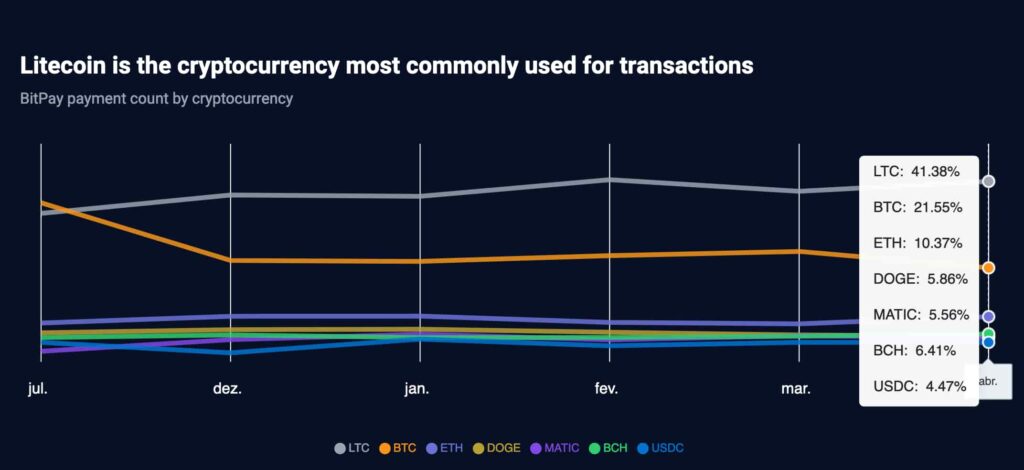

The demand for Litecoin’s (LTC) payment solution surged in April, reaching a record ratio of nearly 2:1 against Bitcoin (BTC) in BitPay. This higher demand is also observed in on-chain coin velocity data, giving strong fundamentals for long-term sustained and organic growth.

In particular, Finbold retrieved data from BitPay on May 8, showing that nearly two times more payments were made with Litecoin than with Bitcoin on the platform. BitPay is a leading cryptocurrency payment service provider, having over 54,000 crypto transactions processed in April.

Notably, approximately 22,345 of these payments used Litecoin, for a 41.38% dominance over the other available cryptocurrencies. Bitcoin was the second-most used payment method, with over 11,635 transactions, or 21.55% of the total.

Picks for you

This makes a ratio of 1.92:1 for LTC payments over BTC, achieving nearly two times more demand.

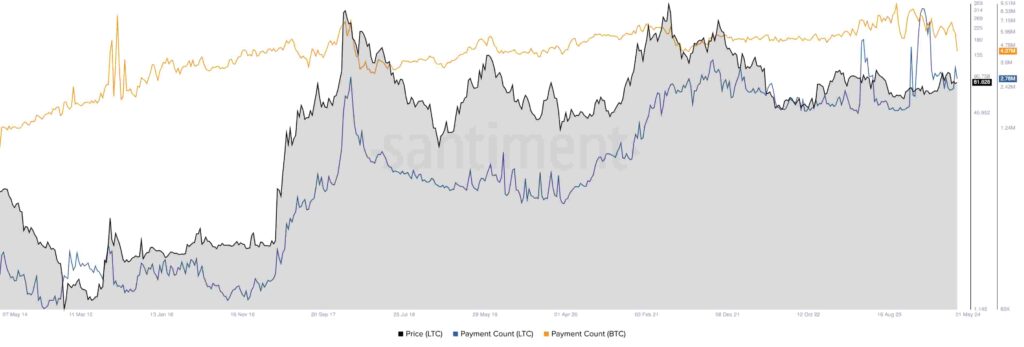

Litecoin vs. Bitcoin payment count and price growth

Interestingly, Litecoin’s payment count has steadily increased in the past 10 years, with a notable correlation with the LTC price. This growth suggests that demand for payments in the network could affect the market demand for the coin, favoring prices.

Finbold retrieved this data from Santiment on May 8, 2024, tracing back to May 7, 2014, through Sanbase Pro.

Meanwhile, Bitcoin’s payment count has grown slower over the years and is now experiencing a drop. A similar drop was previously seen in 2021 during a network fee spike. Currently, the drop happened after the average transaction fees of BTC reached record highs above $100.

With Bitcoin fees skyrocketing and payments becoming more difficult, cryptocurrency users have migrated to more efficient protocols such as Litecoin. Other alternatives include Nano (XNO), a zero-fee network, Bitcoin Cash (BCH), Monero (XMR), and Dogecoin (DOGE).

As of this writing, LTC trades at $81.62 per coin. Additionally, Litecoin has over 2.78 million on-chain payments registered in the last seven days. Bitcoin’s seven-day payments count registers 4.73 million—at a 1.7:1 ratio against Litecoin—a remarkably low ratio, considering BTC has 205 more capitalization than LTC.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.