust demand for AI technologies, which continue to drive its market value higher despite broader market pressures.

Nvidia’s trajectory suggests it is well on its way to reaching a $3 trillion market cap, potentially surpassing Apple .

With its strategic positioning in the AI revolution, robust financial performance, and significant market endorsements, Nvidia is set to continue its impressive growth.

If the company maintains its current momentum, it is poised to become the most valuable company in the world, reflecting a remarkable transformation from its modest beginnings a decade ago.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.