After starting 2024 running, the stock market has entered into a significant downturn with the beginning of April, causing a surge in concerns about whether the U.S. is in fact, heading into a recession.

On the other hand, there have been those seeking to take advantage of the relatively low stock prices – especially compared to those seeing earlier in the year when the benchmark indices such as the S&P 500 were running at record highs.

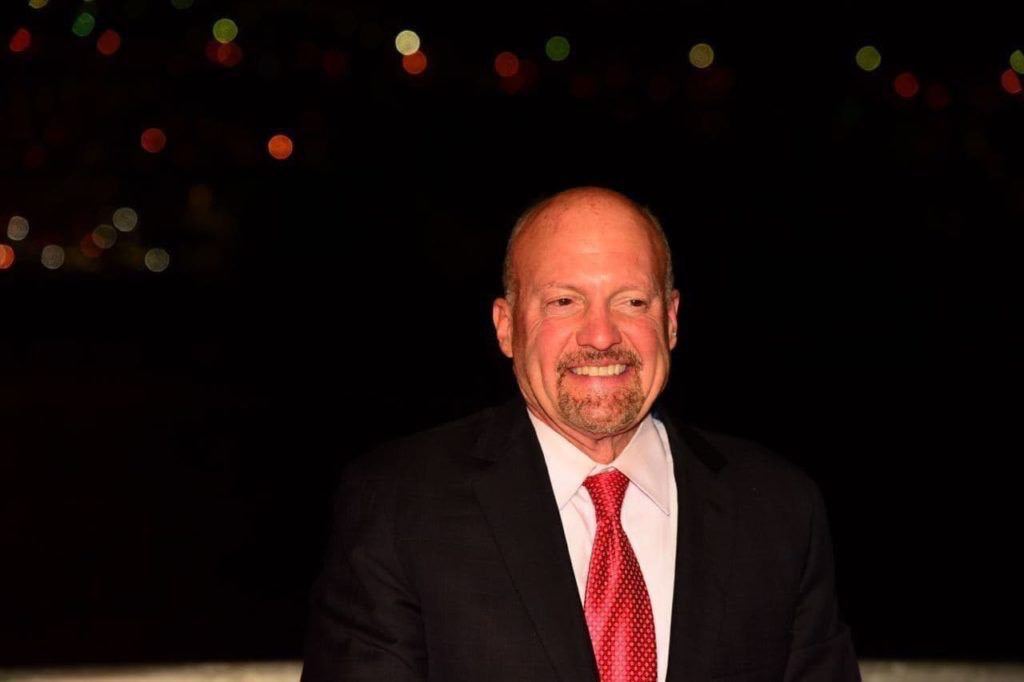

While not actively warning of an imminent crisis, Jim Cramer, the energetic host of ‘Mad Money,” is one of the experts cautioning investors on April 18 against attempting to ‘buy the dip’ as he believes the market will drop even further before finally reaching the bottom.

In Cramer’s opinion, a particularly bloody market open during which numerous investors seek to exit their positions no matter the price would signal that stocks are near the bottom and is a likely prerequisite for a return to a sustained uptrend.

The former hedge fund manager also pointed toward S&P 500’s recent intraday turning into the green before a closing in the red as proof that it is unwise for traders to attempt to ‘buy the dip’ at the market’s opening.

Is a recession now imminent?

Though Cramer’s warning against entering a long position did not extend to a forecast of a recession, multiple experts have lately also been predicting that the market is far from its bottom and that it will, indeed, continue crashing until the U.S. enters into a full-blown financial crisis.

One of the more recent forecasts came from David Brady, a former FX trader and money manager, who believes the stock market will continue crashing until, later in the year, the FED intervenes with quantitative easing and interest rate cuts, only to collapse to or below 3,500 points after the November elections.

Others, like the CEO of JPMorgan (NYSE: JPM), Jamie Dimon, have also been opining that there is an approximately 65% chance of a recession, while the bank itself recently issued a dire warning that stocks could crack in earnest at any moment.

There have also been warning that the FED’s current policy is certain only to lead to a renewed and even worse inflation crisis, while others have been pointing out that one of the main drivers of the Q1 bull market – the artificial intelligence (AI) boom – is, in fact a bubble.

Still, some prominent traders such as ‘The Big Short’ investor Steve Eisman believe the economy is doing fine despite the turmoil and that the real danger of a crash would come only if the FED intervenes with premature rate cuts – a risk that has been growing less likely with the recently-renewed calls for rate hikes.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.