As the stock market reaches record highs, with the S&P 500 and Nasdaq composite delivering solid performances in 2024, prominent investors and CEOs appear less optimistic about the future.

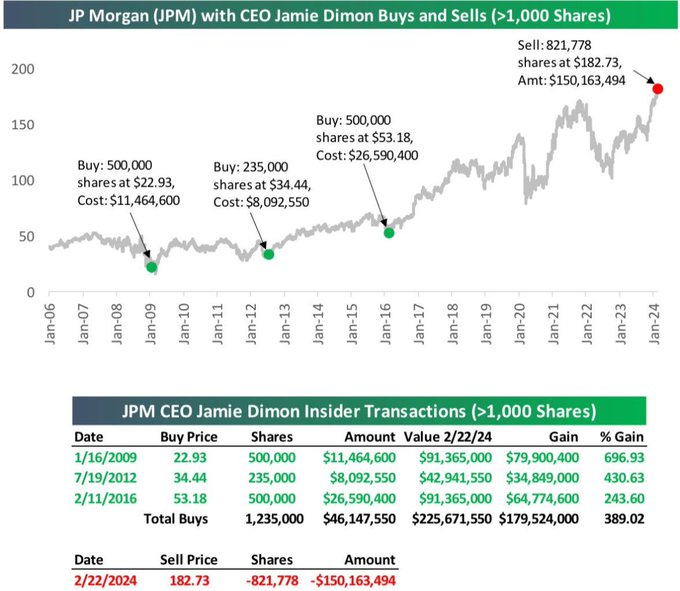

The latest example is Jamie Dimon, CEO of JPMorgan (NYSE: JPM), who recently sold 821,778 shares of his company JPM, totaling over $150 million.

These trades wouldn’t stand out if it weren’t for their historical timing. Dimon had a habit of buying JPM stock before strong market performances boosted its value. These purchases, which trail back to 2009, amounted to over 1.2 billion shares.

However, it’s different this time, as Dimon sold his JPM shares for the first time, suggesting that the stock market might be heading into a rough patch.

Following other CEOs’ suit

While a single instance of a CEO selling their company’s stock might not raise concerns, such occurrences have become increasingly common over the past month.

For example, Jeff Bezos recently divested $8.5 billion of Amazon (NASDAQ: AMZN) shares, and Mark Zuckerberg sold $500 million of Meta (NASDAQ: META) shares.

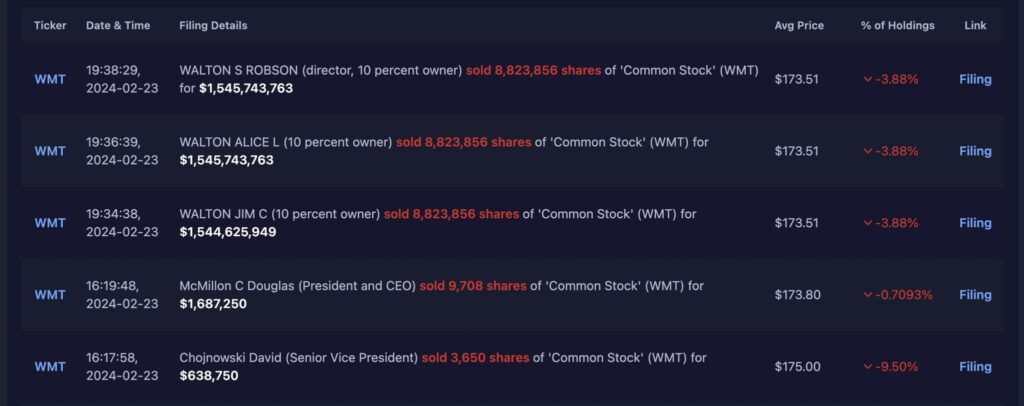

Additionally, the Walton Family offloaded $4.6 billion of Walmart (NYSE: WMT) shares and the Bill & Melinda Gates Foundation has also been actively selling Microsoft (NASDAQ: MSFT) stocks.

Considering the multitude of CEO sell-offs, the argument for weak stock market performance gains traction. This is particularly noteworthy given the trading history of these individuals, who possess insider knowledge about their companies and the broader stock market.

Whether this will prove just to be an ‘immaculate timing’ or an ominous sign, only time can tell, but history has taught traders that there is more to it than meets the eye.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.