Over the past week, the stock market has demonstrated a notable rebound despite previous challenges, including geopolitical tensions in the Middle East. This resurgence has predominantly been fueled by the strength of technological and large-cap equities, supported by robust underlying fundamentals.

With most stocks posting gains in the last seven days, the week ahead appears promising for investors. Recognizing this trend, Finbold has identified three stocks poised to enrich investors’ portfolios. Notably, given recent market volatility, investors may seek stocks positioned for potential growth.

Nvidia

This chipmaker has dramatically benefited from soaring demand for graphics processing units (GPUs) utilized across various sectors, from gaming to artificial intelligence (AI). While the stock recently experienced a correction that halted its trajectory toward the $1,000 mark, a bullish sentiment surrounds the equity. This optimism stems from Nvidia’s (NASDAQ: NVDA) approximately 12% rise over the past week.

Considering the prevailing sentiment, incorporating this stock into a portfolio in the upcoming week could be a strategic entry point for investors. Notably, the stock is likely to surge to $1,000 against the backdrop of its Q1 results announcement on May 22nd.

The semiconductor giant aims for a revenue of $24 billion in the quarter, an increase from the $22.1 billion reported in the fourth quarter. As a leader in the AI sector, Nvidia has been garnering significant investor attention, and investors may want to capitalize on this momentum before any potential rally toward the $1000 mark.

As of press time, NVDA was valued at $877.35, boasting year-to-date gains of 82%.

Microsoft

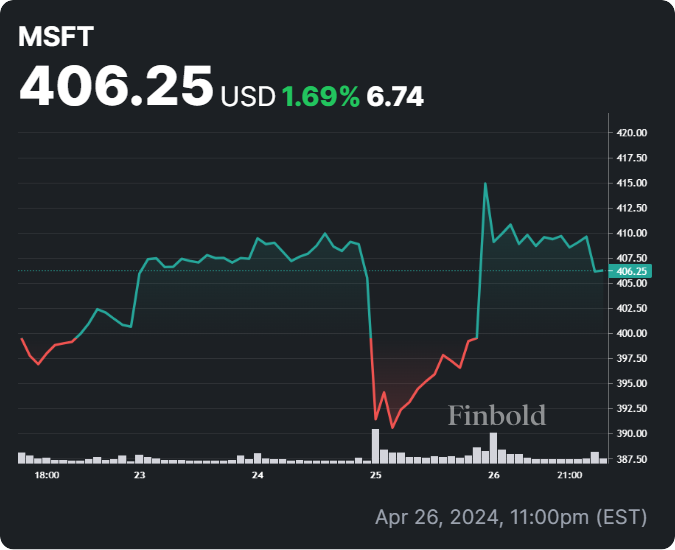

Microsoft (NASDAQ: MSFT) boasts a diversified business model as a tech giant, with its recent foray into AI marking a pivotal component. The stock experiencing bullish momentum in the past week presents another excellent opportunity for investors to capitalize.

MSFT is looking forward to sustaining the momentum from its previous quarter results, where the software giant surpassed expectations. The quarter saw another robust performance from its Azure cloud computing business and increased demand for AI workloads.

Microsoft recorded revenue of $61.9 billion, marking a 17% increase from the year-earlier period and surpassing consensus estimates by $1 billion, standing at $60.9 billion. Profits reached $2.94 per share, exceeding forecasts of $2.82.

The company’s diversification and strong growth across its divisions highlight its formidable position in the market and its effective utilization of AI advancements. CEO Satya Nadella emphasized Azure’s market share gains, underscoring its ability to outperform competitors. These factors provide a robust foundation for investors to consider investing in the stock.

By press time, MSFT was trading at $406.32, boasting weekly gains of approximately 1.5%. In 2024, the stock had increased nearly 10%.

Tesla

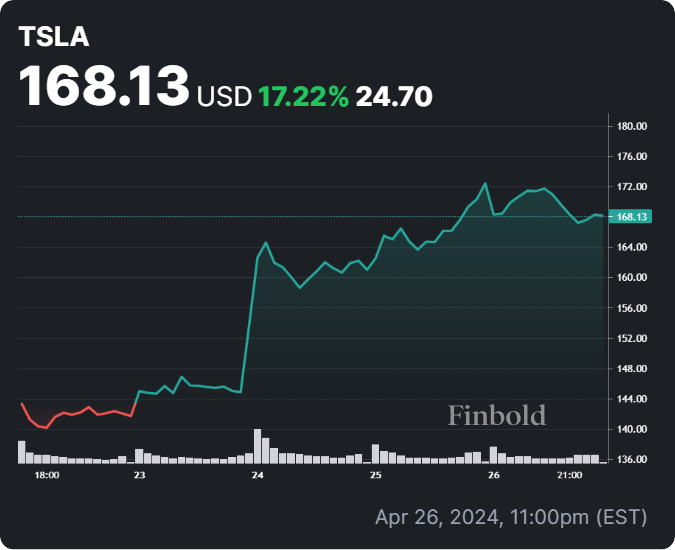

In 2024, the electric vehicle pioneer has faced challenges stemming from the slowdown in the EV industry. Notably, Tesla’s (NASDAQ: TSLA) stock breached several key support zones amidst this situation, raising doubts about its sustainability.

However, TSLA presents an opportunity for investors to engage in the upcoming week, having demonstrated resilience in the past week. Despite analysts’ projections of a further plunge below the $150 mark, the equity staged a revival, surpassing $160.

This resilience is particularly evident as TSLA surged despite the company reporting disappointing results. Specifically, Tesla witnessed a significant decline in its earnings per share (EPS), plummeting by 47%, alongside a 9% decrease in revenue, totaling $21.3 billion, which fell short of lowered expectations.

The company also announced plans to introduce “affordable” new models by late 2025, with CEO Elon Musk suggesting that production could commence before the end of 2024. Furthermore, Musk expressed optimism regarding Tesla’s delivery projections for 2024. Despite analysts continuously revising down earnings estimates, Tesla’s shares experienced a surge from their 52-week low, thus providing an opportunity to engage in the coming week.

As of press time, Tesla traded at $168.29, marking an almost 20% gain in a week. However, in 2024, the stock is down 32%.

In conclusion, although the highlighted stocks have the potential to sustain a bullish momentum, they will heavily rely on the overall market sentiment.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.